|

Getting your Trinity Audio player ready... |

In late 2018, it’s strange to me so many adults require, crave minders. In financial matters especially, aren’t you sick and tired of having a government nanny at every interval of life? I’ve seriously had an ass full. And when it comes to money, the ticket by which we measure success, wealth, time, and access to the good life, every attempt at bureaucratic intervention grates, gnaws at me to my core.

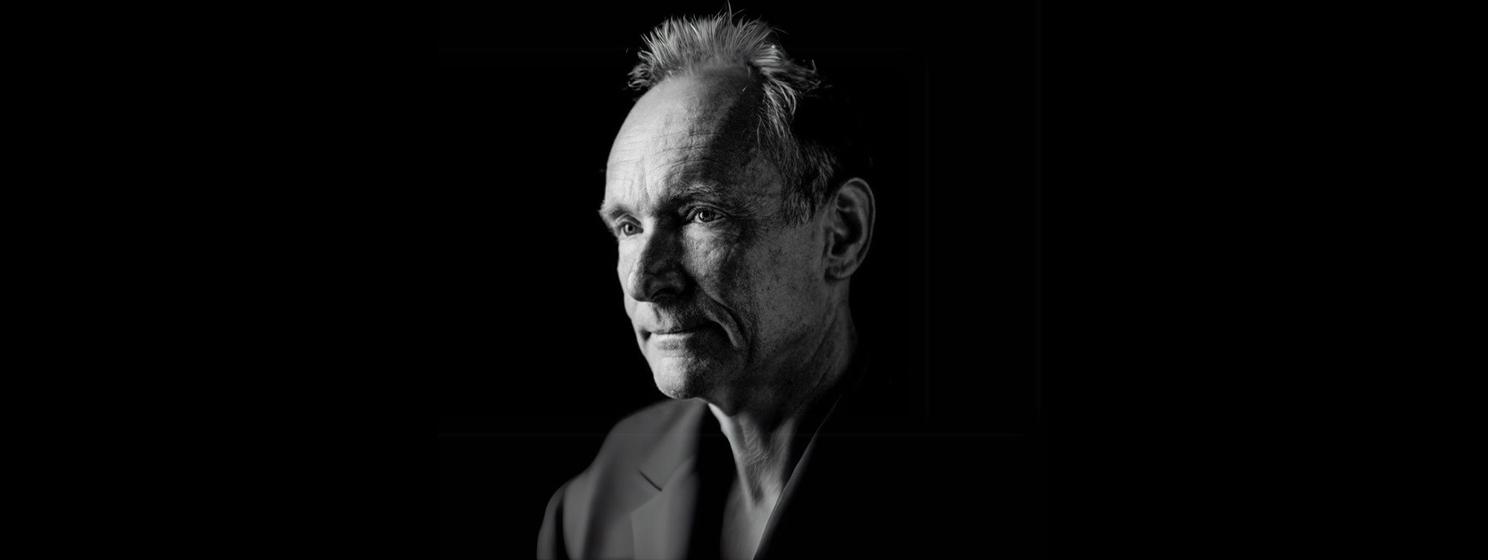

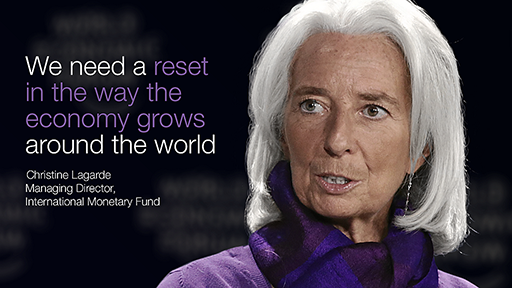

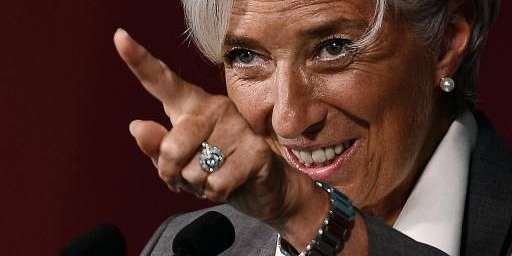

To that end, the International Monetary Fund (IMF) has had a more hate-than-love relationship with cryptocurrency, at once pretending (early on) to embrace the tech while at the same time ramping up warnings. Christine Lagarde and her outfit for a solid calendar year, going back to this very month in 2017, have been hammering away at cryptocurrency.

In its recent and very typical over-titled report, World Economic and Financial Surveys: World Economic Outlook, Challenges to Steady Growth 2018, on page 41, of a 215 page tome, rests its lone reference to cryptocurrencies and their promise. Chapter 1, “Global Prospects and Policies,” under the subheading “Financial Tensions,” at the section’s very end, is a rather dire warning.

New vulnerabilities

“Cybersecurity breaches and cyberattacks on critical financial infrastructure,” the sudden phrasing turns, “represent an additional source of risk because they could undermine cross-border payment systems and disrupt the flow of goods and services. Continued rapid growth of crypto assets could create new vulnerabilities in the international financial system.”

Without any hyperbole, this literally is a Keynesian outfit—as in it was the brainchild of Lord Keynes. The father of modern quantitative easing and short run thinking gave birth to the IMF. It’s comprised of over 180 nations, founded in the wake of Bretton Woods following World War II. Carrying the day was infusing economies with cash, lots of paper, to jump start rebuilding places like an utterly gutted and defeated Germany.

The IMF has since morphed into a fixer, facilitating bailouts through special drawing rights (SDR), a kind of forex reserve. Its unit of account is the XDR, a pseudo currency in lieu of dollars or gold. At any one time, the IMF holds over half a trillion worth of SDR in XDR from which member countries can pull during a crisis. Uncontroversial would be to write a 73-year-old legacy, internationally connected reserve banking organization, designed to bail out the world’s worst economies, might have something to say about the increasing popularity of cryptocurrencies. And less shocking still is how that body wouldn’t be too pleased economies it demands seek its help could have other options in the near future.

Consistent pattern

Indeed, it was around this time last year Lagarde began to make overtures only someone in her position could: it’s getting close to having to care about crypto in general and Bitcoin in particular. Then, as now, she warned at an annual meeting how the IMF is “about to see massive disruptions,” and they should adjust “to the impact of the combined breakthrough technologies that will impact markets,” which she had pinned as blockchain and cryptocurrency both.

The run-up of late 2017 surely fueled IMF fears, as by mid December Bitcoin Core (BTC) had hit as high as $18,000, sending its market capitalization beyond that of the legacy agency’s own reserves. BTC was then valued at some $300 billion, while SDR/XDRs were roughly 10 billion less. That a technology in fewer than 9 years could leapfrog a better than 7 decades-old institution must’ve sent shockwaves through its Washington, DC hallways.

By spring of the present year, the gloves were off. Addressing the Dark Side of the Crypto World were Lagarde’s pointed comments at crypto. She insisted, “The same reason crypto-assets like Bitcoin are so appealing is also what makes them dangerous.” Her tone set how future takes on crypto would be framed. “The rapid growth of crypto-assets,” she continued later, “the extreme volatility in their traded prices, and their ill-defined connections to the traditional financial world could easily create new vulnerabilities.” Clearly a pattern is developing.

Schizophrenia

A tad later, Lagarde offered a more measured approach to crypto, issuing a pair of blog posts aimed at coming to grips with money’s future. She intended to “examine the promise they offer. A judicious look at crypto-assets should lead us to neither crypto-condemnation nor crypto-euphoria.”

Of the then blooming ecosystem, where the space had grown to thousands of digital variations on the BTC theme, she stated flatly how “it seems inevitable that many will not survive the process of creative destruction. The crypto-assets that survive could have a significant impact on how we save, invest and pay our bills. That is why policymakers should keep an open mind and work toward ¬¬an even-handed regulatory framework that minimizes risks while allowing the creative process to bear fruit.”

Her agency’s main talking point when speaking on crypto made its way into a post, however. “Our preliminary assessment is that, given their still-small footprint and limited links to the rest of the financial system, crypto-assets do not pose an immediate danger.” Still, regulators should keep close watch of the potential for crypto “to magnify the risks of highly leveraged trading, and to increase the transmission of economic shocks should they become more integrated into mainstream financial products.”

Return to form

By September of this year she and the agency returned to doing what they do best, bullying. In nearly 60 pages, the IMF addressed the Marshall Islands and their interest in mounting a state-backed version of crypto. “The potential benefits from revenue gains appear considerably smaller than the potential costs arising from economic, reputational, AML/CFT, and governance risks. In the absence of adequate measures to mitigate them, the authorities should seriously reconsider the issuance of the digital currency as legal tender,” the agency scolded.

For a smaller country, IMF chastisement is the kiss of death. Banks particularly in the United States were told to stay clear of the Marshalls, effectively. The Marshall Islands had planned to launch about $30 million worth of crypto through an airdrop and initial coin offering. A philosophically secure regulatory body would’ve issued pros and cons, and left it at that. Allowing countries, especially smaller economies, to sandbox crypto is probably the best of all worlds if the IMF is truly worried about vulnerabilities and the like. They could’ve allowed the plan to fail naturally and sat back, watching the chaos knowingly.

And that’s the truth of the matter, ultimately. The body only pretends at help, and is much rather inclined to dictate terms in favor of existing economic arrangements. This is why their calls to stabilization ring so hollow to modest income countries. That only means propping up the well-connected, dictators, banksters, those who benefit most by state graft and corruption. In the name of vulnerabilities and stabilizing, anything is game, possible with the IMF so long as nothing substantive changes.

Cryptocurrencies such as Bitcoin (BCH) are very real threats. They’re officially dismissed now, but the chatter in recent years and months from legacy bodies such as the IMF is telling. In the streets of Turkey and Venezuela, no sentence means less than “We’re from the IMF, and we’re here to help.” Turks and Venezuelans are already ditching fiat and plowing their wealth into crypto, and the trend worldwide is only growing.

C. Edward Kelso is a financial technology journalist based in Southern California. Follow him on Twitter.

11-22-2024

11-22-2024