|

Getting your Trinity Audio player ready... |

Bitcoin, an electronic cash system, is not just a currency or a new form of money, but also a technology platform, and until just the last few months, few people understood this. Recently, the Ordinals protocol on BTC has created a frenzy of digital tokens that have exploded in popularity and ignited a token bull run amid “crypto” market stagnation and generally flat mainstream market price action of stocks and other traditional assets.

But did you know this isn’t the first Bitcoin token boom? In fact, it’s not even the first Bitcoin data era. That’s right! We have been here before.

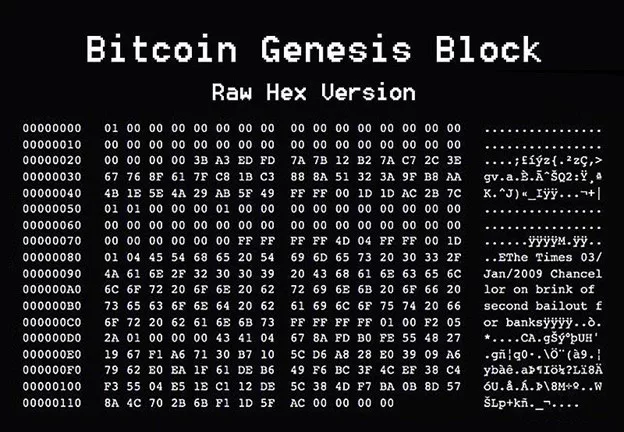

Satoshi Nakamoto kicked off the blockchain with the “arbitrary” data of the Times headline to prove there was no pre-mine of the tokens. A perfect timestamp proof for the world to remember in perpetuity. But today, many advocates would call such a thing SPAM.

In breaking news, it is possible that the first known purchase using Bitcoin may have been a screensaver-sized JPEG procured through a discussion on the forums in participation with Satoshi Nakamoto himself. Adding credence to Bitcoin’s usefulness as cash and the bizarre notion that digital art might be exponentially more valuable than a bitcoin itself. In this case, it appears someone valued this screensaver more than five hundred bitcoins!

This Twitter Space was FIRE

We discovered that:

🔥 the first purchase EVER with bitcoin was buying a JPEG for 500 BTC in Feb 2010

🔥 it pre-dates the the famous 10,000 BTC pizza

🔥 satoshi himself helped facilitate the JPEG sale

🔥 laser-eye cult in absolute SHAMBLES pic.twitter.com/b6ESOkbf0i

— Udi | BIP-420 🐱 (@udiWertheimer) May 14, 2023

Years later, as we enter a new cycle of debate about the value of bitcoin, electronic cash and tokens, it is important to remember that it has never ended well for token advocates, and Bitcoin seems to consistently lose ground to investment guru-type advocacy.

Maybe this time, it’s different.

Context

Few people know that Bitcoin’s underlying technology is just a distributed database, powerful script language, and a communications network that is combined to make scarce programmable money. The most common use of Bitcoin is simple payments using an unlocking script to send, but with a little more creativity in the use of the script stack, developers have successfully created tokens or unique digital assets that can represent anything from a piece of art, proof of purchase or something like real estate property.

Fewer people understand that this concept is nearly as old as Bitcoin itself!

The advent of colored coins and counterparty tokens, both forms of Bitcoin tokens, ignited significant disagreement within the Bitcoin community, leading to what is commonly referred to as the “Bitcoin Civil War.”

The Genesis of Bitcoin tokens

Bitcoin tokens were conceived as far back as Satoshi himself discussing tokens in vending machines and adult sites, but at the time were just theoretical. In 2013, colored coins were conceived to implement sats in transactions beyond simple monetary transactions. Ordinals are based on this premise today.

The idea was to embed extra information into Bitcoin transactions, turning them into “tokens” representing any form of value—not just currency. This opened up a world of possibilities, from tokenized assets to decentralized applications.

Introduction of CounterParty tokens

In 2014-15, Counterparty tokens took the concept of Bitcoin tokens a step further. Colored coins could “color” a specific Bitcoin, marking it as representing a certain asset or contract. Counterparty tokens, on the other hand, allowed for creating custom tokens within the Bitcoin blockchain using added scripts in OP_Return which allowed for more complex applications and financial instruments.

At the time, the companies behind CounterParty were soliciting potential customers, including common playing card games and large retailers who were interested in issuing assets on Bitcoin.

Here's a BTC wallet from 2014 with fungible #bitcoin tokens displayed. This is from back before the geniuses that control the BIP process nuked it and paved the way for the creation of 20,000 altcoins.

There never needed to be an Ethereum or altcoin economy, folks… #coinprism pic.twitter.com/ClL2uFp6Sh

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) October 6, 2022

The Bitcoin Civil War: Causes and battles

However, these new developments were not welcomed by all. Some small blocker purists argued that these tokens detracted from Bitcoin’s sole purpose as a simple, decentralized currency. Others were concerned about the scalability and security implications of these tokens. These disagreements turned into a full-blown conflict, with debates, forks, and even personal attacks marking the 2015-16 era as the opening of the “Bitcoin Civil War.”

Luke Dashjr, a prominent Core developer of BTC, issued a “patch” that reduced the size of OP_Return to 40kb—killing CounterParty’s use cases with a single software update across the network and showing the problems of centralization in the software issuance process of Bitcoin.

The fallout

The fallout from this conflict was significant. This era saw the opening of major schisms, and the community split into different factions, each supporting different technological and philosophical paths for Bitcoin. This included dividing social groups, brands “taking sides” and ultimately led to a split of Bitcoin in 2017. Since then, the value and reputation of Bitcoin have suffered—losing roughly half of its market dominance since 2017 as the dream of a unified, global Bitcoin currency has receded and been replaced with a pump-and-dump economy of mostly nonsense.

The resurgence

In the 2017-2022 era, big blockers (BCH, then later BSV) focused on research and development of token standards, scalability, and smart contracts that interact natively in the Bitcoin stack. This has included CounterParty style OP_Return tokens, Script-style tokens like STAS, and a smattering of hybrid systems that have shown themselves to be scalable up to a little less than three million token transactions per block—a number inconceivable on any other blockchain.

Found Fresh Bananas 🍌🍌

Block: 733,689

Size: 3.65 GB

Tx count: 2,512,670

Average fee: $0.00038

Total fees: 9.76 BSV

Total revenue: 16.01 BSV

Revenue from fees: 60.96%https://t.co/tbY59NdZvf— BananaBlocks™ by GorillaPool🍌🍌 (@banana_blocks) April 4, 2022

On the small blocker side, BTC has tightened the swimlanes of the network to reduce use cases and focus on limiting bandwidth to encourage node count to grow as a metric of “decentralization” and “store of value.”

Recently, though, these old debates have been resurfacing after a BTC developer named Casey Rodarmor created a simple, elegant tokenization standard using a variation of the colored coin method to inscribe non-fungible assets atop satoshis. Since it uses an ordinal counting method of sats, the protocol is called “Ordinals,” and it has ignited a firestorm of controversy about transaction validity, SPAM, and other politically motivated drama. During the original civil war, massive amounts of money were poured into influencers, media, and social campaigns to teach people that Bitcoin wasn’t capable of tokens or scalability. Ordinal inscriptions on BTC have severely undermined the authoritative claims by small blocker aristocrats like Luke Dashjr, who has been searching for a way to put an end to this tool on BTC again.

Nice of “Luke Dash Jr” to assume a fiduciary role over #BTC like this! pic.twitter.com/q1lczmcOTn

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) May 10, 2023

As Bitcoin continues to evolve and new applications for its technology are discovered, the same battles over its purpose and direction are being fought anew. This resurgence is fueled by the same passion and disagreements that marked the original Bitcoin Civil War. It has created an opportunity for newcomers to revisit the discussions that precipitated all of this. The BSV faction has recently released the 1Sat Ordinals protocol, which makes use of the basic Ordinal tokenization system, but allows truly single-sat transactions, micropayments, and sub-cent fees to empower entrepreneurs to focus on the value of their tokens rather than being forced to value them based on the cost of utilization.

Similar projects are popping up on Litecoin and Dogecoin because of their basic similarities as Bitcoin forks.

Looking forward

The future of Bitcoin, and its tokens, remains uncertain. Will the community learn from its past and find a way to reconcile its differences, or is another civil war inevitable?

Will BTC split into an ordinal chain and a non-ordinal chain? How will tickers and hash power shake out? Will this teach people that BTC transactions are not mutable, and have the developer aristocrats painted themselves into a narrative corner? Could the threat of removal push more energy and development onto other chains the same way BTC dominance has been in a nearly six-year decline in market dominance?

Whatever the outcome, the journey of Bitcoin tokens from a novel idea to a contentious issue has been a fascinating reflection of the broader struggles within the Bitcoin community for the last ten years.

CoinGeek Weekly Livestream: Ordinals on BSV! Luke Rohenaz explains their Utility and Value

11-21-2024

11-21-2024