|

Getting your Trinity Audio player ready...

|

Seven months since its official launch and three months since Block Dojo Philippines

kicked off in Bataan, its first batch of cohorts is now at the crucial stage of developing their services—getting funding from investors.

Last week, Block Dojo Philippines organized a Virtual Showcase event where three startups from the first batch of cohorts gave a brief background of their services, including their revenue model, target audience, initial funding, and how blockchain can help power up their businesses. Watch the replay here.

Hosted by Block Dojo Philippines Head of Marketing Dominic Santiago, the event opened with the incubator’s Managing Director in the Philippines, Kristoffer Briones, saying the Virtual Showcase event is “not just a celebration” of participants’ resiliency in making it this far, but “a culmination of the 12-week intense program.”

Driven by its vigor to create real-world solutions, Block Dojo Philippines believes leveraging technology through entrepreneurship while fostering diversity will help with its ambition.

“We have structured the three-month program…through a carefully cultivated set of courses, and also work practices,” said Briones.

Not only did participants learn how to build the foundation of their businesses, but Block Dojo Philippines taught them to push past their boundaries, allowing them to conquer their fears, he continued.

While passion is essential in developing a business, talent and skills are equally important, one which the Philippines is abundant in, forcing Block Dojo to venture out into the country.

“We’ve opened in the Philippines because we’d identified that there’s a huge amount of technical talent…some incredible talent, and I just believe that the market is underserved,” said Block Dojo Global Commercial Director Jay Gujral, who gave a short insight of the development of the incubator program in the country.

Gujral noted that homegrown companies in the U.K. outsourcing Filipino workers is a testament to the Philippines’ rich talent pool.

Apart from this, Gujral said Block Dojo believes it could help the local government attain its ambition to develop the Philippines as a global blockchain hub.

Changing landscape investing with RealFlip

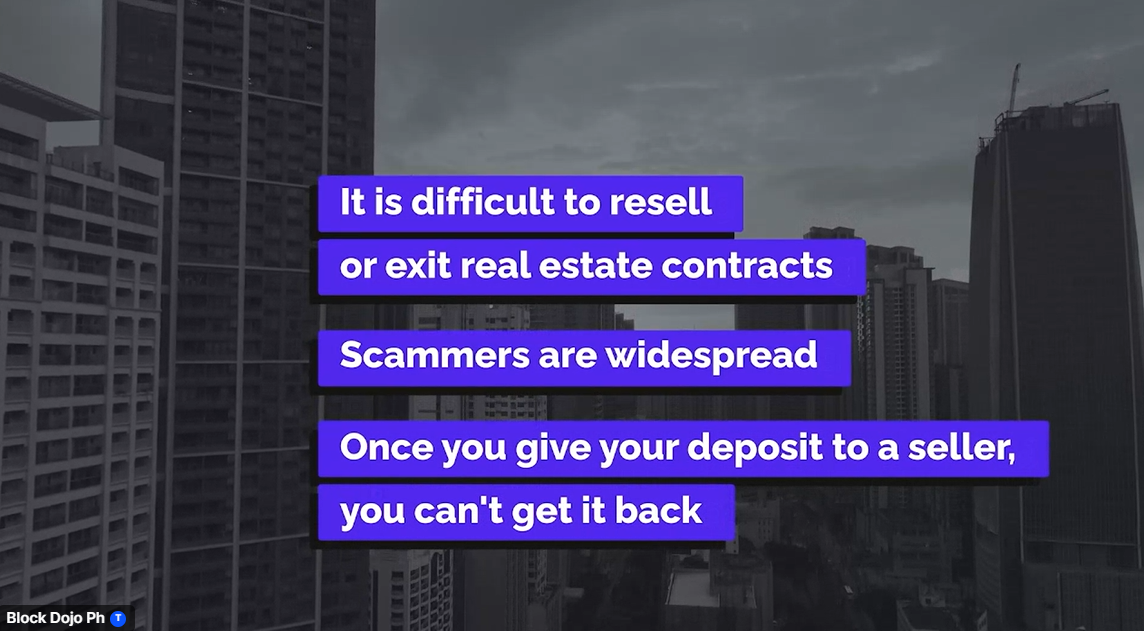

The real estate sector is one of the most resilient industries in the Philippines and among the top choices for Filipinos looking to grow their wealth.

However, with Filipinos’ continued interest in real estate investing, so is the proliferation of scams related to this.

Jaimee Ligan’s previous trip to the United States, where escrow services are widely available online, gave her an idea to bring a similar service to the Philippines—one that would not only be easily accessible to all but would guarantee secure transactions.

Powered by blockchain, RealFlip lets property investors buy and flip real estate contracts online.

“We’re doing this through user experience that optimizes document collection and sales conversion,” explained Ligan. “We have escrow features for trackable and safe collection of refundable deposits with banking-level verification and digital KYC.”

The app features a step-by-step guide on flipping properties for Filipinos new to real estate investing.

Ligan’s RealFlip not only serves investors a secure investment platform but also addresses the absence of a platform for off-plan property buyers.

With a proposed funding of $250,000, Ligan looks to target pre-selling buyers for the early adoption of the app, leveraging social media, online advertising, and events to gain users. The fund would also cover the development of a minimum viable product (MVP) and legal and compliance validation for a one-year pilot run of RealFlip.

In terms of revenue generation, RealFlip will rely on introductory fees for flipped contracts, off-plan sales commissions, escrow transaction fees, subscription and advertising, data monetization, white-label licenses, and lender commissions.

RealFlip isn’t a one-person project, with Ligan supported by the startup’s CTO, Atty. Timothy James Felarca, Advisor and CMO Kristoffer Mago, and CFO John Robert Catalan.

Bound by their shared values, Ligan sees their expertise in their individual field as a fair advantage in the real estate market, adding that utilizing blockchain technology could help propel their services to greater heights.

While RealFlip pays great importance to streamlining property investments, Ligan said their priority would be compliance with existing property laws.

“We will prioritize legal compliance and validation…to put up a licensed financing company here in the Philippines,” Ligan said when asked how her team will utilize the funding. “Second, we’ll use it for our go-to-market wherein we will be holding events targeted [at] Overseas Filipino Workers. Third is, of course, our sales and operations.”

In her presentation, Ligan noted that the majority of property investors are foreign real estate buyers and migrant workers who are contributing significantly to the Philippine economy through remittances.

Currently, RealFlip is finalizing a Memorandum of Agreement with a brokerage in the province of Palawan, which Ligan considers a stepping stone in acquiring early adopters of their service.

Revolutionizing movement with FleetHive

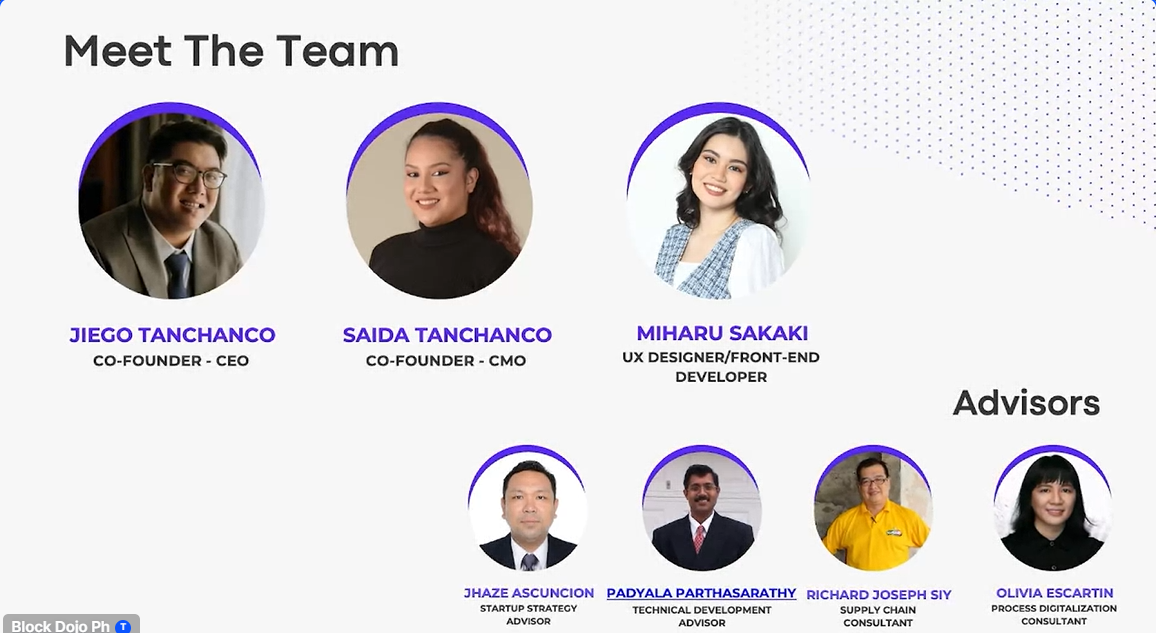

Building on Block Dojo Philippines’ objective to mold founders in creating real-world solutions, Jiego Tanchanco and his team ensure that their service will not only address issues in the logistics industry but empower local drivers and truckers, whose roles are often overlooked.

“I want to change this. I want to speak for them to address their needs and show the world how important they are to our growth and progression as a society,” said Tanchanco, who believes that emerging technologies will be a key driver in attaining this.

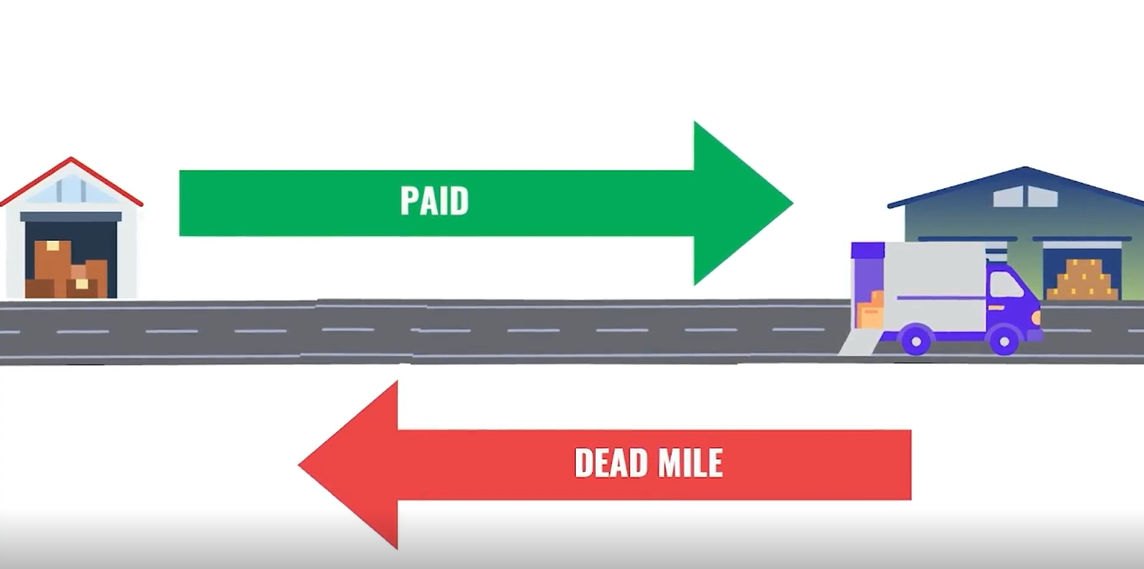

With seven years of experience in fleet management, Tanchanco’s FleetHive strives to resolve the issue of empty cargoes traveling on the road, which costs the Philippines $6.4 billion annually. The underserved community of drivers and truckers not only has to deal with slim profits and long hours but also faces excruciating traffic when delivering goods from various locations, while businesses suffer from higher costs.

“These inefficiencies are caused by three factors—lack of visibility of available shippers, lack of trust and transparency, and dependency on manual processes,” he said.

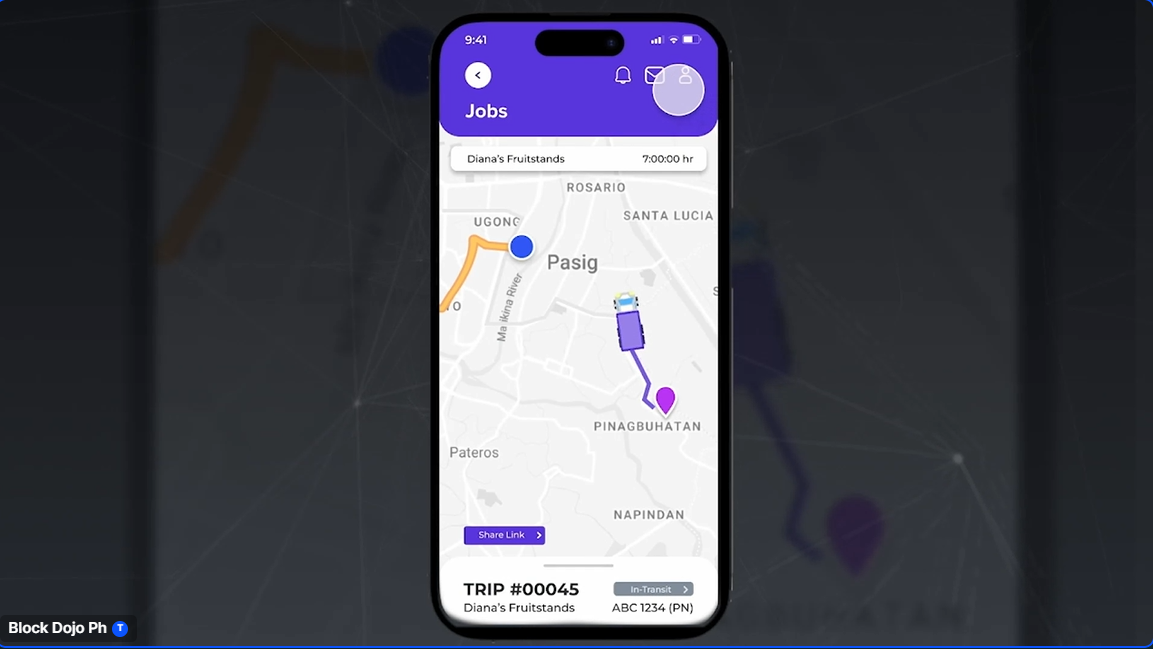

As a B2B platform with commission as its primary revenue generation, FleetHive connects businesses with pre-verified carriers, which Tanchanco said reduces costs while giving entrepreneurs greater control and valuable data insights.

With blockchain as its core technology, FleetHive assures businesses of data security and can track their shipment location in real time.

“We at FleetHive bridge the gap, offering flexible options for any business need, from single trucks to entire fleet,” said Tanchanco, explaining that while most logistics firms in the Philippines focus on big companies, his team looks to cater to all.

“This positions FleetHive as the go-to solution for efficient B2B logistics in the Philippines,” he continued.

While there are a number of technologies in the market that offer nearly similar services to FleetHive, Tanchanco is asked why none have succeeded in the second-mile delivery market.

“Number one is the ease of use. Sometimes, these technologies are too complicated…number two is sometimes it’s too expensive or they have upfront costs,” Tanchanco said, explaining that these factors deter businesses from using the existing apps currently available on the market.

Since FleetHive is dealing with the logistics market, Santiago pointed out that liabilities are a common cause of concern, leading him to ask Tanchanco how his startup plans to safeguard itself from such occurrences.

Tanchanco said FleetHive having a KYC process is one of its means of protecting itself from liabilities.

“We can definitely monitor the chain of custody and the proof of delivery since we offer an end-to-end visibility on every step of the journey. We can monitor the timestamps, the location, and even the digital signatures of each delivery, making sure you have a proof of trust every step of the way,” he said, adding that having per-trip insurance coverage for cargo, vehicles, and drivers makes FleetHive a more secure app.

With a proposed $250,000 funding, FleetHive plans to expand its geographical coverage and network of drivers and explore embedded insurance for security.

Three companies have already pledged their support to pilot the first version of FleetHive, which targets small- and medium-sized businesses, primarily in the manufacturing, agriculture, food, hardware, and construction industries, as its early adopters.

Tanchanco said his team plans to set up roadshows next year and develop digital marketing campaigns to gain potential customers.

Apart from championing the underserved community of drivers, Tanchanco said FleetHive is all for promoting sustainability, which he described as a “win-win situation” not just for truckers and businesses but for the environment as well.

Combatting fake credentials with APDXS

Another startup with a B2B approach showcased its pitched service, with blockchain technology centered on the Philippines’ educational landscape.

Founded by Warren Joseph Moises, APDXS focuses on the local certifications market, with the aim of leaving a legacy in the sector using the BSV blockchain.

With over 30 years of experience in the academe, having built, managed, and operated eight local and five international campuses, Moises is tapping blockchain to counter fraud in the educational sector and promote fair competition among new job seekers.

The local educational sector remains largely traditional, so APDXS seeks to help secondary institutions, universities, and colleges transition into the digital era.

The three-man team is developing APDXS, describing it as a “revolutionary record certification system” that aims to streamline schools’ verification process while ensuring that all documents stored on-chain are secure and tamper-proof.

“We are a blockchain-based authentication system that enables universities and colleges to issue tamper-proof digital diplomas to graduates,” said Moises, adding that high schools can also use APDXS to issue digital transcripts for students.

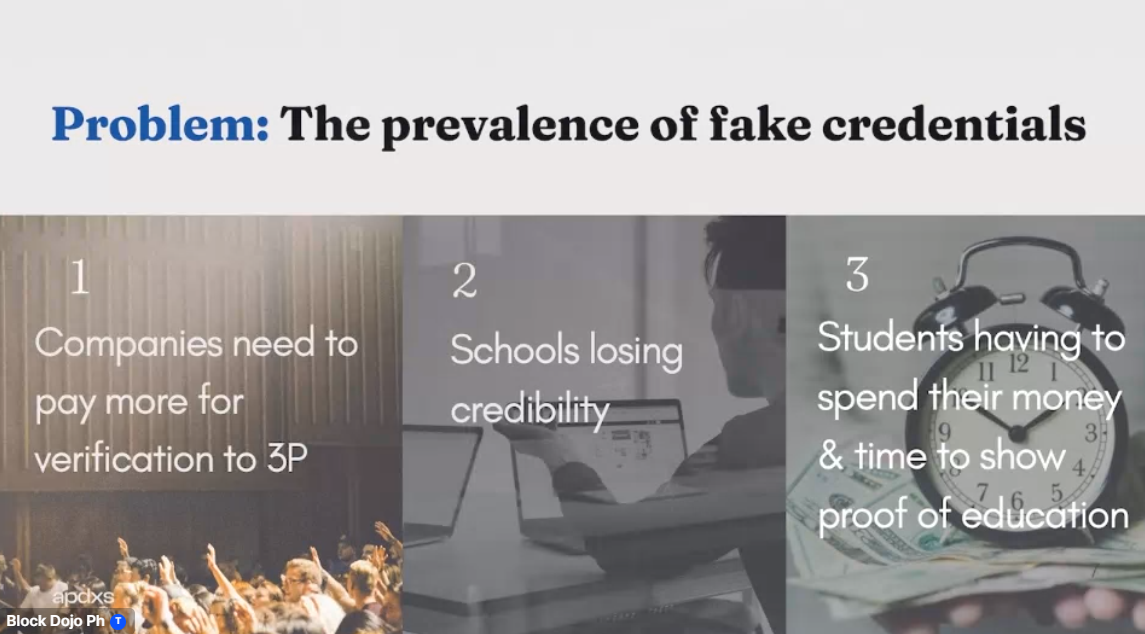

With stiff competition in the labor market and completing education has become difficult for some families, some Filipinos have resorted to faking their diplomas in a bid to get a decent job, a problem that Moises’ team looks to resolve through APDXS.

“The existence of fraud documents is still prevalent,” he said.

APDXS’ system uses a QR code for its authentication, and when scanned, it will take the user to the university verification portal to send a request to students, who will then give approval to access their documents.

“We will leverage BSV blockchain’s advantages on transaction fees and transaction capacity. Plus, we offer a whitelabel and customizable verification system,” said Moises.

Hailed from the Greek word apodeixis, which means demonstration of proof or showing the truth, APDXS targets to onboard 200,000 users in its one-year pilot run, with its mode of generating revenue dependent on commission and subsidies.

The proposed pricing for its service starts at $3 per student annually and $15 for any third party who wishes to avail of its verification service.

Currently focused on small and medium school markets, Moises said APDXS plans to expand its services to include organizations handling and issuing certifications in the future.

Learn more about Block Dojo Philippines’ first batch of cohort and their services by downloading the Look Book here.

Watch: Block Dojo Philippines—Pushing startup boundaries to create solutions

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-10-2024

11-10-2024