|

Getting your Trinity Audio player ready... |

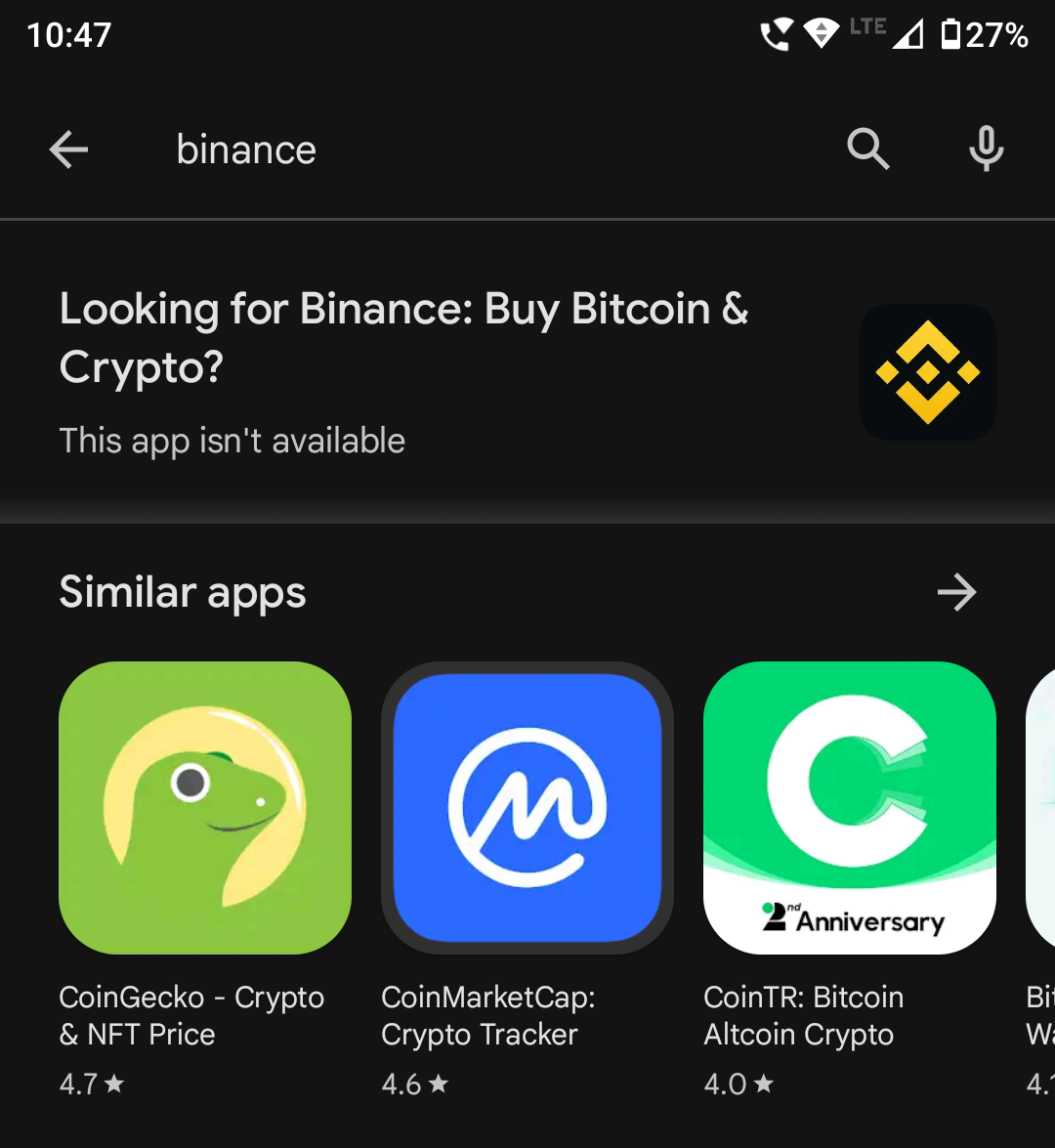

Days after Apple (NASDAQ: AAPL) pulled Binance, Kraken, and other foreign exchange apps from its App Store, Google (NASDAQ: GOOGL) has delisted the trading platforms from its Play Store in India.

The Financial Intelligence Unit (FIU), India’s anti-money laundering agency, took aim at offshore exchanges late last month, issuing “show cause” letters to nine platforms on December 28.

Apple delisted eight of the nine shortly after, with Bitstamp the only exchange that survived the initial Apple purge. Sources within the government revealed that Apple was acting on the orders of the Ministry of Electronics and Information Technology (MeitY).

Google was not as quick to delist the apps, but followed the move late last week. Local media reports that ISP providers in India have also started blocking the exchanges’ URLs to comply with the ministry’s orders.

India’s offshore exchange purge stems from the country’s requirement for all trading platforms to report with FIU and obtain a license. According to the agency, 31 exchanges have obtained this license, but most are local bourses.

The foreign exchanges have failed to obtain this permit, which, among other requirements, demands they adhere to India’s controversial tax regime. The country demands a 30% flat tax on digital asset income and a 1% tax deducted at source (TDS).

Despite commanding a substantial market share, Binance and other foreign exchanges have failed to submit to these requirements.

This is quickly changing, and with the crackdown now intensifying, local exchanges are set to regain the market share they lost a year ago.

WazirX, one of the largest local exchanges, lost over 90% of its trading volume after the tax regime took effect. However, as it revealed to one outlet, its deposit volume shot up 250% since the December 28 warnings by the FIU to foreign platforms.

Mudrex, a local exchange backed by American accelerator Y Combinator, revealed that it had recorded over 30,000 new signups since the warnings.

“The figures we usually do in three months, we’ve been able to realize those in the past two weeks,” the exchange CEO Edul Patel disclosed.

The two exchanges further revealed that 70% of their volume had come directly from Binance as users fled the global exchange.

Digital asset exchanges caught in India-China rivalry

For India, the foreign exchanges have an additional risk, according to local experts: they have ties to Chinese entrepreneurs. In a letter to the Ministry of Home Affairs (MHA), New Delhi-based think tank Esya Centre alleged that seven of the top exchanges have founders of Chinese origin, including Changpeng Zhao of Binance.

Justin Sun, the controversial TRON founder who owns HTX exchange (formerly Huobi), was born in China’s northern province of Qinghai. HTX was among the exchanges banned by FIU. Gate.io—also banned—was founded by Lin Han in China but moved to the Cayman Islands as Beijing cracked down on ‘crypto.’

India has been aggressive in its economic and geopolitical rivalry with China. Over the past three years, Indian authorities have banned over 250 apps with Chinese links, including TikTok, which had over 200 million users in India.

According to Sana Hashmi, the Indian government is unlikely to relent in its offshore exchange crackdown due to its concerns about its rivalry with China. Hashmi is a fellow at the Taipei-based think tank Taiwan-Asia Exchange Foundation.

“The current developments, too, are reflective of India’s ongoing scrutiny of incoming Chinese investments and the operation of Chinese companies within the country,” stated Hashmi.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple, Ethereum,

FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024