|

Getting your Trinity Audio player ready... |

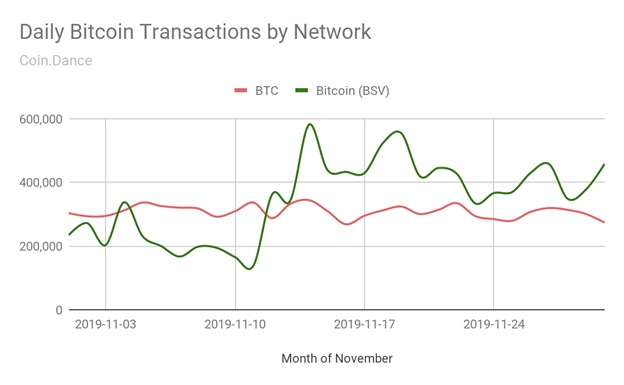

Thanks in part to the Quasar protocol upgrade, Bitcoin SV (BSV) surpassed the BTC token in the number of daily transactions in November.

BSV now handles more transactions than the BTC token, reaching as high as 581,000 transactions per day last month, according to data from blockchain visualizer Coin.Dance. Bitcoin SV averaged 347,847 daily transactions during November versus 307,848 daily transactions on the BTC network. According to Bitinfocharts.com, the BSV network handled 396,000 transactions on December 1st, while the BTC blockchain just saw 274,000 transactions.

For many in the BSV community, this news comes as no surprise since the number of transactions per second (TPS) had doubled every quarter. During November 2019, BSV processed 5 TPS on average, permanently overtaking BTC (~3.5 TPS). BSV is projected to exceed ETH (~8 TPS) in Q1 of 2020.

Other blockchain projects have famously shown they can momentarily boost network transactions without providing any real-world utility. The rising activity on the BSV network can be tied directly to the developer community’s excitement over roadmap to restoring the original Bitcoin protocol to increase on-chain scaling.

In the Bitcoin SV ecosystem, transactions are driven by all the activities on the chain as developers continue to build on the only blockchain project that can massively scale. Contrast this to the BTC network, where transactions are driven exclusively by the fluctuating market prices and trading activity.

Scaling BSV will help support enterprise usage for tokens, smart contracts, big data, and other applications. It is the only advancing blockchain capable of support high transaction volumes while also keeping fees low. Commercial users needed these features to transmit information and manage the microtransactions effectively.

More significant scaling will soon be coming to the Bitcoin SV blockchain. A test on November 7 by the Bitcoin SV Node team’s Scaling Test Network (STN) set a new record for the number of transactions in a single block at over 2.7 million, smashing the previous record. The 2.7 million transactions would have generated 5.4 BSV in fees and took under 30 minutes to fill.

The increased number of transactions bodes well for miners as the halving set to occur around May-June 2020 quickly approaches. The primary income of Bitcoin miners will rely less on block rewards, and more on transaction fees as the Bitcoin whitepaper initially intended. Once the rewards stop around 2140, miner’s income will be entirely derived from transaction fees.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024