|

Getting your Trinity Audio player ready...

|

This post was first published on Medium.

Blockchain technology has the potential to revolutionize the financial markets, and catastrophe bonds are one area where this potential is being realized. Catastrophe bonds are a type of financial instrument that allows investors to hedge against the risk of natural disasters. They work by issuing bonds that pay out to investors if a certain threshold of damage is caused by a natural disaster. Traditionally, catastrophe bonds have been issued through traditional financial intermediaries. However, blockchain technology can make the issuance and trading of catastrophe bonds more efficient and transparent.

In this article, we will explore how blockchain technology can be used to implement such a financial instrument. We will also discuss the potential benefits of using blockchain for this purpose.

What are catastrophe bonds?

A catastrophe bond (cat bond) is a type of insurance-linked security (ILS) that is designed to protect investors from the financial losses caused by natural disasters. Cat bonds are typically issued by financial institutions or insurance companies, and they are backed by a pool of assets that are designed to cover the losses in the event of a natural disaster.

Cat bonds are typically structured as fixed income securities, and they pay investors a fixed rate of interest over a specified period of time. However, if a natural disaster occurs and the losses exceed a certain threshold, the cat bond will pay out to investors in addition to the interest payments. Cat bonds are a relatively new financial instrument, but they have grown in popularity in recent years. In 2021, the world experienced a record number of natural disasters, with total losses estimated at over $280 billion.

Implement catastrophe bonds

Traditionally, cat bonds have been handled through traditional financial intermediaries, such as investment banks and insurance companies.

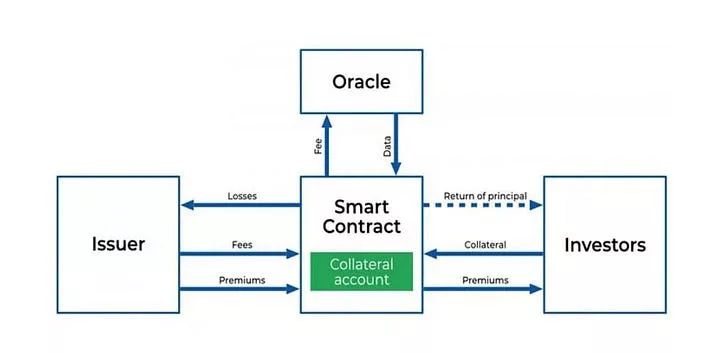

We’ve constructed an sCrypt smart contract that allows for a payout to the issuer in case of a catastrophe. The data used to determine if a catastrophic event occurred comes from a trusted third-party data provider, also known as an oracle.

The flow of the smart contract can be broken down into the following steps:

- The issuer deploys the cat bond smart contract on the blockchain.

- Investors deposit investments into the deployed contract. The contract keeps track of these investments.

- If a catastrophe occurs (as reported and signed by the oracle), the smart contract releases the funds to the issuer. The issuer can take the funds using a valid signature of the oracle.

- If no catastrophe occurs during the bond’s term, the smart contract returns the invested funds back to the investors.

The smart contract is listed below.

We can observe, that the smart contract has three public methods:

- invest : this public method is called by investors to deposit an investment. The method ensures that a sufficient amount was deposited and adds a new entry to the contracts state.

- payout : in the case the catastrophic event happens (an earthquake in this particular example) this public method can be called to pay the issuer. The method takes as parameters a message containing the event data (earthquake magnitude and timestamp) and the signature for this message by the oracle.

- mature : if no catastrophic event occurred, then after a specified period of time the payout method can be called to pay back the investors with their initial investment plus some interest. The method logic ensures the consuming transaction will contain an output for each investment, paying a sufficient amount back to the investor.

The full code along with tests can be found in our GitHub.

What if the issuer defaults?

A meticulous reader may have already identified a potential problem in the implementation above: the lack of a default protection mechanism for investors. Specifically, there isn’t a provision in place that guarantees the investors will receive the designated interest should the issuer default. Here are two potential solutions that could counteract this issue:

1. Pre-depositing interest at contract deployment

Under this approach, the bond issuer would be required to pre-deposit the entire interest amount when the contract is deployed. This locked fund would then be automatically disbursed to investors upon the bond’s maturity. This approach guarantees that regardless of the issuer’s financial circumstances at the end of the term, the investors will receive their promised interest.

2. Involvement of a guarantor oracle

Our second proposed solution calls for the inclusion of a second oracle. This entity could act as a guarantor for the deal, stepping in to ensure the payout to investors should the issuer default. By performing the role of a financial backstop, this oracle could offer an extra layer of security to the investors.

Potential benefits of using blockchain for catastrophe bonds

There are a number of potential benefits to using blockchain for catastrophe bonds. These benefits include:

- Reduced costs: Blockchain can help to reduce the costs of issuing and trading cat bonds by eliminating the need for intermediaries.

- Increased transparency: Blockchain can help to create a more transparent and efficient system for managing cat bonds.

- Improved security: Blockchain can help to improve the security of cat bonds by making it more difficult to counterfeit or manipulate the data related to these securities.

- Increased liquidity: Blockchain can help to increase the liquidity of cat bonds by making it easier for investors to buy and sell these securities.

Conclusion

Blockchain technology has the potential to revolutionize the financial markets, and catastrophe bonds are one area where this potential is being realized. The use of sCrypt to implement a cat bond smart contract demonstrates how blockchain technology can transform traditional financial markets. We can create a more efficient, transparent, and secure system for issuing and trading cat bonds. This will help to make cat bonds a more attractive investment option for investors, and it will also help to reduce the cost of insurance for businesses and individuals.

Watch The Bitcoin Masterclasses #7: Sovereign Nodes

11-10-2024

11-10-2024