|

Getting your Trinity Audio player ready... |

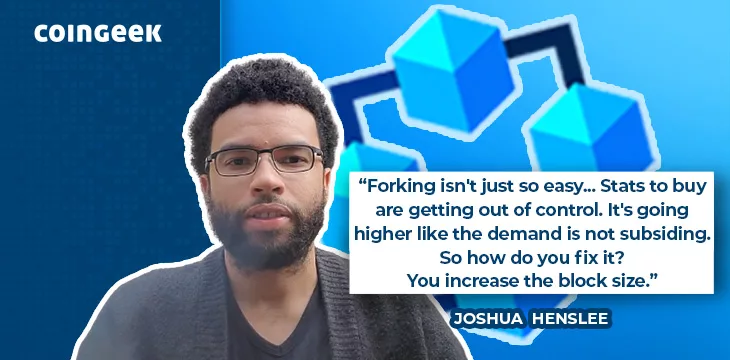

Bitcoin philosopher and developer Joshua Henslee recently released a new video titled ‘Fork Theory.’ He discussed how the on-chain economy is driving BTC to breaking point, but it won’t be easy for them to raise the block size limit to deal with it.

How the on-chain economy broke BTC in May 2023

Henslee starts by noting how, back in May 2023, the ORDI token hit an all-time high of almost $20. Back then, BitMap wasn’t around yet, and the on-chain economy was smaller, but even in its infancy, it drove BTC to the point it was unusable.

Interest in all of this has picked up, and ORDI has surpassed its previous high. Even Binance has listed it, and other exchanges will likely do the same to capture some of the market. There are now many Ordinals inscriptions on the blockchain, and there’s now a lot more awareness about and enthusiasm for them, Henslee says.

Fees are rising, but there’s no easy solution

Henslee points out that this time, users want to do computation and put data on-chain. This has all left BTC developers wondering how to deal with it; there’s even talk of reenabling opcodes that BTC Core disabled. As the fees increase dramatically, there’s only one real way to fix it: raising the block size. However, this isn’t so simple or easy as it leads to a fork.

Why wouldn’t BTC Core developers risk a fork right now? Aside from killing many businesses, as we saw before when it happened, BTC maximalists know parties like BlackRock are watching. They’re desperate for a fresh injection of fiat to pump the price, and the BlackRock ETF paperwork directly spoke about the risk of forks, so there’s direct evidence they’re concerned about it.

All of this puts BTC in a dilemma; they can’t raise the block size because a) they have resisted it for so long, and b) it would risk the much-touted spot ETF, but they can’t deal with the rising fees the demand is causing any other way.

The interest in Ordinals and the on-chain economy isn’t going to slow down, and thus, the fees are likely to increase further, totally disabling the network. Henslee describes this as “being stuck between a digital piece of lead and a hard place.”

Even if BTC developers try to restore some of the original opcodes on BTC, they suffer from serious hubris and won’t do things the simple way, Henslee notes. Instead, they’ll add things in, tinker with it, and in doing so, they’ll risk the entire network.

The hash rate is fixed, and it can move rapidly

Wrapping things up, Henslee makes a point he has already made a few times: the hash rate is fixed (X), but prices can change at the speed of thought.

If all of this interest in Ordinals and on-chain tokens causes a switch to BSV or BCH, and the token prices increase. As a result, miners can and will switch hash power away from BTC. This is yet another problem for BTC and adds another angle to the dilemma they’re already facing.

Summary of this Joshua Henslee video

- Henslee highlights how interest in the Ordinals and the on-chain economy is picking up. This is causing fees on BTC to rise rapidly. When this happened previously, it made the BTC network unusable.

- One way to fix this would be to raise the block size. However, this constitutes a fork and is borderline sacrilegious to some BTC advocates. Right now, they can’t risk a fork as BlackRock is watching and has stated forks are a risk. BTC desperately needs a BlackRock spot ETF to pump prices.

- Thus, BTC is in a dilemma of its own making. They need new fiat to enter the system, so they can’t raise the block size (fork). However, if they don’t do something, the fees are going to once again cripple the network and make it unusable.

- All of this could lead some to migrate to BSV or BCH. If it does so, these token prices could rise, and miners would then switch hash power to these networks. This is yet another problem for BTC that its advocates and developers are powerless to solve.

Watch: Bitcoin white paper – 15 years on, the significant landmark but what does it mean?

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024