|

Getting your Trinity Audio player ready... |

Congratulations to the BSV blockchain and everyone involved in it. When Bitcoin launched in 2009, scaling was a theory. A decade later, world records started to occur.

As stated by bsvdata.com, over 1 billion transactions have been processed from January to the end of August 2023, with even more economic activity to come.

we're now approaching 3 billion total transactions in BSV since genesis. it took 14 years to reach the first 2 billion. the third billion so far has taken about 184 days https://t.co/qGNPuHGkfy pic.twitter.com/emzLHFexBd

— root (@1rootSV) September 15, 2023

How did we get to 1 billion transactions on the BSV blockchain?

1,000,000,000 transactions in 9 months—let it sink in. That result is not an accident, but quite the opposite and can be tracked down to a point in time 14 years ago. It was Satoshi Nakamoto himself who wrote in 2009:

The existing Visa credit card network processes about 15 million Internet purchases per day worldwide. Bitcoin can already scale much larger than that with existing hardware for a fraction of the cost. It never really hits a scale ceiling.

That was a bold statement in 2009, but let us see if Satoshi was right:

- In 2018, we celebrated a 64 MB block on the BSV blockchain.

- After that, we witnessed a stunning 128 MB block in 2019.

- The year 2021 brought a world record 638 MB block.

- In 2022, a gigantic BSV block of 3.65 GB (yes, GB!) was processed.

Keep counting because nowadays, in 2023, the BSV nodes were hit with 128 million transactions within 24 hours. All of this, while the fake version of Bitcoin with the ticker symbol BTC has a crippled block size of 1 MB and processes something like up to 7 transactions per second.

Yes, up to 7 transactions per second on BTC, while BSV blockchain—the original Bitcoin—can process 128 million transactions within 24 hours. These numbers seem ridiculous, but this is solely because BTC has deviated from what Bitcoin was really meant to be.

Dr. Craig Wright explains why scaling matters

There is a dichotomy of tracing and privacy in Bitcoin. On the blockchain, each transaction is public, while the identity behind the transactors is not. If the BSV blockchain continues to process the above-mentioned amounts of transactions, privacy increases with the number of transactions—while maintaining the function of traceability.

The inventor of Bitcoin, Dr. Craig Wright, said:

The only rational conclusion that can be derived from an analysis of the system and the evidence lies in accepting that individuals involved with the BTC network and other blockchain systems are misapplying and misrepresenting the terminology of scaling to hide the development of “privacy” solutions, which are really designed to help hide transactions.

See, the BTC network tries to artificially keep the block size limited, as in: “Do not transact too often with Bitcoin, please!” Why would they do that? How come BTC is offering so-called second-layer solutions that funnel transactions off-chain?

Precisely to keep their privacy—and disable traceability at the same time. That is not Bitcoin, though. Bitcoin is both. Bitcoin is privacy at scale, plus traceability, and the reason behind this concept is relatively simple. Honest money, criminals get caught, but average users enjoy privacy.

Bitcoin is about transactions, not about token price

Furthermore, Bitcoin is a commercial system. It is not a coincidence that the Bitcoin white paper’s introduction starts with the word: commerce. The economic incentives in Bitcoin depend on an ultra-scaled future. Bitcoin’s efficiency as a payment system and data management tool comes to fruition with more and more transactions being processed at lower and lower transactional fees.

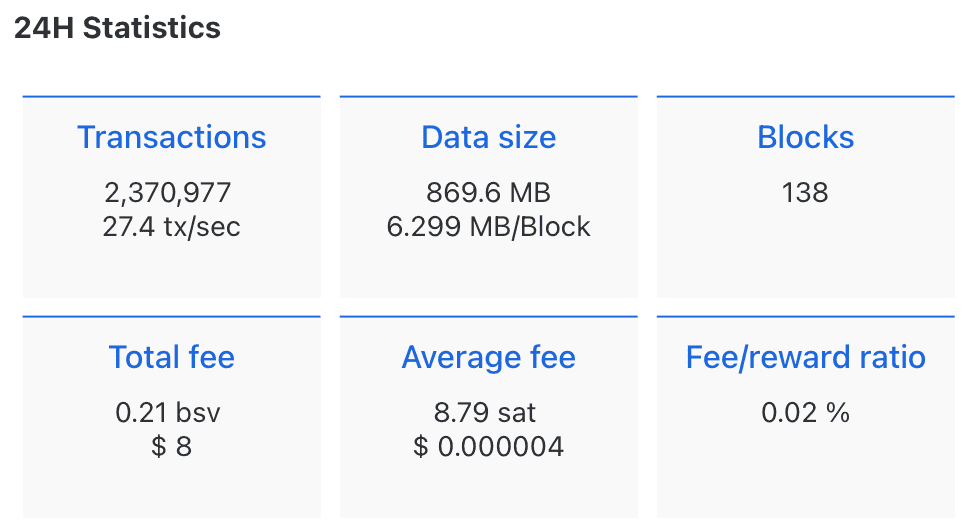

In other words, Bitcoin is to be cheap—for the users! Look at the average fee on the BSV blockchain and compare it to what other payment systems charge:

After all, Bitcoin needs miners (nodes) to be profitable. With a decreasing block reward subsidy, the whole Bitcoin economic system shifts to a scenario where miners will earn money by processing transactions and collecting the fees thereof—picture Bitcoin as it needs to inhale transactions the same way we humans breathe in oxygen.

Again, Dr. Craig Wright stated:

By enforcing rules and not creating them, processing transactions as needed, and implementing the ability to freeze transactions, nodes can build a business that facilitates the payment of transactions, indexing transactions without allowing double-spending. It is a commercial system. It acts within the law.

Get on board. We are going nowhere but to more and more transactions!

BSV blockchain is such a pure and helpful technology that it almost appears “too good to be true.” Such could be the reason why BSV might be underrated in the digital asset sphere—for now.

However, anyone may verify the above-mentioned numbers for themselves, and pay close attention to those who already understand what BSV blockchain is offering to the world:

- Economist George Gilder applauded the BSV Blockchain

- IBM’s Dr. Agata Slater researches the value of BSV’s scalability

- Billionaire Calvin Ayre’s VC Group heavily invests in BSV-powered companies

- IPv6 Forum President Latif Ladid works on integrating BSV into IPv6 roadmap

Watch: George Gilder on Craig Wright’s “great vision” for BSV blockchain

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024