|

Getting your Trinity Audio player ready... |

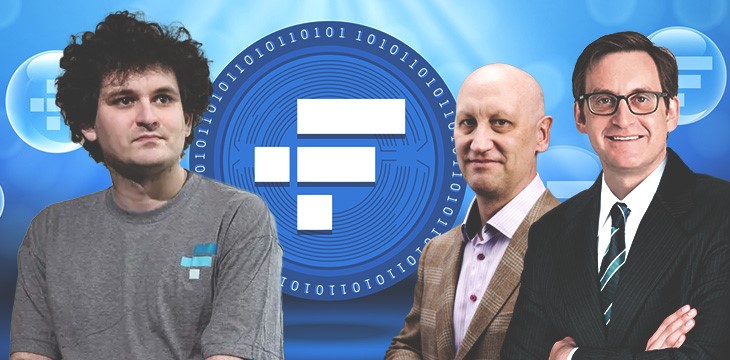

The FTX digital asset exchange’s breathless plunge into bankruptcy has disturbing echoes of the 2011 crackdown on online poker sites, with some of the sketchier players like Dan Friedberg and Stu Hoegner making appearances in both.

Last Friday’s bankruptcy of FTX and roughly 130 subsidiaries—including the U.S.-licensed FTX.US exchange and the Alameda Research market-maker—hasn’t yet been dubbed ‘Black Friday’ by the ‘crypto’ community at large, but black adequately describes the general mood out there. Numerous companies that either loaned funds to FTX/Alameda or used FTX for asset storage will undoubtedly confess the full extent of their poor judgment in the days and weeks to come.

As someone who began writing about the gambling industry back when Bush was president, last Friday revived painful memories of April 15, 2011, aka Black Friday, when the U.S. Department of Justice (DOJ) indicted 11 individuals associated with the world’s three largest online poker companies: PokerStars, Full Tilt Poker (FTP), and Absolute Poker (AP). The DOJ simultaneously seized the sites’ dot-com domains and froze over 75 bank accounts scattered across the globe.

I spent that weekend mainlining coffee and bashing out frantic updates as the fallout spread. A few days later, the DOJ struck deals with the indicted companies to release their seized funds for the express purpose of returning account balances to their U.S. players. It soon became evident that only one of the companies (PokerStars) was actually capable of doing so because the others had utterly ignored the strict church/state separation of customer funds and operating capital.

High-stakes poker players are notorious for loaning each other vast sums of money as their individual fortunes wax and wane. Some of FTP’s sponsored pro players had been ‘advanced’ millions of dollars from the site’s customer accounts, apparently based on the site operators’ belief that they’d never be faced with a scenario in which all their customers would simultaneously request withdrawals of their entire account balances.

AP and its sister site, Ultimate Bet (UB), were similarly caught with their financial pants down. In the end, both FTP and AP/UB went belly-up, although the Full Tilt brand was maintained by PokerStars, which, as the only responsible company in the bunch, took responsibility for bailing out users of the other indicted companies as part of a deal with the DOJ.

There isn’t likely to be any such rescue for FTX users, nor for any investors who sunk vast sums into FTX/Alameda. Although, since those investors—unlike retail users—had ample opportunity to do due diligence but instead chose to take FTX/Alameda owner Sam Bankman-Fried (SBF) at his word, screw ‘em.

There also isn’t likely to be any salvation for the countless digital asset firms that FTX promised to support in the wake of this spring’s collapse of Terraform Labs’ UST/Luna tokens, which led to a tsunami of insolvencies/bankruptcies that continues to this day.

How's the balance sheet? https://t.co/Av5KzQxHX1

— Jacob Silverman (@SilvermanJacob) November 16, 2022

As a brief aside, this article was inspired by writer Jacob Silverman (@SilvermanJacob), who tweeted Tuesday expressing his desire for someone to shed more light on the Daniel S. Friedberg/Stuart Hoegner nexus. Silverman has since deleted the tweet, possibly because he’s now planning to incorporate this angle into the book he’s writing with Ben McKenzie. This is the best we can do on short notice, Jacob, but hope it helps.

Absolute shitshow

Of the indicted poker sites, the AP/UB saga most directly resembles FTX’s current plight. AP was founded by some frat boys who fancied themselves coders, while FTX was founded by some M.I.T. wizzes turned financial quants. In both cases, the actual experience of running a business was lacking. In both cases, the companies launched while their respective sectors were exploding in popularity. And in both cases, their out-of-the-box success left them with a sense that they were far brighter and accomplished than they were.

There’s also the small fact that both UB and FTX share some executive DNA in the form of Daniel S. Friedberg, FTX’s chief compliance officer. As we detailed last year, Friedberg joined FTX in March 2020 as the exchange’s general counsel before ceding that role to Ryne Miller (who currently has his hands full trying to justify FTX’s antics while Friedberg is, as usual, trying to stay off the radar).

Friedberg has scrubbed all mention of UB from his official resume, but he helped get the site off the ground in 2001, thanks to his connection to poker pro Phil Hellmuth. Hellmuth and Friedberg attended the University of Wisconsin-Madison together, and Friedberg was serving as Hellmuth’s personal attorney when the pro was pitched on investing in a fledgling online poker start-up.

UB ultimately became successful enough that it split into several software divisions, with the poker side coming under the corporate banner of Excapsa. In early 2006, Excapsa welcomed none other than Stuart Hoegner—current general counsel for Bitfinex and Tether—as its new director of compliance and to help prepare the company for its planned listing on the London Stock Exchange.

Later that year, Excapsa was listed on the LSE’s AIM index but swiftly de-listed after U.S. President George W. Bush signed the Unlawful Internet Gambling Enforcement Act (UIGEA) in October 2006. The UIGEA, as it became known, prohibited financial institutions from knowingly processing payments on behalf of online gambling companies.

This development convinced UB’s primary owners to ‘sell’ their operations to a private, non-American company that had conveniently also purchased Absolute Poker. The two sites were ultimately combined into the new Cereus Network but maintained the fiction that they were separate operations. The proceeds from UB’s ‘sale’ remained a bone of contention for years to follow, with many minority investors complaining that they’d been left on the sidelines and launching legal action to try to force a bigger payout.

The vehicle known as Excapsa didn’t survive the transition to Cereus, but Friedberg was able to pivot into a top legal role at AP. Here he helped construct another complicated ownership structure that involved a Norwegian company called Madeira Fjord and a subsidiary based on a tax-free island off the Portuguese coast.

Investors were told to expect 12% annual returns, but by 2009 they were told the operation was somehow losing nearly $34 million a year. This was partly due to $10 million in annual payments to lease the poker software the company was supposed to own and $18 million in fees to various ‘consultants.’ (Did we mention that Hoegner started not one but two gaming-focused law firms in January 2007?) Meanwhile, company founders continued to enjoy their opulent lifestyles in their Central American mansions. That is, until Black Friday hit.

The tangled web we weave

Friedberg’s not-so-finest hour came in 2013, long after AP/UB/Cereus had been mothballed by the DOJ, via the release of an audio recording of a UB insiders meeting conducted in early 2008. The meeting involved Friedberg, fellow attorney Sanford ‘Sandy’ Millar, UB co-founder Greg Pierson and a poker pro named Russ Hamilton, who also owned a piece of UB.

Before that meeting, Hamilton and several other insiders had been caught utilizing a piece of UB software known internally as ‘God mode.’ God mode allowed you to see other players’ hole cards, ostensibly to allow software engineers to test that their product was working as advertised and (ironically) to monitor for players’ cheating/colluding. Hamilton and the other cheaters began using it as early as 2003 to make up losses whenever their luck ran out at the legit tables.

Before players caught on to the scam in late-2007, Hamilton and the other cheaters had stolen tens of millions of dollars in unjust winnings from unsuspecting players. In further contradiction of the alleged separation between AP and UB, a similar cheating scandal was brewing on AP around the same time. (And as the declaration filed this week by FTX’s new CEO revealed, SBF used his own ‘god mode’ in the form of a “secret exemption of Alameda from certain aspects of FTX.com’s auto-liquidation protocol.”)

Alameda was secretly exempted from FTX's auto-liquidation protocols.

LITERALLY GOD MODE. pic.twitter.com/dxnZRMjxXj

— wassielawyer (哇西律师) (@wassielawyer) November 17, 2022

Hamilton secretly recorded the 2008 crisis meeting between himself and Friedberg as a cover-your-ass precaution. Not that he needed it, as Friedberg was intent on minimizing the company’s financial liabilities to its cheated players, in part by using “creative” messaging to pay affected players pennies on the dollars stolen from them.

Friedberg also proposed a strategy of blaming the scandal on a nameless former Excapsa staffer they planned to accuse of hacking into the software client. Friedberg lobbied hard for Hamilton to publicly include himself among this phantom ex-staffer’s victims in order to help sell this story to the public.

Excapsa, which was in liquidation at the time, was eventually compelled to contribute $15 million in shareholder cash to repay impacted players. In yet another echo of FTX’s ‘customer money is our money’ approach, some of the funds used to compensate impacted AP/UB players were reportedly obtained from unaffected player accounts, adding to the unfunded liabilities the poker sites faced when the Black Friday indictments were issued.

Don’t go away mad, just go away

Friedberg’s penchant for duplicity to make legal problems vanish for his corporate paymasters didn’t end with UB’s demise. NBC News recently reported on a 2020 incident involving SBF’s promotion of the Ethereum-based Cover Protocol and the unfortunate experience of one Dave Mastrianni, an investor who was prevented from cashing out his $400,000 in paper winnings due to “insufficient liquidity” on FTX before the COVER token cratered.

When Mastrianni contacted FTX to accuse SBF of having a “pump and dump” role in the debacle, Friedberg called back with an offer. How would Mastrianni, a graphic artist, like a job creating NFTs for FTX? Friedberg offered Mastrianni an ‘adviser’ contract that would pay him one BTC for 30 days’ work, but it also required Mastrianni to absolve FTX, Alameda, and its affiliates of any responsibility for Mastrianni’s COVER losses.

Mastrianni eventually agreed, but while he did receive that one BTC, FTX never accepted any of his artwork. Freidberg later emailed to inform him that the payment “was primarily for your release of all claims” and, with that goal accomplished, FTX had no more reason to maintain this subterfuge.

Hoegner/Tether/FUD

Like SBF’s post-bankruptcy pledges that he’d make everything right, UB’s crooked cronies didn’t lack for chutzpah. Pierson went on to run Iovation, a digital security firm that provides player verification and fraud detection for other online gambling sites. (Based on the principle of ‘takes one to know one,’ we suppose.)

15) A few weeks ago, FTX was handling ~$10b/day of volume and billions of transfers.

But there was too much leverage–more than I realized. A run on the bank and market crash exhausted liquidity.

So what can I try to do? Raise liquidity, make customers whole, and restart.

— SBF (@SBF_FTX) November 16, 2022

As for UB’s attorneys, following Black Friday, Friedberg, Hoegner and Millar somehow all ended up in the ‘crypto’ game, with Friedberg and Hoegner sometimes appearing on the same conference panels (and this panel features lofty rhetoric from Dan about the need for strict regulatory compliance that sounds extremely ironic given his current situation).

In some respects, this pivot to digital assets was not unforeseen, as online gambling in those days was all about effective payment processing. But when you hear Friedberg tell an audience—as far back as 2013—that he “works closely with Stuart on a lot of these issues,” one’s conspiratorial spidey sense can’t help but tingle.

The fact that Hoegner ended up in a key role at the company that issued the controversial Tether stablecoin and Friedberg ended up working for SBF—whose companies drank deep at the Tether trough—does raise questions regarding how closely the pair may have conspired to bring about crypto’s current state of affairs.

As evidence mounts of SBF’s criminal duplicity—including simultaneously listing the same assets on both FTX and Alameda balance sheets to provide the illusion of solvency—the pressure is mounting on Tether to provide more than a mere attestation of the financial reserves allegedly backing the over $68 billion in circulating USDT. Particularly since Alameda was one of the two largest recipients of all issued USDT, most of which was immediately funneled into the FTX casino.

Hoegner and Tether CTO Paolo Ardoino have been prodded on countless occasions regarding the need for greater transparency but continue to dismiss any and all concerns with a wave of their hands. Anyone who dares to challenge the legitimacy of Tether’s reserves is accused of spreading FUD (fear, uncertainty, and doubt).

It’s telling that some of Tether’s strongest supporters are also some of BTC’s biggest boosters. (Friedberg himself wrote an alarmist op-ed during the 2016 block size wars that warned of “serious legal consequences and potentially criminal liability” for any chain that dared break with BTC.)

Other BTC/Tether stalwarts include Adam Back from Blockstream, which claims to abide by a code of “Don’t trust. Verify.” And yet these same individuals accept weak attestations rather than a third-party audit of Tether’s reserves, likely because they know USDT-BTC wash-trading is the only thing keeping the overall digital asset market from imploding.

As bad as the present wave of ‘liquidity’ (read: insolvency) problems is, none of the companies caught cooking their books can or will have the same impact as confirmation that Tether is a naked emperor who claimed to be John ‘The Wad’ Holmes but is, in reality, Pee Wee Pamplemousse.

Remember that SBF himself once characterized Tether founder Giancarlo Devasini as being “fairly annoyed at people he sees as … shitting on his businesses without real reason for it.” Now that SBF has been exposed as a fraud, how likely is it that the people behind the stablecoin his companies relied on to perpetrate their fraud is equally fraudulent?

The professor flunks

More than a year after Black Friday, Full Tilt’s co-founder and former president Howard Lederer submitted to a lengthy interview to offer his side of the company’s collapse. Lederer wasn’t indicted on Black Friday but was later accused by the DOJ of defrauding FTP’s players as part of a “global Ponzi scheme.” Lederer eventually settled the civil complaint by forfeiting assets worth over $2.5 million but managed to dodge prison time.

Lederer’s infamous video interview—which saw him discard his poker nickname of ‘The Professor’ in favor of something resembling a ‘D’ student—caused an uproar among other poker players for his (a) refusal to admit any wrongdoing and (b) claims of ignorance of the financial malfeasance that occurred on his watch. The parallels between Lederer’s denial and the mealy-mouthed justifications SBF has offered following FTX’s bankruptcy are striking.

No doubt SBF is hoping to share Lederer’s fate—admit no wrongdoing, disgorge a few millions in ill-gotten gains and rejoin society as a remade solid citizen. No doubt SBF is encouraged by insane comments made this week by the likes of Kevin ‘Mr. Wonderful’ O’Leary that he’d back a new SBF venture because—despite all evidence to the contrary—SBF “was one of the most brilliant traders in the crypto universe.” A low bar, admittedly.

Bank shot

Some of online poker’s Black Friday indictments did result in prison sentences, including for one John Campos, vice-chairman and part-owner of the SunFirst Bank in Utah. Campos got in trouble for agreeing to mislabel online poker payments as non-controversial transactions in exchange for a $10 million investment in the struggling SunFirst. The bank was closed by Utah authorities in November 2011, and Campos was sentenced to three months in prison the following year.

Concerns are now mounting about the fate of Deltec Bank & Trust, the Bahamas-based financial institution that conducts business on behalf of both FTX and Tether, as well as numerous other crypto firms. This week, Deltec felt compelled to issue a statement denying the “malicious and completely baseless” rumors that FTX helped finance Deltec’s acquisition earlier this year of local rival Ansbacher Bank & Trust. Deltec also insisted that it “is not a creditor to FTX.”

The U.S.-based Silvergate Bank also worked with FTX and, up until last year, Silvergate was still processing transactions for the integrity-challenged Binance exchange. Silvergate’s shares slid more than 17% on Tuesday to $29.36, a far cry from their nearly $150 value just this spring. More worrying, Silvergate tumbled as other crypto-centric stocks enjoyed modest gains. Silvergate regained some ground on Wednesday, rising 6.7%, but dropped another 11% to $27.90 on Thursday.

Last week, Silvergate sought to calm the waters by declaring that “our relationship with FTX is limited to deposits” and those accounted for less than 10% of the bank’s total deposits. But longtime FTX critic/short-seller Marc Cohodes went public Tuesday with his plans to short Silvergate based on his view that there’s more (or less) here than meets the eye.

The FTX plot thickens. Everyone needs to see this. 👀 #Silvergate RETWEET pic.twitter.com/RqAcpQtnkx

— TaraBull (@TaraBull808) November 15, 2022

The question likely dominating investors’ minds is who else among Silvergate’s customers might be secretly underwater. We now know that FTX/Alameda took a far larger hit from the ripple effects of this spring’s UST/Luna collapse than SBF was willing to admit publicly. Now, after FTX’s collapse, every day brings fresh news of companies teetering on the brink. Who will be the next domino to fall?

Wednesday’s publication of SBF’s incriminating text messages to a Vox writer doesn’t seem to give him much wiggle room in terms of avoiding jail time unless narcissistic personality disorder and/or insanity is his planned defense. But SBF likely has enough inside dirt on other figures in this space—particularly given his extensive dealings with Tether—that he may be able to cut a sweeter deal than many expect. Assuming he isn’t found dead in his holding cell from a ‘suicide,’ obviously.

We’ll close with a bit of joyless schadenfreude. As I wrote last year, FTX’s hiring of Friedberg “calls into question not only Sam Bankman-Fried’s commitment to compliance but also his overall judgment. When you’re on an extended roll and are the subject of countless flattering media profiles, the temptation to view oneself as infallible tends to rise. Such rises rarely come without a fall, and SBF/FTX appear headed for a doozy.”

Remember, surround yourself with crooks, and you’ll eventually start acting like one. And when people show you who they are, believe them.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024