Digital asset users in the Philippines can now report non-compliant virtual asset service providers (VASPs) directly to the country’s central bank. The Bangko Sentral ng Pilipinas (BSP) announced the new measure recently as it seeks to offer investors extra protection.

The Philippines has become a global hub for digital asset adoption, eclipsing former heavyweights such as the United States, Japan, the United Kingdom, and India. This adoption has come along with several scams targeting investors, ranging from investment to romance scams.

The Philippines’ digital asset market has also seen its fair share of unlicensed VASPs that mislead investors into believing they are registered to serve the country. Binance is the best example; the exchange is not licensed by the BSP and yet continues to serve millions of Filipinos. Despite the efforts of a local think tank, Infrawatch PH, which has lobbied relentlessly against Binance, the exchange continues to operate and organize meetups in the country.

BSP is seeking to stamp out non-compliance from the local digital asset space. The bank called on investors to contact it directly if they had any concerns about their VASP.

Users can make reports via the BSP Online Buddy icon on the regulator’s website, through Facebook (NASDAQ: META), or through a text message.

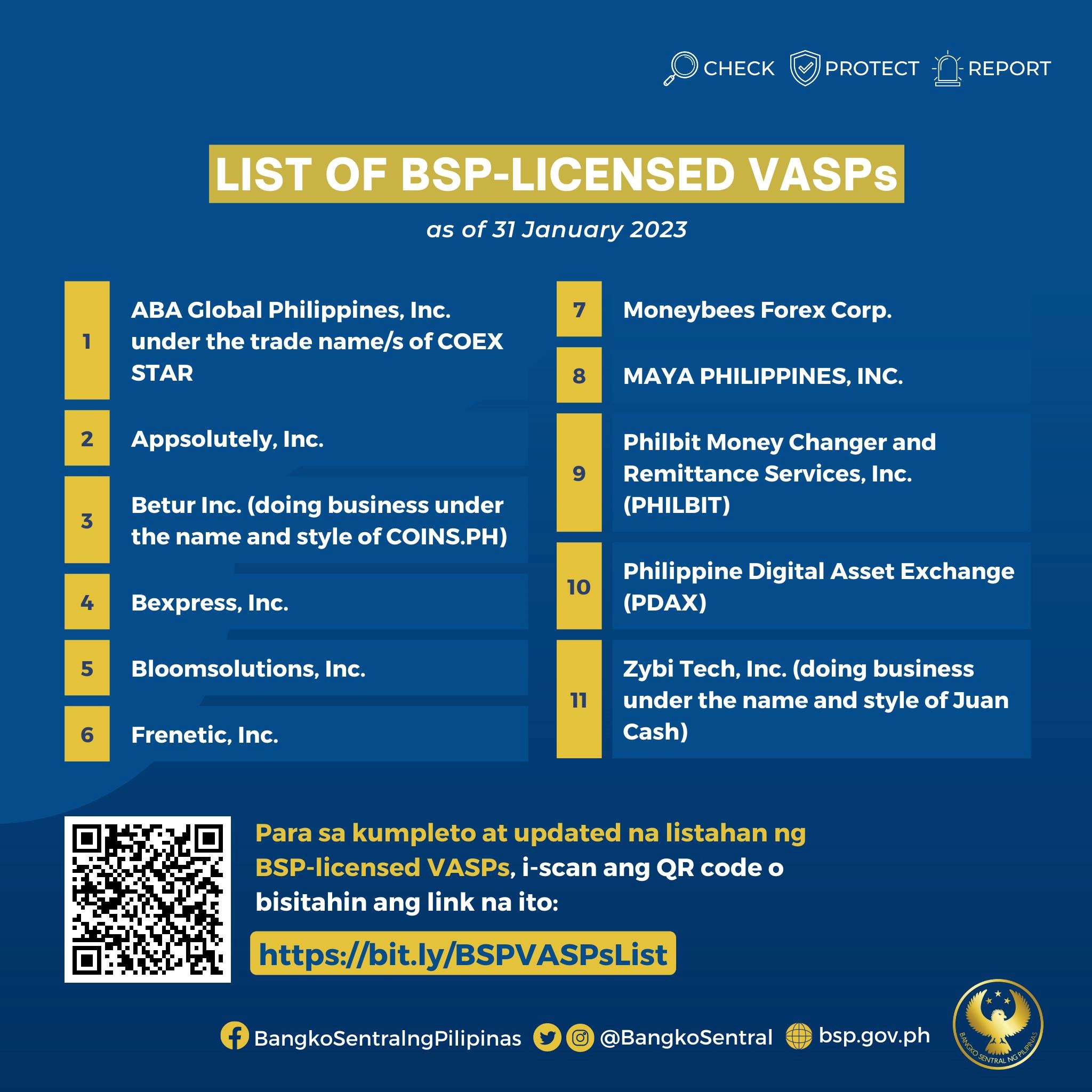

BSP also reminded investors of the licensed VASPs, including the country’s digital banking giant Maya. However, GCash, which reportedly debuted its GCrypto digital asset service to select users recently, wasn’t on the list.

The list has been recently updated. In November last year, it axed Novi, the Facebook experiment that regulators globally coordinated to put an end to. Novi, a digital wallet Facebook hoped would launch the company into the digital payments space, had been licensed by the BSP for 11 months.

While the latest move will give investors more assurance, the BSP still has some way to go in offering clarity to the Bitcoin sector. Last year, the central bank was blamed by the Department of Trade and Industry (DTI) as the reason Binance couldn’t be banned in the country.

Infrawatch PH had lobbied DTI to act against Binance, but the department claimed its hands were tied, pointing fingers at the BSP.

Watch: Philippines needs to create more blockchain use cases

09-23-2024

09-23-2024