|

Getting your Trinity Audio player ready... |

An experiment into "brc-20's" and fungibility on bitcoin with ordinals 1/x pic.twitter.com/9khKLbEPk6

— domo (@domodata) March 9, 2023

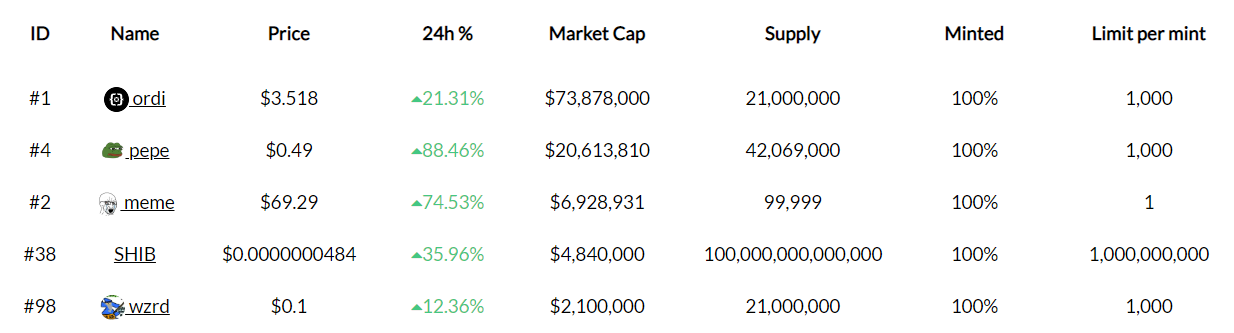

A simple experiment of a token protocol atop BTC deployed shortly after the Ordinals craze started has sparked a frenzy of hype, FOMO, and liquidity. BRC-20 tokens have collectively amassed over $100 million in marketcap in less than 60 days from the “launch” of BRC-20.

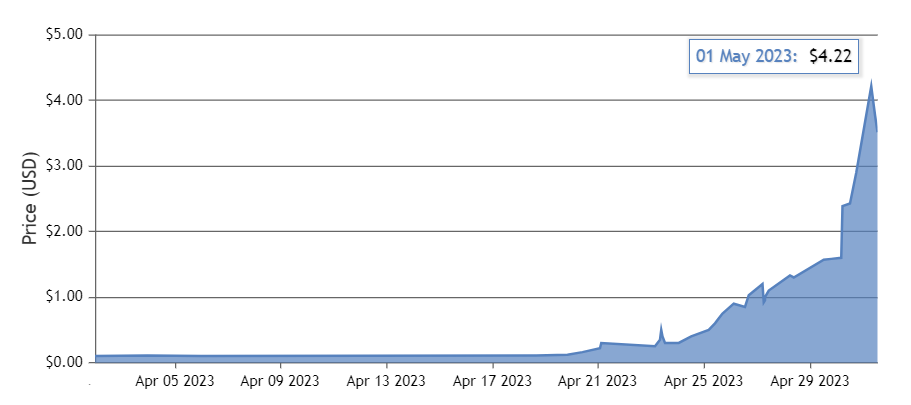

The launch is in quotes because on March 9, the creator of this protocol stated that these tokens would be worthless. On May 1, the first BRC-20 token he deployed (ordi), reached a value of $4 per unit, returning those who minted an astronomical return.

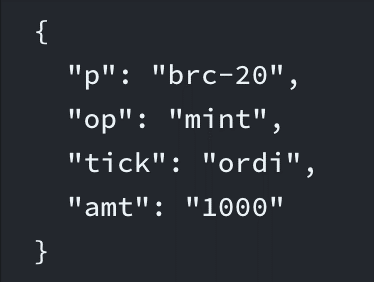

BRC-20 only has three functions, deploy, mint, and transfer. Anyone can create a token via the deploy function, and anyone can mint. The validity of tokens is established by the “first is first” principle adopted from the Sats Names protocol that BRC-20 is influenced by. In the deploy function, the creator sets the ticker, max supply, and mint amount. Once deployed, anyone can mint as many times as they want, and as long as those transactions are ordered inside a mined block and within the threshold of the max supply, they are valid.

For example, the first 21,000 mint transactions of 1,000 ordi each in the BTC blockchain are valid. Any mint transaction after that is invalid. Therefore, the best-case scenario is that one mints some tokens for a few hundred or thousand satoshis; the worst case is they waste those satoshis on an invalid BRC-20 transaction. This is somewhat of a poor user experience, but the “first is first” principle is deeply ingrained in BTC’s culture, so this is recognized and accepted. Over 7,500 tokens have been deployed as of May 1, 2023, and show no signs of slowing down. Aside from ordi, meme coins round out the top 5 tokens ranked by marketcap, pepe, meme, SHIB, and wzrd.

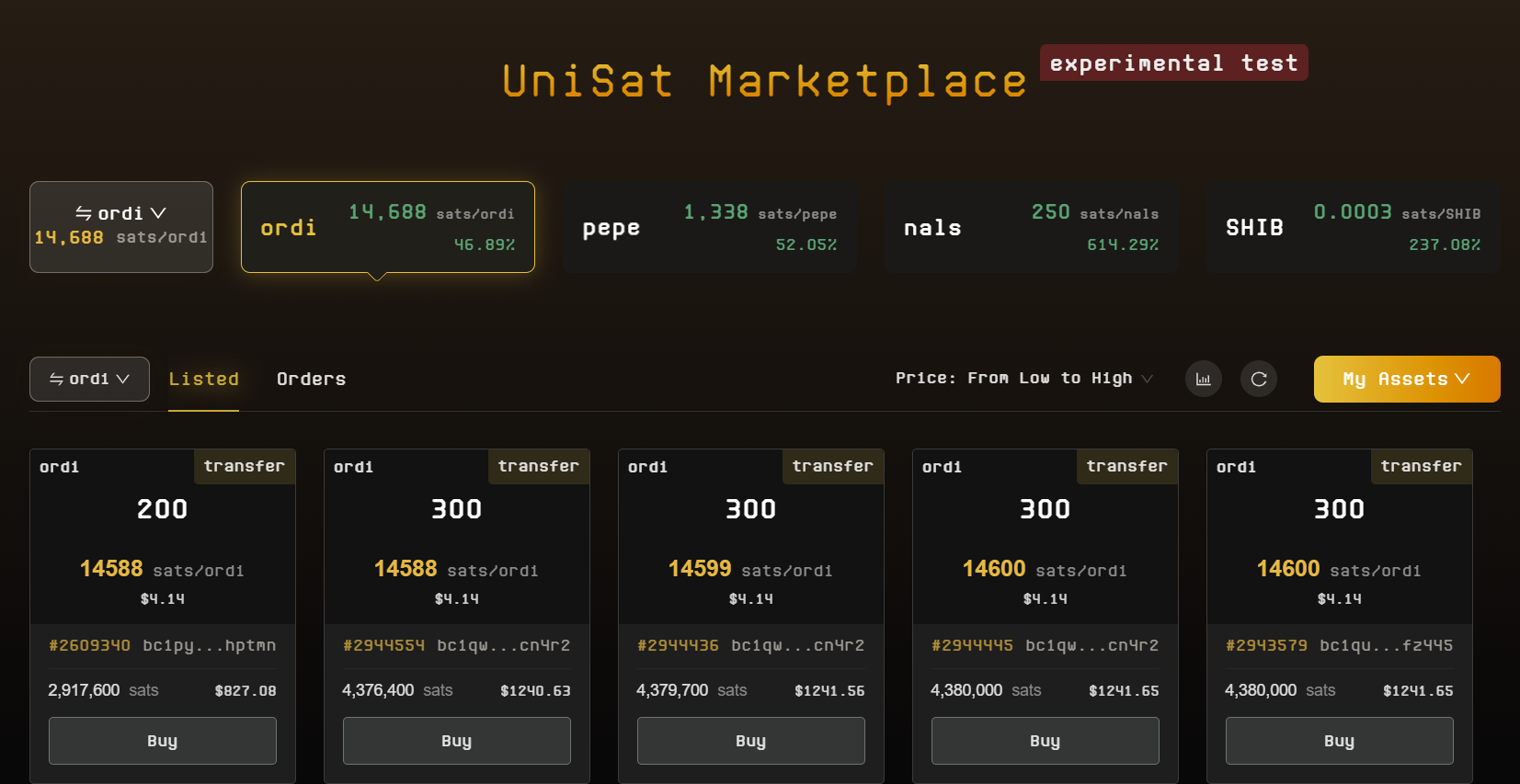

Most trading to date has been done primarily OTC (over the counter) and on Ordinal exchanges such as UniSat or Ordinals Wallet, ordi, and pepe have been tokenized on BSV, trading on RelayX.

This wild price appreciation and liquidity have caught the attention of centralized exchanges, including Binance, Huobi, and okx. Huobi’s announcement in particular cause ordi to spike to nearly $5, before retracing to $4.

Given that the protocol only has three simple functions and does not use Bitcoin script, the indexing of valid transactions is difficult. UniSat has already experienced “double-spend attacks” due to “a vulnerability” in their codebase, likely stemming from the complexity of evaluating valid BRC-20 transactions.

Despite these issues and continued criticisms of the protocol, its growth continues. The novelty is its inclusiveness, where anyone can simply create or mint a token as long as they pay the mining fee. The ticker supports up to only four characters but can represent so much more. Communities may form around a token with shared incentives to increase its value. Finally, the creator cannot pre-mine tokens. Mints are only valid after a deployment; therefore, everyone has a fair shot at minting. Along with being issued on the perceived most secure blockchain, all of these reasons justify the viral growth of this new, “technically flawed” token protocol.

Joshua Henslee: Every significant metric is positive for BSV

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-21-2024

11-21-2024