The Financial Industry Regulatory Authority (FINRA) in the US has taken action against a former financial advisor with Merrill Lynch for his extracurricular activities. Kyung Soo Kim, who was previously let go from the firm for the same reason, was found to have been managing a cryptocurrency mining operation in violation of FINRA’s rules of disclosure. He was fined by the financial authority and suspended for a month from any financial activity.

Kim worked as a General Securities Representative (GSR) and an Investment Company and Variable Contracts Products Representative (GSR) for Merrill Lynch from March 2014 to April 2018. However, in December 2017, he reportedly launched the mining operation without informing the company or regulators, in violation of FINRA Rules 3270 and 2010. Unfortunately for Kim, a violation of one of these is automatically a violation of the other.

FINRA Rule 3270 stipulates that “no registered person may be an employee, independent contractor, sole proprietor, officer, director or partner of another person, or be compensated, or have the reasonable expectation of compensation, from any other person as a result of any business activity outside the scope of the relationship with his or her member firm, unless he or she has provided prior written notice to the member, in such form as specified by the member.”

According to a statement from FINRA (in pdf), a violation of that rule “is also a violation of FINRA Rule 2010,” which requires associated persons to observe high standards of commercial honor and just and equitable principles of trade.”

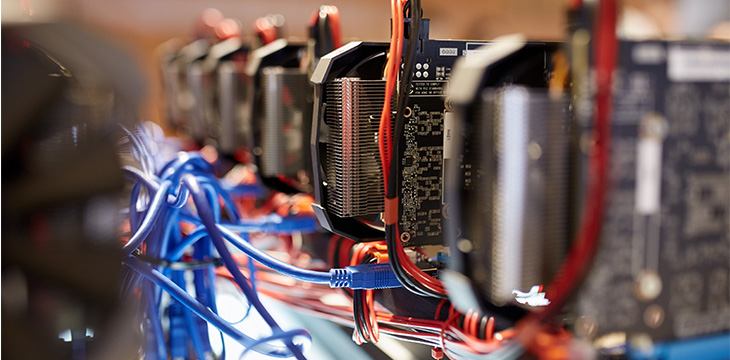

Kim has acknowledged that, in December 2017, he formed an S Corporation of which he was the only shareholder and director. That corporation engaged in crypto mining and entered into an agreement with another entity to build and operate the mining rigs and software for the operations. He also opened and funded a bank account for the corporation, and paid the third party from the account for its services.

The crypto entrepreneur will now have to turn over $5,000 to FINRA and is suspended from working for any FINRA member entity in any capacity for one month.

09-21-2024

09-21-2024