Interest in retail CBDCs has dwindled significantly over the past two years, a new report by the Bank for International Settlements (BIS) has found.

BIS surveyed 86 central banks globally on the trends that emerged in 2023 in CBDCs and digital assets. The banks also shared insights into their interaction with stablecoins and the future of digital payments.

BIS found that 94% of global central banks are exploring CBDCs, with most working on both retail and wholesale currencies. However, around one in three focused exclusively on retail, while only a mere 2% are only working on wholesale CBDCs. Half the banks are working on proofs of concept, while around 30% have advanced into a pilot.

Advanced economies have seen the steepest rise in wholesale CBDC activity, with 81% running proofs of concept, up from 60% the year prior. Emerging markets saw a slight uptick from 37% to 39%.

In contrast, retail CBDCs have recorded a drop in interest, BIS reports. Initially, the retail side dominated, with China’s digital yuan once being described as the future of finance by its proponents and as the greatest modern threat to the West by its detractors. Jamaica, the Bahamas, Nigeria, and the Eastern Caribbean launched their retail CBDCs, further strengthening the movement.

However, as the report reveals, retail CBDC interest has dropped among the advanced economies (from 29% to 27%). With the emerging markets, this interest rose slightly to 82%.

Overall, the number of nations expected to launch a retail CBDC over the next five years has nearly halved from 11 in 2023 to 6 this year. Meanwhile, wholesale CBDC predictions remained constant at nine.

The report further found that central banks are experimenting with several aspects of potential retail CBDCs. Some of the most popular features include imposing holding limits, interoperability with domestic payment systems, offline capabilities, and separation from bank accounts.

With wholesale CBDCs, interoperability is the guiding principle.

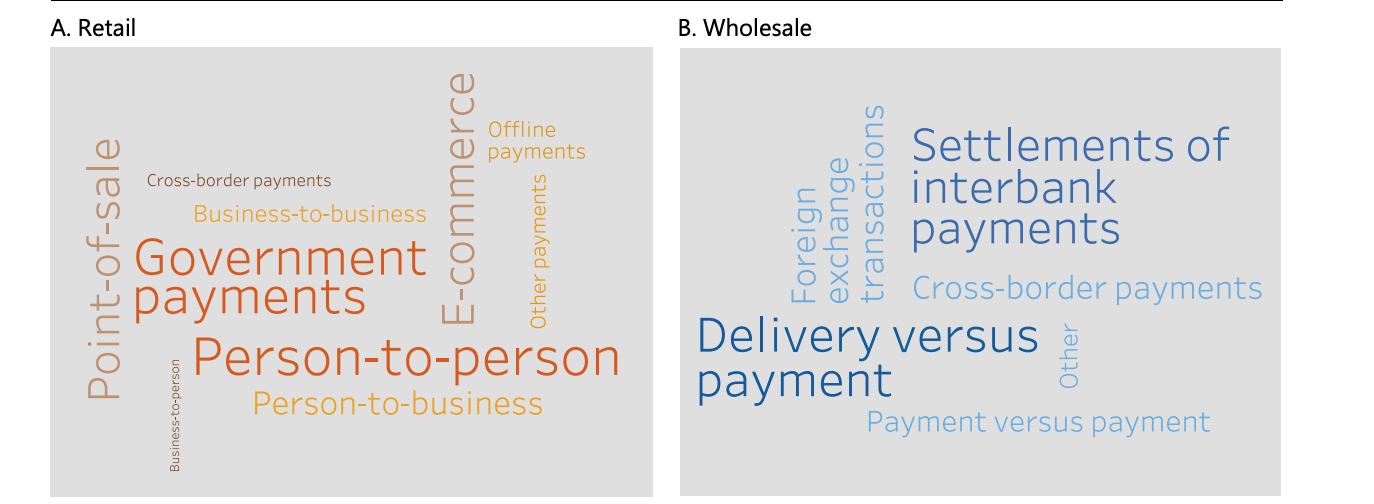

The two approaches also target different niches. With retail, government payments, person-to-person, e-commerce and point-of-sale transactions are key, according to the survey. Wholesale focuses on settling interbank payments, delivery versus payment, and cross-border transfers.

According to the Atlantic Council’s CBDC Tracker, 134 countries are exploring digital currencies, representing 98% of global GDP.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: CBDCs are more than just digital money

09-20-2024

09-20-2024