|

Getting your Trinity Audio player ready... |

Distributed ledger technology (DLT) is becoming increasingly important globally this year, with exchanges, fintechs, and custodians being the biggest adopters, a new report has revealed.

The report, “DLT in the Real World,” was published by the International Securities Services Association (ISSA), a global body whose members include central securities depositories (CSDs), custodians, tech firms, and other players in the securities sector.

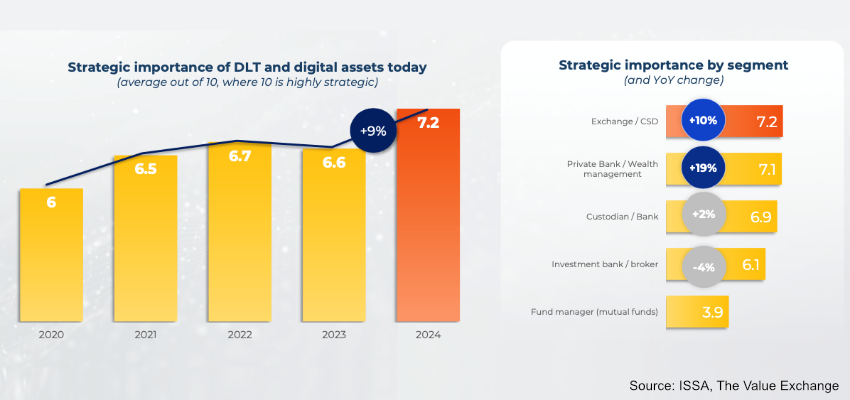

ISSA’s survey, which involved over 340 securities firms globally, found that DLT’s importance to the sector had increased 10% since last year. Overall, the technology’s strategic importance hit a record high after a slight dip last year.

ISSA found that while DLT users are diving deeper into the technology, the overall deployment has stagnated. The share of live deployments stayed constant at 37%. While digital tokens now account for over $15 billion, half of the projects have an annual turnover below $1 million.

Cutting costs and increasing revenue have become the two key factors driving DLT adoption in the securities sector, replacing learning and experimentation.

Bonds have also cemented their spot as the most common asset class deployed on DLT. Some of the world’s largest companies have been experimenting with blockchain bonds for years now, and governments have recently offered their support.

This year, Swiss cities have settled hundreds of millions of dollars in digital bonds through the country’s wholesale CBDC. Hong Kong completed the sale of $750 million in digital green bonds earlier this year, which the Philippines has partnered with the Asian Development Bank to explore.

ISSA further found significant variance in DLT development across regions. In the Middle East and Africa, the highest number of respondents were in the proof-of-concept stage, and Latin America had its highest share in development.

In North America, Asia, and Europe, nearly one in two respondents have a live application on the DLT.

The most common challenges cited were low return on investment and a lack of a compelling business case. Other common hurdles included limited liquidity of tokenized securities and legal uncertainty.

The report further revealed that public blockchains are increasingly losing their market share to private blockchains. The latter now controls 65% of the market, up from 55% last year, with securitized assets and private debt the most common private blockchain use cases.

Watch: Determining blockchain’s economic value

11-22-2024

11-22-2024