|

Getting your Trinity Audio player ready... |

The responsibility of closing out the middle day of London Blockchain Conference fell to Tibor Merey, managing director and partner at Boston Consulting Group.

The topic was, in a sense, deceptively straightforward: taking place on the Best Practices for Enterprise Adoption track, Merey discussed the realities of getting Web3 business ideas off the ground. To do so, Merey draws from an impressive body of experience in blockchain, based on the 180+ blockchain and Web3 projects that Boston Consulting Group has advised on in the enterprise space.

Merey started asking for a show of hands: who predominantly works in Web3 or blockchain? Most of the hands in the room went up, with some hold-outs. Keep your hand raised if you’re getting more client demand than you can served? Most hands went down.

“Why is not everyone in this room keeping their hands raised? The answer is: it’s all about the business value.”

He describes a recent survey that interviewed decision makers with budgets to spend on blockchain solutions. It revealed business value as the number one most valued feature. Technical features, he points out, were way down the list, at the seventh most valued priority.

Stepping back a moment, Merey said that we are currently entering the fourth phase of Web3 technology.

“We’ve all been part of the previous phases. It started centred around digital currencies, it has moved on to smart contract capabilities, and has added digital ownership as well.”

“The phase we are in we call embedded Web3 or embedded blockchain: adding that technology deep into the stacks of the supply chains of corporates around the world.”

He says we are seeing incumbents from both finance and tech embark on these technologies and high levels of investment entering the space. This, he says, is an indication that the blockchain will be the protocol layer that governs the relationships and transactions of an augmented world. This is, no doubt, great news for the gathered audience.

Merey then discussed some proven use cases to make his point. His first example is Tracr. Tracr is a venture that BCG built for DeBeers, the biggest diamond distributor and producer in the world. Tracr enables proof-of-providence from mine to fingers, and has by now established itself of the de facto standard of proving where a specific diamond has come from. Blockchain’s unique capabilities of immutability and transparency is a prime technology to establish this sort of trust, says Merey.

Another example? Klockner, a German steel manufacturer. For their green-steel product line, BCG has built a digital product passport, which on-chain proves the level of CO2 that went into a specific product. The nice thing, he says, is that customers of the company can take that data packet and apply it into their own, downstream products.

He also gave an example of smart contracts via Eherisc, a service that embeds the payout of a claim for damages—due to, for instance, flooding—directly into the smart contract layer. It then uses Oracle technology to bring real-world information on-chain and enables the instant disbursement of funds.

“We see this taking place time and time again across industries,” said Merey.

“The financial system is becoming aware of this. Tokenization of assets as well as securities is a big, big thing. At BCG, we estimate that by 2030, $16 trillion of assets will be tokenized. Not just securities or bonds; it will also include real-world asset tokenization. That will lend itself to a much more innovative, much more decentralized financial system built around decentralized finance but on a bigger scale and going much deeper.”

“All of these use cases, I would say, are in the proto stage of what’s to come. Because up until now, many of the fundamental technologies are not scaled in the fashion they need to be. But we see the interest from corporates. We see the first pilots. We see that consumers are starting to embrace the idea.”

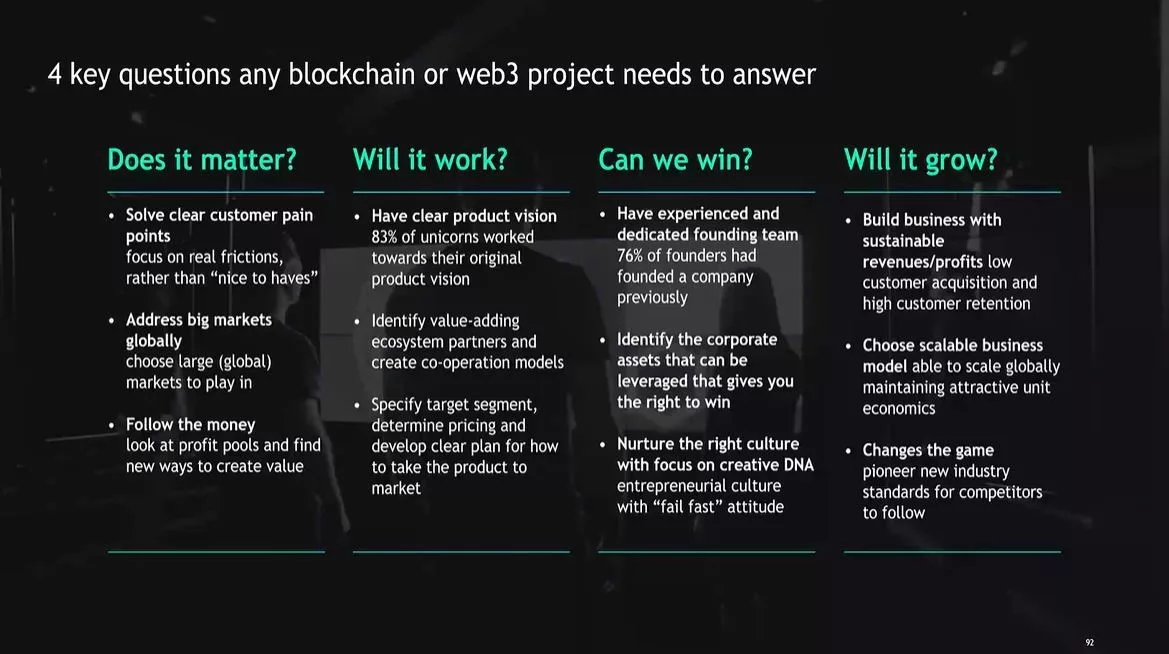

But adoption remains the goal: what can all of us sitting in the audience do to ensure it is achieved? Merey says that anybody who thinks they have a Web3 or blockchain-suitable business idea must be able to answer four key questions—and they must be answered in order:

- Does it matter? This, Merey says, is the number-one question we need to ask ourselves—not our customers. Another way of putting it: is someone willing to pay for it?

- Will it work? Have a clear product vision, identify the target segment, and identify value-adding ecosystem partners. He mentions that virtually all unicorn companies have kept to their core value proposition.

- Can we win? Is it realistic? Identify the corporate assets that can be leveraged.

- Will it grow? The business must have sustainable revenues and profits, with low customer acquisition and high customer retention. Key to this: will it scale?

When asked in the ensuing question-and-answer session, which drew many passionate hands, what the key difference is between the many failed startups and the unicorns, Merey referred back to these questions. Things usually go wrong, he said, with questions one or two.

“One component of how you can overcome that difference between a failed startup and a unicorn is that you talk to customers very, very early on. If you get too hung up with the ‘will it work’ or ‘can we win’ section, sometimes you forget talking to the customers. The work we do with BCGX, which is our build unit at BCG, is we actually talk very early to customers. Oftentimes, only with a mock-up, only with a demo, only with a landing page, and we get that feedback.”

That’s some efficient advice to cap off a very practical day at the London Blockchain Conference 2024.

Watch: Day One Summary at #LDNBlockchain24

Watch: Day Two Highlights at #LDNBlockchain24

11-21-2024

11-21-2024