|

Getting your Trinity Audio player ready... |

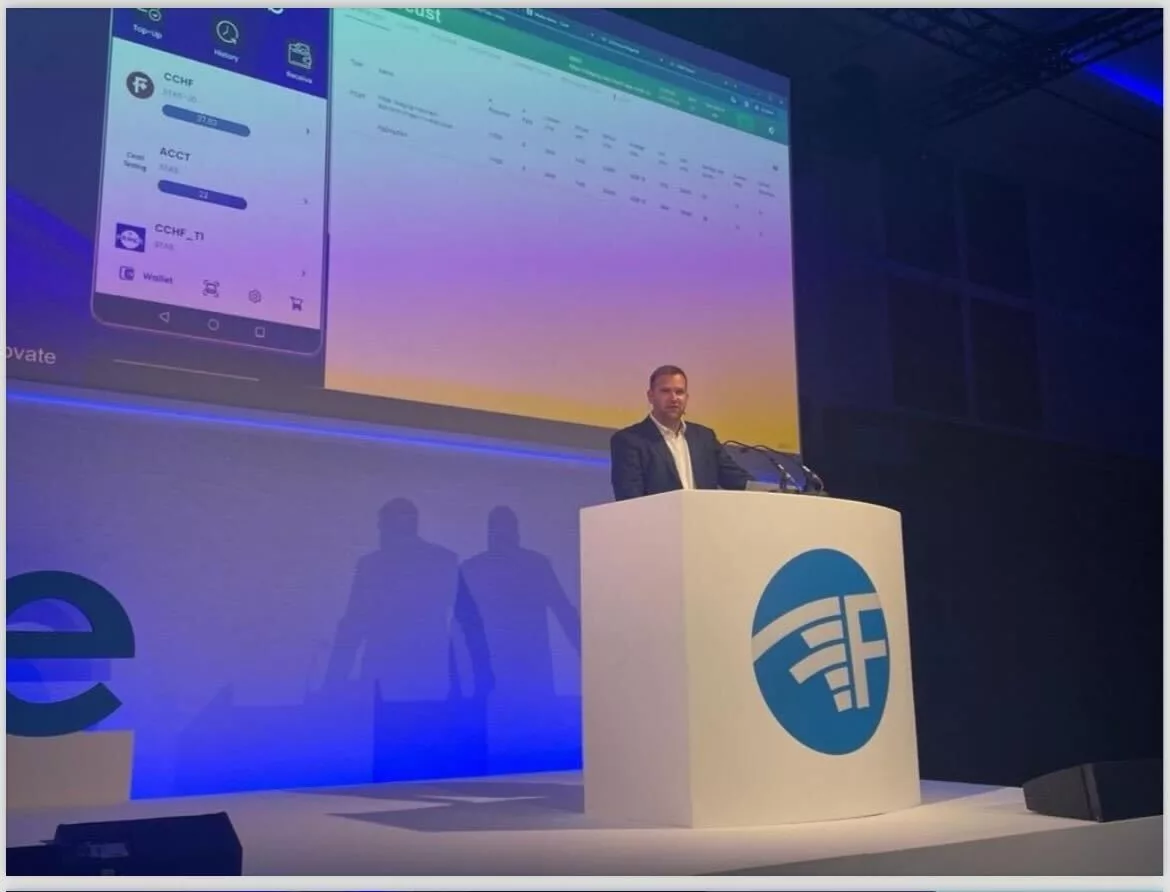

Blockchain fintech services company Centi AG has set a new record, processing 1 million financial transactions in 24 hours. The million transactions, which were part of a demonstration this week for FinovateEurope 2024 in London, consisted of

microtransactions worth 1 cent each in Centi’s stablecoin token. It showcased both Centi’s and BSV blockchain’s speed and efficiency, all at near-zero cost.

The presentation was a public demonstration of Centi’s proprietary stablecoin technology, designed to be high-speed and scalable. The company is cementing its reputation as a leader in micropayments denominated in recognizable units while remaining fully compliant with existing financial regulations.

The success at FinovateEurope 2024 proved Centi’s ability to develop broader financial applications across banking and other fintech services, the company said.

It’s been almost a year since Centi launched its Swiss franc stablecoin (CCHF), a tokenized asset based on BSV blockchain contracts. CCHF is intended for both businesses and consumers to use, and micropayments will be its marquee feature. Under existing financial networks, sending transactions as low as one cent is impossible, as fees would be prohibitive.

Stablecoins to offer speed, familiarity

A stablecoin allowing micropayments is attractive to all participants in the digital economy. The denomination and value are familiar, and BSV’s low usage fees eliminate the costs associated with mainstream digital payment networks, including credit cards and other payment apps. Such speed and low cost also remain unavailable on most blockchain networks, especially considering BSV’s proof of work (PoW) confirmation protocol, which is considered more secure and robust than other “high speed” blockchain networks.

For reference, for a million transactions, credit and card-based networks would hit users with over US$100,000 in fees. Ethereum (without Layer 2 solutions) would cost a whopping $3 million for the same number of transactions, and even more “cost-effective” Layer 2 solutions would still cost $13,000.

A Layer 2 solution is a network separate but connected to the Layer 1 blockchain, which usually bundles transactions to confirm on-chain later. Bundling transactions on a separate network layer is similar to how credit cards process smaller charges, though blockchains would settle them more often. Processing and settling individual transactions on Layer 1 (on-chain) at a miniscule cost and without bundling could be seen as a holy grail—except that BSV can already do it.

Bernhard Müller, founder and CEO of Centi AG, said:

“Centi’s showcase at Finovate London signifies our deep commitment to transforming the payments landscape. Our technology sets new industry standards in terms of speed, cost-efficiency, and security, heralding a new era of accessible, inclusive financial transactions.”

Centi aims higher than demo record

The company doesn’t intend to rest on a mere million transactions in a day. The further goal is to reach 20 million per day in 2024.

Centi can also process rapid payments, each within three seconds, matching “instant payments” performed by banking networks. “Instant” is in quotes since banking-based payments are still not finally settled, even though the transaction is completed from the merchant/consumer point of view.

However, Centi doesn’t consider itself an external competitor to banks and other fintech service providers. The company would prefer instead to work with these institutions and collaborate on integrating its stablecoin technology into existing structures.

It’s a better way to address existing technological limitations in banking and finance, such as inclusivity/access and micropayments, and find ways to turn its innovations into practical applications.

Watch: Centi—Bridging digital money and traditional banking

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024