|

Getting your Trinity Audio player ready... |

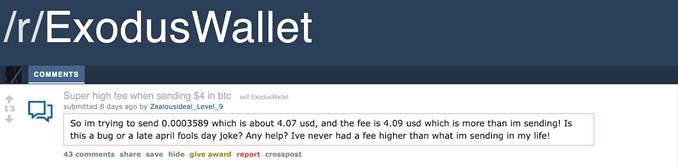

If I had to summarize why BTC fails, I would choose this recent Reddit post to make my point:

Someone complained in the Exodus wallet’s Reddit forum about high fees transacting BTC. The person tried to send 0.0003589 BTC (about $4) and had to face the fact that the transaction fee to do so would be more than what he was going to send.

So the 0.0003589 BTC cannot be moved unless he gets more BTC.

Is it a bug or a late April Fool’s Day joke? This is what the person is asking the other Reddit users there. Good question.

No, it is not a bug, it is a feature of BTC:

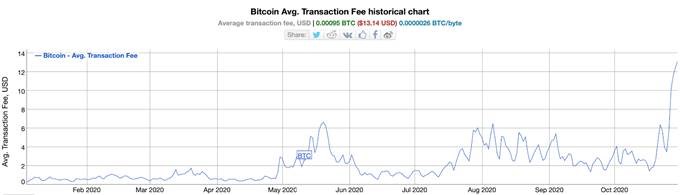

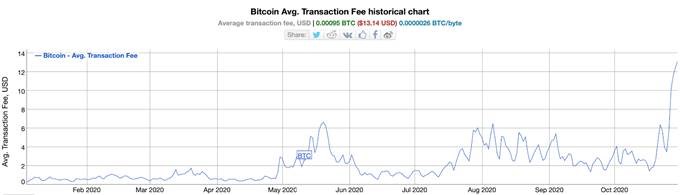

In the chart above, you will see rising transaction fees in BTC since January 2020. BTC users pay more and more to move their BTC.

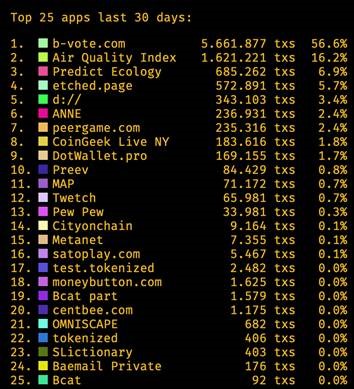

In comparison, if you send 0.0003589 Bitcoin SV (BSV) instead of BTC, you would not even notice the transaction fee. No wonder Bitcoin SV beats BTC in transactions and block size already and brutally dominates BCH, too:

The minimal fee is intended in BSV, as Bitcoin is an electronic cash system according to the original Bitcoin whitepaper and cash should not only be easy, but cheap to transact with:

As one can see, the chart above clearly shows how Bitcoin SV’s transaction fees are decreasing. So BSV users enjoy cheaper and cheaper fees to move their BSV.

This is crucial, as Bitcoin’s real power is in usage, not in “hodling” it. Only recently, Bitcoin SV powered social media platform Twetch celebrated 1 million transactions being made on chain by its users:

We started this company with a dollar and a dream.

Thank you all for supporting our vision for a brighter future.

1,000,000 TRANSACTIONS ON CHAIN!!! LETS GOOOOO 🥳 pic.twitter.com/VevOFllkxK

— Twetch (@twetchapp) October 27, 2020

Exactly that kind of real Bitcoin usage via micropayments is not possible with BTC due to ultra high fees.

Ultra high fees? I have to be exaggerating, right? Let us see how much more you pay in BTC compared to BSV:

As of writing this article, it is a staggering 73,789x more expensive to transact in BTC than in BSV.

You read that right, 73,789 times more on transaction fees in BTC than in Bitcoin SV. This is just one of the reasons why businesses use Bitcoin SV and have abandoned BTC.

Now it makes sense why PayPal—after recently announcing to let its users buy and sell cryptocurrencies on their platform—has added this sentence into their terms:

You currently are NOT able to send Crypto Assets to family or friends, use Crypto Assets to pay for goods or services, or withdraw Crypto Assets from your Cryptocurrencies Hub to an external cryptocurrency wallet. If you want to withdraw the value from your Cryptocurrencies Hub you will need to sell your Crypto Assets and withdraw the cash proceeds from their sale.

So PayPal users will be able to buy and sell BTC but not actually use it.

PayPal has no choice though, as people that buy small amounts of BTC would not grasp why their BTC cannot move.

Can you imagine PayPal customer support trying to explain why $4 in BTC cannot be sent because of ultra high transaction fees?

To fully explain that, PayPal would have to refer its customers to the ongoing war on Bitcoin, the crypto cartel, and the plan behind crippling BTC’s capabilities. And they will not be able to communicate all of the reasons in to an easy to understand few sentences.

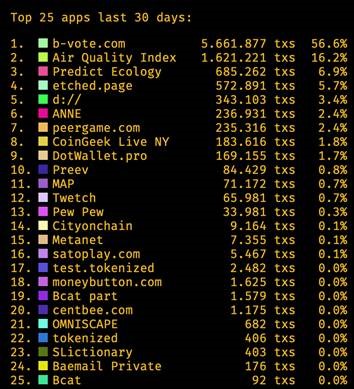

While BTC is busy damaging the Bitcoin brand, Bitcoin SV dedicated apps and services generate more and more transactions on-chain, creating real value for Bitcoin:

See also: One World, One Chain presentation by Jimmy Nguyen at CoinGeek Live

https://youtu.be/1qzTi6PiM8E

如果要我总结BTC失败的原因,我会选择最近Reddit的这个帖子来阐明我的观点:

有人在Exodus钱包的Reddit论坛上抱怨BTC的交易费用高。此人试图发送0.0003589个BTC(约4美元),并且不得不面对这样的事实,即这笔交易的费用将超过他要发送的金额。

因此,除非他获得更多的BTC,这0.0003589个BTC是不能移动的。

这是一个BUG还是愚人节后期的玩笑?这个人就是在那里问其他Reddit用户的。好问题。

No, it is not a bug, it is a feature of BTC:

在上图中,您会看到自2020年1月以来,BTC的交易费用不断上涨。BTC用户要支付越来越多的费用来转移他们的BTC。

相比之下,如果您发送的是0.0003589个比特币SV(BSV)而不是BTC,您甚至都不会注意到交易费用。难怪比特币SV在交易量和区块大小上已经打败了BTC,并且还残酷地碾压了BCH。

BSV中的费率最低是有其用意的,因为根据原始比特币白皮书,比特币是一种电子现金系统,现金交易不仅要方便,而且转账费用要便宜。

大家可以看到,上图清楚地显示了比特币SV的交易费用是如何下降的。所以BSV用户在转移BSV时享受到了越来越便宜的费用。

这一点至关重要,因为比特币的真正威力在于使用,而不是“瞎忙活”。就在最近,比特币SV驱动的社交媒体平台Twetch庆祝其用户在链上进行了100万笔交易。

确切地说,这种通过小额支付的真正的比特币使用场景通过BTC是不可能实现的,因为BTC的费用超高。

超高的手续费? 我说得太夸张了吧?让我们看看您用BTC比用BSV多付了多少钱。

在写这篇文章的时候,BTC的交易费用比BSV贵了惊人的73,789倍。

你没看错,BTC的交易费用是比特币SV的73789倍。这只是企业使用比特币SV而放弃BTC的原因之一。

现在,这就可以理解为什么PayPal——在最近宣布让用户在他们的平台上买卖加密货币之后,又在他们的条款中加入了这句话。

您目前无法向家人或朋友发送加密资产,无法使用加密资产支付商品或服务,也无法从您的加密货币中心向外部加密货币钱包提取加密资产。如果您想从您的加密货币中心提取价值,则需要出售您的加密资产,并提取其出售的现金收益

所以,PayPal用户将能够买卖BTC,但不能实际使用它。

不过PayPal别无选择,因为购买少量BTC的人不会明白为什么他们的BTC无法移动。

你能想象PayPal的客户支持部门试图解释为什么4美元的BTC因为超高的交易费用而无法发送吗?

为了充分解释,PayPal将不得不向客户介绍正在进行的比特币战争,加密领域卡特尔(同业联盟),以及削弱比特币能力背后的计划。而他们将无法把所有的原因通过几句容易理解的话表达出来。

当BTC忙着破坏比特币形象的时候,比特币SV专用应用和服务却在链上产生越来越多的交易,为比特币创造了真正的价值。

另见 Jimmy Nguyen在CoinGeek大会直播上的“同一个世界,同一条链”的演讲

https://youtu.be/1qzTi6PiM8E

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024