|

Getting your Trinity Audio player ready... |

Whenever the curtain is pulled back on the operations of Tether, the representations made by its executives change dramatically.

For example, we now know that Tether and exchange Bitfinex are in fact owned and operated by the same people (the parent company is iFinex). This wasn’t always the case: in fact, up until 2017, the companies insisted there was no relation between the two (when asked at one point if the two companies are the same, Bitfinex CEO Phil Potter denied it, saying the two companies merely bank at the same banks.

Then, when the Paradise Papers which leaked that year showed this to be false (including the revelation that Potter was in fact a director of Tether), Tether makes no acknowledgement of the leak and then begins to live life as though it is not and never has been a secret that the two are run by the same people.

Or how about when Tether went to great lengths to represent that each Tether (USDT) is backed 1:1 with the U.S. dollar, a position it maintained right up until the point where they had no other option to concede the truth by admitting—via sworn affidavit—that at best, each USDT is backed at a rate of 74%, and not even necessarily by pure U.S. dollars?

Each time a lawsuit or regulatory investigation peels back another layer of the Tether story, our understanding of exactly what Tether is and how it is run changes dramatically, while Tether seems comfortable to roll with the punches, revising the claims it makes for itself each time, offering whatever platitudes or falsehoods that it thinks it can get away with.

But Tether can’t stay ahead of the truth forever. It finds itself square in the crosshairs of a fraud investigation by the New York Attorney General’s office, while multiple lawsuits have been consolidated into one mammoth class action alleging fraud and mass market manipulation by Tether and Bitfinex.

Unfortunately, Tether could be playing a much larger role in the machinations of the digital asset industry than any sane person would be comfortable with. Therefore, the outcome of these legal actions have the potential to determine much more than the 180 taken by Tether’s PR team.

The initial con

Until very recently, Tether claimed—loudly—to be backed by U.S. currency. There was no ambiguity in these claims: Tether was marketing itself as a ‘stablecoin,’ and until February 26, 2019, Tether’s front page boasted the following:

It sounds good: enjoy the convenience of a digital asset without facing up to any of the pesky volatility so often associated with them.

However, there has never been an independent audit of this claim. The degree to which USDT is backed by USD is a near-total mystery and demands for proof of Tether’s backing have been met with obfuscation if not outright deceit by Tether.

For example, in 2017, Tether retained accounting firm Friedman LLP to perform an ‘audit’ of Tether’s balance sheet. Despite being heralded by Tether as an answer to the skeptics, Friedman’s output ended up being a report which, at most, finds that the amount of USD owned by Tether match the number of USDT in circulation: with a very important caveat that the firm did not evaluate the terms of any of Tether’s bank accounts, whether Tether could even access the funds, and perhaps most strikingly, that it could not verify whether those funds were earmarked for purposes other than USDT backing.

This obviously was not enough.

Then, after repeated promises to prove the very premise upon which Tether was built, Tether suddenly changed track. This did not come in the form of an audit, but of Tether completely reinventing the premise on which it was (supposedly) built: Tether quietly changed the language on its website, proving what sceptics had said about Tether all along: it isn’t backed 1-to-1 by currency at all. In place of the above-pictured promise is now the following:

Look at the promises made by Tether personnel, including its own general counsel, in the run up to this moment. At no point did anybody associated with Tether indicate anything other than complete backing by the USD. Until this change was made, you will find no instance of, say, Tether general counsel Stuart Hoegner, indicating that Tethers are backed by a combination of USDT and other financial assets.

In fact, when the sudden change of track happened in February 2019, it was shortly followed by Hoegner signing an affidavit in the NYAG investigation of Tether where he admits that Tether only has reserves to back 74% of its ‘stablecoin’ issue. The timing of these two events should speak for themselves: after years of denials from every level of Tether leadership, they finally admit that the premise at the core of their business was a lie. They admitted this not out of loyalty to the supporters they had misled, but because all other paths had been closed by a rapidly encroaching NYAG investigation.

The problem here isn’t so much that Tether isn’t backed 1:1 by USDT, but that for the longest time Tether insisted that it was—while exhausting every avenue it could find in order to avoid being audited, and once there was no more room left to run it quietly stopped making the claim.

Unfortunately, this isn’t the worst thing that Tether is accused of doing. However, Tether’s long-time lie that its coin was backed by the U.S. dollar is merely a moving part in a larger scam.

New York Attorney General announces investigation of Bitfinex, Tether

Much of this occurred against the backdrop of an open investigation by the New York Attorney General into Bitfinex and Tether over the apparent loss of $850 million worth of co-mingled client and corporate funds which was not notified to investors and may constitute securities and commodities fraud.

The money disappeared when Bitfinex apparently handed over the hundreds of millions to a shady Panamanian payment processing company called Crypto Capital Corp, apparently outsourcing their fund storage and withdrawals/deposits to this company. According to the NYAG, this was done without a contract between Bitfinex and Crypto Capital, and for reasons not entirely clear, the funds are gone.

Bitfinex and Tether claim that the money is tied up in a series of asset freezes being enforced by multiple foreign governments on Crypto Capital’s bank accounts. The CEO of Crypto Capital was indicted in 2019 on fraud charges, the company president was extradited to Poland on drug and money laundering charges. One notable Crypto Capital operator, Reginald Fowler, has also been indicted for running an unlicensed money transmitting business for digital asset traders.

While obviously disastrous for Bitfinex, there is some cause to believe that they knew Crypto Capital was not an entirely legitimate enterprise. Across the period in which Crypto Capital was engaged by Bitfinex, customers wanting to deposit to the exchange directed to Crypto Capital, from whom they would receive the deposit details for a bank account tied to yet another company.

Wow. So this is new pic.twitter.com/iBjMslOesd

— Larry Cermak (@lawmaster) October 16, 2018

Customers would be instructed to keep the banking instructions confidential, while also being given instructions to lie when effecting the deposit by earmarking the transaction as “Treasury transfer back to my own account.”

https://twitter.com/CasPiancey/status/1187790855341371392

In any case, Bitfinex no longer has access to the funds—a massive loss and one which Bitfinex did not disclose to investors. Instead, the NYAG alleges, Bitfinex used up to $900 million of Tether’s reserves to cover the loss and hide what has to have been a critical solvency problem. Keep in mind, this was during the period in which Tether was still claiming that its coin was fully backed by U.S. currency—a virtual impossibility if $900 million was being funneled to a sister company.

The investigation is still ongoing and charges have yet to be brought. The New York Attorney General secured a court order barring Bitfinex from taking any more of Tether’s reserves, and requiring that the companies produce all documents relevant to the accusations which is expected to include loan documents concerning the massive movements of cash between the two entities. Assuming these documents are produced, we may get the first real insight into just how solvent Tether and Bitfinex are.

The deadline for this handover is 15 January 2020, at which point it will presumably be left to the Attorney General’s office to decide whether to pursue charges securities and commodities fraud.

The Tether-BTC conspiracy

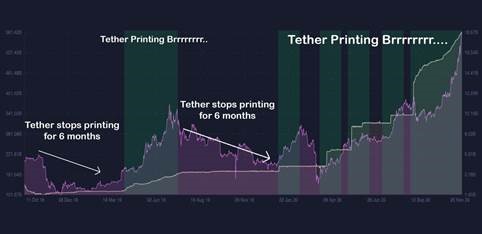

In November 2019, research out of the University of Texas showed massive amounts of Tether—regardless of actual cash demand for the coin—moving from Bitfinex (the exchange owned by the same people as own Tether) to exchanges Poloniex and Bittrex in exchange for BTC—and were able to link these movements to predictable BTC price spikes. In fact, the research links this activity to the notorious BTC price spike in 2017.

Since, Tether and Bitfinex have been hit with four lawsuits, all accusing the companies of the market manipulation identified in the University of Texas research. The two companies are accused of colluding to manipulate the price of BTC by printing unbacked Tether and using it to buy swathes of BTC, artificially inflating its price. Representations made by Tether that the asset was fully backed by the US dollar is said to have greatly contributed to the knock-on effects of these purchases.

The suits were consolidated in the State of New York in January of 2020, and Poloniex and Bittrex were added as defendants in June of 2020 for their role as facilitators.

The suit identifies two wallet addresses which it is claimed were used by Bitfinex to perpetrate the scheme on each exchange and that both exchanges knew the wallets were being used by Bitfinex to inflate the price of BTC.

The suits—and the UT research—are merely the crystallization of persistent accusations surrounding Tether, its misleading claims about how its assets are backed and the role it plays in the highly volatile BTC market. Tracking Tether printing against movements in BTC price reveals a suspicious correlation between the two. This was demonstrated in a now-restricted Twitter thread, user @JacobOracle highlighted the price of BTC set against Tether’s printing rates:

Critics and market watchers have been making noise about this pattern—of spikes in BTC prices following the issuing of new Tether—for years. Given that Tether has moved from claiming that its coin is 100% backed by USD down to acknowledging that it is at best 74% backed, Tether’s apparent influence on the BTC price should be cause for massive concern.

Influx of Tether into exchanges leading to price bumps for BTC on the basis that the Tether has value accordant with USD is one thing. But as time goes on, the degree to which Tether says that USDT is actually pegged to fiat gets smaller and smaller: not so long ago it was 100%; now it’s 74% backed, and not purely by fiat, either. At the rate Tether is revising its position on this subject, we will have discovered Tether is backed by precisely nothing within a year.

This poses massive risk to the current BTC volatility: the more evidence about Tether’s actual (lack of) backing comes out, the more investors will see that the BTC boom has been built on little more than the printing machines of a company with potentially extreme solvency issues and which could be hit with criminal indictments any day now.

This serves as a reminder that despite the strides being made by regulators and prosecutors in reining in the worst of the industry’s con artists, we are still in desperate need of regulation and enforcement to protect investors at a time when they are flocking to digital assets in droves.

Stormy seas ahead

As bad as things are with Tether, the victory of Joe Biden over President Donald Trump in November is an encouraging sign that the days of reckless price manipulation and consumer exploitation are numbered. Once sworn in, Biden will begin making his appointments, one of which will be for the new chairperson of the Securities and Exchange Commission (SEC)—and the current favorite is former U.S. Commodity Futures Trading Commission (CFTC) Chairman Gary Gensler.

For those in favor of a safe, regulated and honest digital asset ecosystem, Gensler is the dream appointment. For those profiting from currently regulatory deficiencies, it’s a nightmare—at least if Gensler’s time at the CFTC is anything to go by.

Under Gensler’s Chairmanship, the CFTC was transformed from a hands-off regulator into an aggressive industry watchdog, with Gensler being credited as a key driver behind the reformation of the financial derivatives market at the center of the 2008 global financial crisis. The reforms included the introduction of real-time reporting requirements, registration obligations for dealers and a number of consumer protections.

Most exciting is his record of bringing bad actors inside his jurisdiction to justice: he oversaw prosecutions against five financial institutions implicated in the LIBOR scandal in 2012 and which resulted in penalties totaling US$1.7 billion. The LIBOR scandal refers to a period of financial collusion between banks to manipulate the LIBOR, a benchmark interest rate used for the pricing of loans and other derivatives.

Gensler’s time at the CFTC is a useful indicator for how his tenure at the SEC might go—not least of all because the state of the financial industry during that period is reminiscent of the current phase that the digital asset industry is facing.

Fortunately, a new day is already dawning for the digital asset industry. Under the new AML regulations coming into effect at the start of 2021, anyone caught breaching AML legislation may be barred from sitting on the board of any U.S. financial institution for 10 years. This means, for example, had this already been the case, Reginald Fowler would never have been in a position help Tether and Bitfinex cover up the scandal. This can only be a good thing.

Bubbles pop. When they do, regulators—particularly people like Gary Gensler—crack down hard by way of sweeping reform and heavy enforcement action. If Gensler is indeed sworn in as SEC chair, he will have his work cut out for him.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift and Ethereum—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024