|

Getting your Trinity Audio player ready... |

Bitcoin miner TAAL announced in June 2023 that they will accept a single satoshi as payment for a transaction so long as the size is below 1 kilobyte. This change reduces the fee rate from 0.05 satoshis per byte to 1 satoshi per kilobyte, hoping to increase demand on the BSV blockchain. This move is controversial, as BSV miners (TAAL, GorillaPool) were barely earning any revenue as fees, given the rates were already low, and the coin price (subsidy) continued to fall in 2023. Also, much of the transaction volume on BSV is already interpreted as “spam” as they are simple OP_RETURN writes of short, garbage data.

Initially, for the above-mentioned reasons, I thought this was a silly move. However, after understanding the implications and hearing others’ opinions, I now believe this to be a great move in the context of 1 Sat Ordinals and Open Protocols on the BSV blockchain. Using standardized scripts such as inscriptions, Ordinal Lock (purchases, listings, cancels), and MAP (Magic Attribute Protocol) also implies data limits. Meaning if different applications utilize these standard scripts, they can reasonably expect the size to be below 1 kilobyte; therefore, they always only require 1 satoshi as the transaction fee. Additionally, complex data transactions can simply reference other transactions via MAP, so they do not contain large amounts of data.

1 satoshi at a BSV price of $40 is 1/25,000th of a cent, so for 1 penny, applications can fund 25,000 of these types of transactions. Interestingly, RelayX started implementing this concept just before the invention of Ordinals on BTC for the Club product.

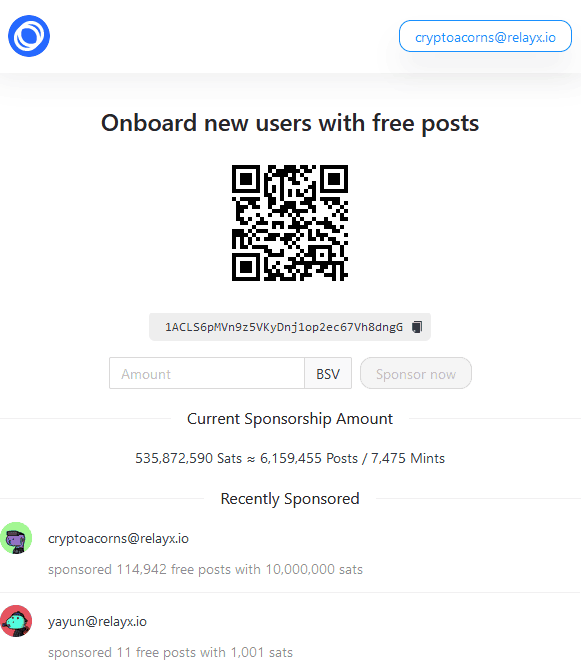

Any RelayX user could fund the fees to onboard new users with free posts by contributing to a pool. This would also fund the minting of their NFTs, which could still be costly if the file is large enough.

Note that this page is not updated with the new fee rates, so my sponsorship of 0.1 BSV would actually fund roughly 10 million transactions.

Applications can onboard users for near zero costs and pay for all their interactions on the blockchain. The so-called onboarding problem is now a non-issue, as all the users must do is to create to earn without needing the coin first.

1 satoshi fees eliminate the "onboarding" problem

— shua (@cryptoAcorns) July 21, 2023

Gone are the excuses of needing credit cards, exchange support, and stablecoins to acquire BSV to use an application. Businesses can now eat that tiny cost for their customers for literally fractions of a penny.

One reason for the ever-dropping BSV price is skepticism of these low fees by the market (by its proponents and its detractors). BTC has engineered a fee market in the opposite direction, where users cannibalize each other to get their transaction in the next block. BSV has engineered the fees “too low,” attracting “spam” and “low-quality” content while also being susceptible to attacks.

However, if we believe that Bitcoin is for everyone, then Bitcoin is for everything. This includes the so-called spam and low-quality content, and anything and everything one can think of. Value is indeed subjective, and no entity has the right to be the arbiter of what one is interested in buying or selling. After all, that is the definition of a transaction.

CoinGeek RoundTable with Joshua Henslee: 1Sat Ordinals on Bitcoin

11-21-2024

11-21-2024