|

Getting your Trinity Audio player ready...

|

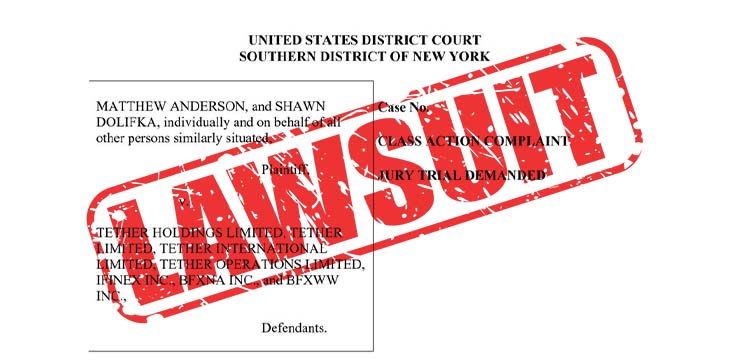

Blockchain fiat currency Tether is being sued again. A pair of disgruntled users has filed a fraud claim in the Southern District of New York against Tether Holdings Limited and a handful of its related business entities, including iFinex and exchange Bitfinex.

Tether is already facing at least three other pending legal actions. The company is clearly irked at the prospect of more legal hassles, releasing a blunt three-line response earlier today that called the suit “another nonsense, copycat lawsuit” and a “shameless money grab”:

Last Friday another nonsense, copycat lawsuit was filed by 2 Plaintiffs and their law firm looking for a payout based on meritless claims. We will aggressively litigate and dispense with the action in due course. https://t.co/u5qemzvVTM

— Tether (@Tether_to) December 13, 2021

Publicly available documents show the new suit was filed on December 10, 2021, by plaintiffs Matthew Anderson and Shawn Dolifka. There are few details about the plaintiffs or the nature of their complaint. But similar lawsuits Tether has faced in the past few years usually concern users looking either for a payout, or more answers about how the “stablecoin” is structured—the nature of the “reserves” that back its 1:1 peg to the U.S. dollar and other national currencies, and its supply in relation to the price of BTC and other major digital assets.

Tether has technically been off-limits to U.S. persons since January 2018. The company makes some exceptions for exchanges with non-U.S. operations and USDT is listed on some U.S. exchanges including Coinbase, Binance US and Kraken, though it may not be available to New York state users.

The untethered world of Tether

Tether may call the lawsuits “nonsense,” and it has defended itself to some extent in this arena. However, it has faced a fraud investigation by the New York Attorney General’s office itself and has been penalized by the U.S. Commodity Futures Trading Commission (CFTC).

On its FAQ page, Tether still has lines like “Tether’s platform is built to be transparent at all times. All Tether tokens are backed 100% by Tether’s reserves.”

In theory, every USDT (“Tether token”) is backed by an actual US dollar in Tether’s accounts, allowing it to maintain the 1:1 USD peg. This claim was for many years considered fictional by many in the digital asset community, and Tether (the company) repeatedly delayed a promised audit of reserve funds. Other claims, such as Tether having no relationship with the Bitfinex exchange were also revealed to be false in the “Paradise Papers” leak, which showed Tether and Bitfinex’s parent company iFinex shared key management personnel.

The CFTC recently handed Tether’s managers US$42.5 million in penalties, finding that USDT tokens were backed by currency reserves just 26% of the time between 2016 and 2018. Reserve assets had regularly been shuffled between unregulated partner entities and other third parties, and the reserves themselves included non-dollar assets like unsecured receivables, other digital assets, and loans. Tether had made “untrue or misleading statements and omissions of material fact in connection with the U.S. dollar tether token (USDT) stablecoin,” the CFTC said.

U.S. Senate Banking Committee Chairman Sherrod Brown also sent letters to Tether executives in late October 2021, as well as to seven other companies including Coinbase and Binance US. Senator Brown requested general details about the digital asset market, in particular how assets are exchanged with USD and the risks associated with them.

Sen. Brown set a December 3, 2021 deadline for the information, and Tether had announced its intention to comply fully. On that date it also released a written statement saying USDT tokens had “always been fully backed” and produced a quarterly assurance opinion from accounting firm Moore to support the claim.

We appreciate the interest from lawmakers on the function, purpose, and security of all stablecoins across the cryptocurrency ecosystem. We have been and are pleased to work with policy makers around the world on these important issues. 1/3

— Tether (@Tether_to) November 25, 2021

In February 2021, New York Attorney General Letitia James ordered both Tether and its associated exchange Bitfinex to pay US$18.5 million in penalties and cease trading USDT in the state. She noted that this was due to “false statements about the backing of the Tether stablecoin,” as well as the companies’ attempts to cover up losses at Bitfinex by moving “hundreds of millions of dollars between the two companies”.

Tether has also been banned from various international banks, and several other jurisdictions have moved to prevent the asset being traded on exchanges. With the CFTC and NYAG office both imposing financial penalties, it may only be a matter of time before the Securities and Exchange Commission (SEC) joins in as well—SEC chairman Gary Gensler just recently gained approval to begin regulating all stablecoins, and is currently working with the CFTC to draft proposals.

The company was previously backing social media personality Peter McCormack in his libel defense against Dr. Craig S. Wright, but reportedly pulled financial support in late 2020, perhaps anxious to avoid more information being revealed during the discovery phase of the trial.

Previous plaintiffs in suits against Tether David, Benjamin and Jason Leibowitz were represented by Roche Freedman, the same litigators that recently represented Ira Kleiman against Dr. Craig S. Wright in the Florida “Satoshi suit.” The law firm published an article on its company blog that accused Tether of artificially manipulating/inflating prices for BTC and other digital assets by “printing” billions of dollars worth of USDT tokens “out of thin air.”

In essence, that would make Tether/USDT a fiat currency based on other fiat currency values, backed only by traders’ trust that they could easily park sold-crypto value in USDT and use it to buy other assets later. Indeed, Tether has to date somehow managed to maintain that function. Large issuances of new USDT from the “Tether Treasury” have correlated to sudden jumps in BTC and other asset prices at times.

Like national fiat currencies themselves, that system survives only as long as users maintain that trust. Tether is not a country and, as such, is far more vulnerable sudden collapse due to legal challenges and regulatory threats—of which there are many.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—a from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple, Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-14-2024

11-14-2024