|

Getting your Trinity Audio player ready... |

At the London Blockchain Conference 2024, Tokenovate CEO Richard Baker presented how his firm is tokenizing real-world financial assets on the blockchain.

Baker’s presentation gave a broad overview of blockchain’s role in the future of finance, design decisions that must be considered when developing solutions, and much more.

Innovation and disruption in finance

Baker begins by characterizing finance: it’s everything from retail apps to capital marketing and central banks. All of it, at every level, is subject to re-engineering and disruption. We’re moving toward a distributed financial market infrastructure, and digital ledger technology can transform both operational processes and product design.

A decade ago, many financial firms would have been running their own computing environments, databases, etc. They were relatively slow to adopt cloud computing due to strict regulations, and the same has been true for blockchain technology.

However, they’ve now studied and understood it, and in the next five to seven years, we’ll see the transformation of clearing houses, exchanges, brokerages, and all other actors as they embrace blockchain, tokenization, and related technologies.

What Tokenovate has built

Tokenovate builds on a public-permissionless blockchain but implements private ledger governance that is suitable for financial institutions.

Baker says it’s important for anyone building on blockchains to consider whether UTXO or account-based models are right for them. Tokenovate decided on the UTXO model with its parallel processing, high levels of security, low fees, and simple validation. In finance, the blockchain each organization builds on must be capable of settling transactions decades into the future.

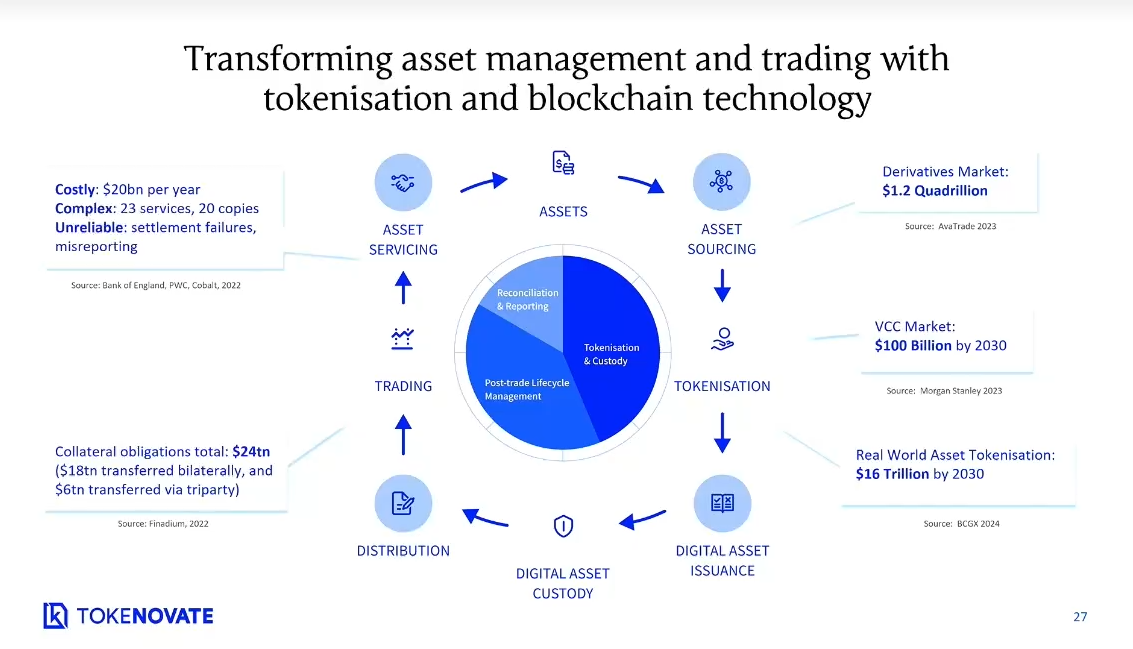

Tokenovate specializes in tokenizing derivatives, a $1.2 quadrillion asset class. This involves large margins underpinned by collateral, which can be fractionalized and verified.

Tokenovate’s platform utilizes smart contracts to implement the International Swaps and Derivatives Association master contract agreements. Blockchain technology plays a key role in controlling the state and conditional logic sequencing of smart contracts.

However, blockchain isn’t the be-all and end-all; it’s a building block. Tokenovate uses cloud computing to scale, while the blockchain is used for settlement. The UTXO model gives it the ability to run private ledgers on public, permissionless chains.

A real-world asset use case

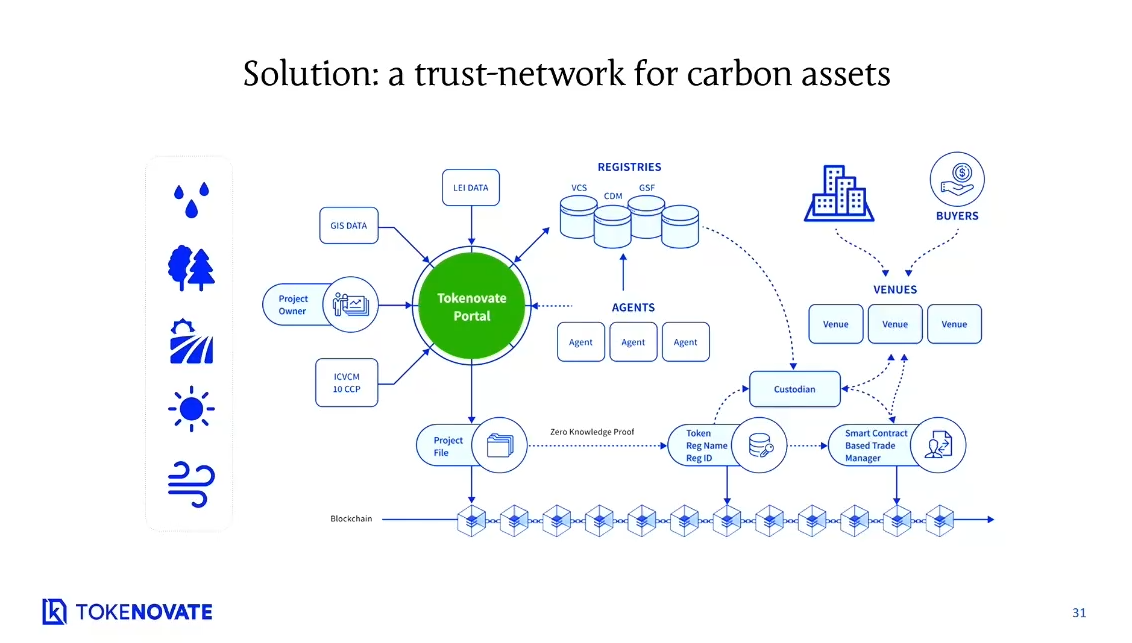

In recent years, there has been much discussion about tokenizing real-world assets. Tokenovate isn’t just talking about it—it has formed a partnership with Land Carbon to do it.

Baker describes this as the “tokenization of the journey toward net zero.” It’s using derivatives to help the voluntary net zero participants meet their obligations while tackling the problems associated with fraudulent greenwashing, compliance with emerging standards and methodologies, and ESG accounting and liquidity requirements.

As with many of the other speakers at the conference, Baker emphasizes how an elegant UX has made it so there’s no need to consider the complexity of everything going on in the background, including the use of blockchain technology.

Watch: Day One Summary at the London Blockchain Conference 2024

Day Two Highlights at the London Blockchain Conference 2024

Day Three Highlights at the London Blockchain Conference 2024

11-21-2024

11-21-2024