|

Getting your Trinity Audio player ready... |

The U.S. Securities and Exchange Commission (SEC) has opened an investigation into Binance.US over its relationship with two trading firms said to be trading against Binance.US customers, according to a report by the Wall Street Journal.

The two firms, Sigma Chain AG and Merit Peak Ltd, are market makers who were controlled by Binance founder and CEO Changpeng Zhao as recently as 2021. Part of the investigation is said to be concerned with whether Binance.US disclosed its relationship to the firms, both of which trade with Binance.US customers. The U.S. securities regime prohibits making money as a result of deceit and/or the omission of material facts in dealing with customers.

The allegations would be in keeping with Binance’s well-documented practice of obscuring its corporate structure from regulators and flouting legal requirements. If the reports are true that these companies were affiliated with Binance and traded on Binance’s platforms, then it would appear that Binance has committed a significant violation of the securities law disclosure rules—at the very least.

As it turns out, Sigma Chain AG and Merit Peak Ltd are both so closely related to Binance that they might properly be said to be its subsidiaries—a fact Binance has gone out of its way to conceal.

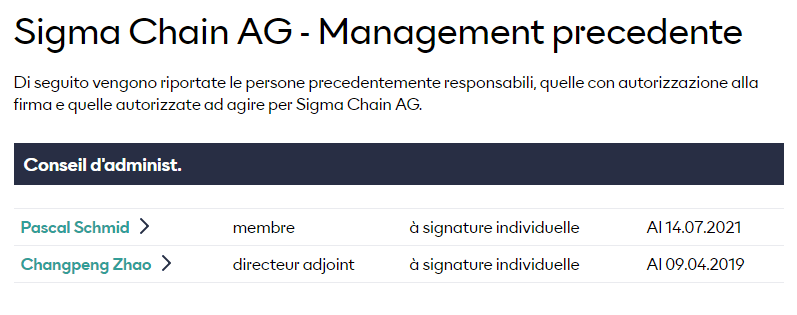

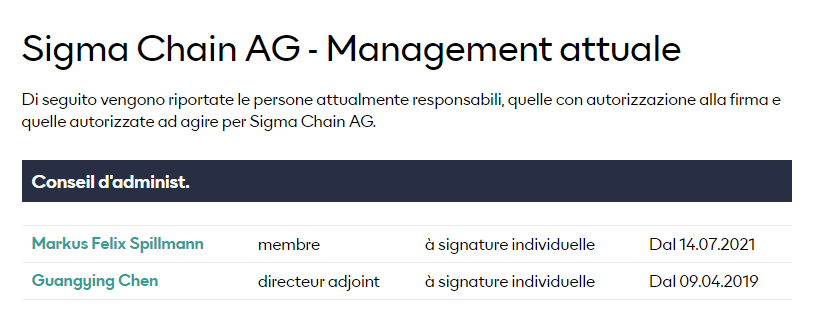

Sigma Chain AG is a Swiss-registered company. Public records from at the time the company was incorporated list Changpeng Zhao as the founding president; the only other member of the company from this period is Pascal Schmid, one-time member of the Cardano Foundation. Zhao occupied this position September of 2019. At that point, control was handed over to someone named Guangying Chen, who is still listed as the company’s director today. Schmid was swapped out for Markus Felix Spillman—listed as a Binance board member – on 14 July 2021.

Guangying Chen is something of an enigma, but the name appears in connection with Binance and Zhao time and time again. She appeared on a leaked list from 2017 which is reported to be a list of digital asset companies that were then the subject of investigation by Chinese authorities. The list, preserved by independent investigative journalist LibreHash, contains an entry for Binance and lists the representative as—you guessed it—Guanying Chen. Guangying’s name also appears on the historical whois lookups for Binance domains, including Binance.com, as discovered by scambinance.com.

There is no information available publicly on the other company, Merit Peak Ltd. A company with that name appears to at one time have been a shelf company registered in the British Virgin Islands. Given the company’s non-presence online and given the sheer number of company names associated with Changpeng Zhao and Guangying Chen, it seems probable that Merit Peak Ltd is another shell company for Binance. The Wall Street Journal has reportedly seen documents signed by Zhao on behalf of Merit “approving an infusion of capital from Merit into Binance.US in exchange for shares in the company,” and the SEC apparently already believes that Merit is a Binance company.

It seems beyond doubt that the Merit Peak Ltd and Sigma Chain AG are Binance companies, despite their best efforts to obscure that fact. Neither company appears in any of Binance’s publicly available materials, so they certainly haven’t disclosed these affiliates to their customer base. The SEC investigation would appear to mostly be a matter of how much activity the two companies are responsible for within the Binance ecosystem and what advantages they might have enjoyed above Binance’s regular customers.

As the Wall Street Journal pointed out, wronged investors and regulators alike have started to take action against exchanges who have affiliates on their platforms trading against their own customers. The founders of the BitMEX are facing criminal charges and private RICO suits for engaging in market manipulation and trading against its own customers, while the SEC has already taken action against other exchanges who failed to disclose affiliates trading on their platforms.

The probe will be a rude awakening for Binance. After a year spent batting away negative press and with regulators nipping at their heels, the beleaguered exchange announced a strategic $200 million investment into Forbes, one of Binance’s more dogged critics in the mainstream media, just days before this latest investigation was reported.

Forbes’ coverage of Binance included the leak of an internal proposal for Binance to circumvent and deceive U.S. regulators by setting up a U.S. subsidiary with an outward focus on compliance and then surreptitiously instructing customers on how to evade geoblocks and access the parent Binance exchange. The plan appears to have (at least partly, if not wholly) manifested as what is now known as Binance.US.

Whether the move—strategic as it is—is enough to stem the tide of negative press surrounding Binance remains to be seen. What is certain, however, is that Binance and Zhao can’t invest their way out of an SEC probe.

The SEC will have to get in line. The Commodity Futures Trading Commission (CFTC) already has two open probes against the company including for insider trading and market manipulation, and it spent much of 2021 being blocked by banks and 86ed by a number of countries over compliance concerns.

Is it still all just FUD?

It’s not a bull market without some FUD.

Ignore FUD, keep BUIDLing.

— CZ 🔶 BNB (@cz_binance) March 12, 2021

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—a from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple, Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-21-2024

11-21-2024