|

Getting your Trinity Audio player ready... |

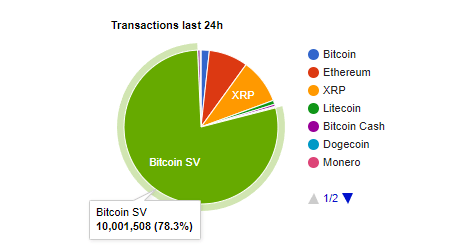

Daily transactions on the BSV blockchain have soared since the end of March. The network has processed over 10 million of them in the past 24 hours, reaching past 9 million and even 9.6 million in a 24-hour period. BSV is now responsible for over 78% of all blockchain-based transactions worldwide, with other networks competing for a diminishing share of the pie.

Source: BitInfoCharts

The other two networks best-known for high transaction volumes are Ethereum and Ripple. Ethereum, arguably the world’s most famous blockchain for running applications and contracts, managed just over a million transactions in 24 hours, while Ripple (which is not actually a blockchain network) reached 1.2 million. BTC, despite all its hype, cranked out a mere 223,000 transactions over the same period thanks to its artificially-limited capacity.

The increase in total daily BSV transactions is due mainly to the growth of gaming on the network. Games like Fyx Gaming’s CryptoFights supply an overwhelming majority of those transactions, and their popularity is growing.

The BSV blockchain is agnostic to application type, so there’s no reason another service couldn’t come along soon to replace gaming as the majority. Two years ago, it was WeatherSV topping BSV’s application data charts, and next year it could be something completely different, or new.

BSV’s fees still low and will stay that way

Despite the huge and steady increase in total transactions, fees on the BSV network have remained low—still a small fraction of a U.S. cent per transaction. Compare that to “payment” blockchains like BTC (currently around US$2) and “app/contract” blockchains like Ethereum (currently a whopping US$20) and BSV’s advantage becomes clear. Notably, BSV handles payment and app/contract transactions with equal ease. There is no limit to how far BSV’s capacity can scale in number of transactions, without fees rising beyond what they are now.

This is how Bitcoin is supposed to work. Transaction processors (aka miners) earn their income by verifying millions of tiny transactions for a small fraction of a cent each, rather than relying on the block subsidy or high user fees.

Found Fresh Bananas 🍌🍌

Block: 733,601

Size: 1.22 GB

Tx count: 835,191

Average fee: $0.00039

Total fees: 3.26 BSV

Total revenue: 9.51 BSV

Revenue from fees: 34.25%https://t.co/4GtgMawR5u— BananaBlocks™ by GorillaPool🍌🍌 (@banana_blocks) April 3, 2022

The block subsidy, which remains miners’ primary source of income on networks like BTC, halves every four years. It is currently 6.25 coins, and will halve again to 3.125 coins around May 2024. Unless the market price of BTC keeps pumping in a way that covers this loss, BTC miners find it difficult to pay their overheads, and stay solvent.

The BTC market price has indeed pumped to meet this in the past. However, that’s hardly a sustainable economic model and it’s quite risky to expect it to continue. Coin value should be built on fundamentals: utility, usage, use cases, and number of users and transactions on the network. Energy efficiency is another one—the more users and transactions on BSV, the more efficient it becomes. Not so much on BTC, which consumes huge amounts of energy despite already running at capacity.

Some may point to other charts that indicate the dollar values of BSV transactions over 24 hours is small compared to BTC and ETH, or Dogecoin. While this is true, it’s also meaningless. It doesn’t indicate the amount of usage, just the amounts (in dollars) being sent and Bitcoin (BSV) is a micropayments network built to allow small causal payments to be sent across the network affordably. Such “value” can potentially evaporate quickly if the market value of these assets drops, or if their relatively small number of users decide there’s an easier way to send money. Remember that most digital asset transactions are to and from exchanges for the purpose of speculative trading, not to build an actual economy.

Even as its daily transaction numbers edge to (and beyond) the 8-figure mark, BSV is still technically running on the older version of the node software. 2022 will see the emergence of Bitcoin’s Teranode, which still follows exactly the same rules Satoshi Nakamoto set in 2008-9, but re-written to lift transaction capacity into the billions, even trillions. Blockchain pie charts will look very interesting once that goes online later this year.

Watch: Teranode Live Demo shows 50K TPS on BSV Blockchain

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024