|

Getting your Trinity Audio player ready... |

As of mid-July 2023, proof of work, UTXO-based blockchains have adopted the Ordinals protocol. BSV blockchain has recently passed BTC in terms of number of total inscriptions (25 million to 18 million). However, Doginals (Ordinals on Dogecoin) still have the most at 28 million. Litecoin is by far last, sitting at 5.5 million inscriptions.

The Ordiport July 17th 2023 pic.twitter.com/kN9EXSyn1R

— Zack Wins (@DevelopingZack) July 17, 2023

Of course, BTC still has the overwhelming lead in liquidity, trading volume, applications, and protocols. This demonstrates the trend that sheer volume of transactions is not so relevant in the current “crypto” industry. Doge and BSV blockchain’s number of inscriptions does attract some attention, but the opportunity to create and earn more coins is still the primary driver for which chain to use.

One common metric across each blockchain one can inspect is the price of the first deployed BRC-20 tokens, ordi, 1sat, lite and dogi on BTC, BSV, LTC and DOGE, respectively.

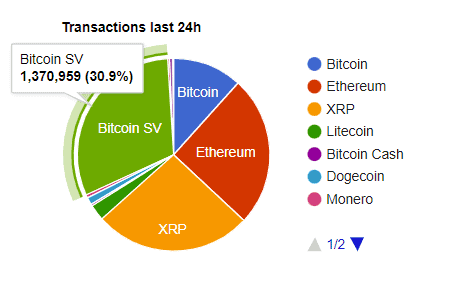

ordi is priced at $7, 1sat at $0.07, lite at $0.02 and dogi at $0.17. The prices of these tokens do have some relationship with usage of the blockchain, with ordi as the exception due to its dominance in liquidity. While the BSV blockchain does more transactions on a daily basis, many of these are labeled as so-called “spam” since they are simply stress tests of various applications writing simple data to the blockchain, not representing any meaningful economic activity.

What does this tell us? Transactions need to actually represent a value exchange between individuals, in a peer-to-peer nature to scale. Simply being capable of having a higher throughput of transactions does not result in more liquidity or higher asset prices. That said, demonstrating higher inscription numbers will attract those who are priced out of BTC when its demand capacity is reached. Arguably, the only reason BTC only has 18 million inscriptions is because of its self-preserved block size limit of 1MB, and consequently can only handle roughly new 500,000 inscriptions per day. BTC has not reached critical congestion levels since early May 2023, and that resulted in the market speculating on other UTXO blockchain prices. If, or likely when those congestion levels are reached again, the BTC community will need to address this long-standing issue or face the risk of losing market share.

In hopes of increasing demand, Bitcoin miner TAAL has lowered fee rates to 1 sat per kilobyte, a huge price cut to the former 0.05 satoshis per byte. This means that if a transaction is 1 KB or less in size, the transaction fee will be only 1 satoshi. This opens many use cases that may have been cost prohibitive before, even with BSV having such low fees before. Theoretically, this should increase the number of inscriptions on BSV further but has not yet. This reality reflects the true problem in the BSV community, a lack of developers, entrepreneurs, and unity in the community.

Having the best scaling ability and cheapest fees means nothing if there is no demand. Entrepreneurs want to earn more by definition, and BSV, LTC and DOGE are all still severely lacking in that department. The cheap, low fees need to be taken advantage of in a novel way, that enables its creators to earn more than they can on other chains, and until that happens, BTC is, and will remain on top in the market.

CoinGeek RoundTable episode 7: 1Sat Ordinals on Bitcoin

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024