|

Getting your Trinity Audio player ready... |

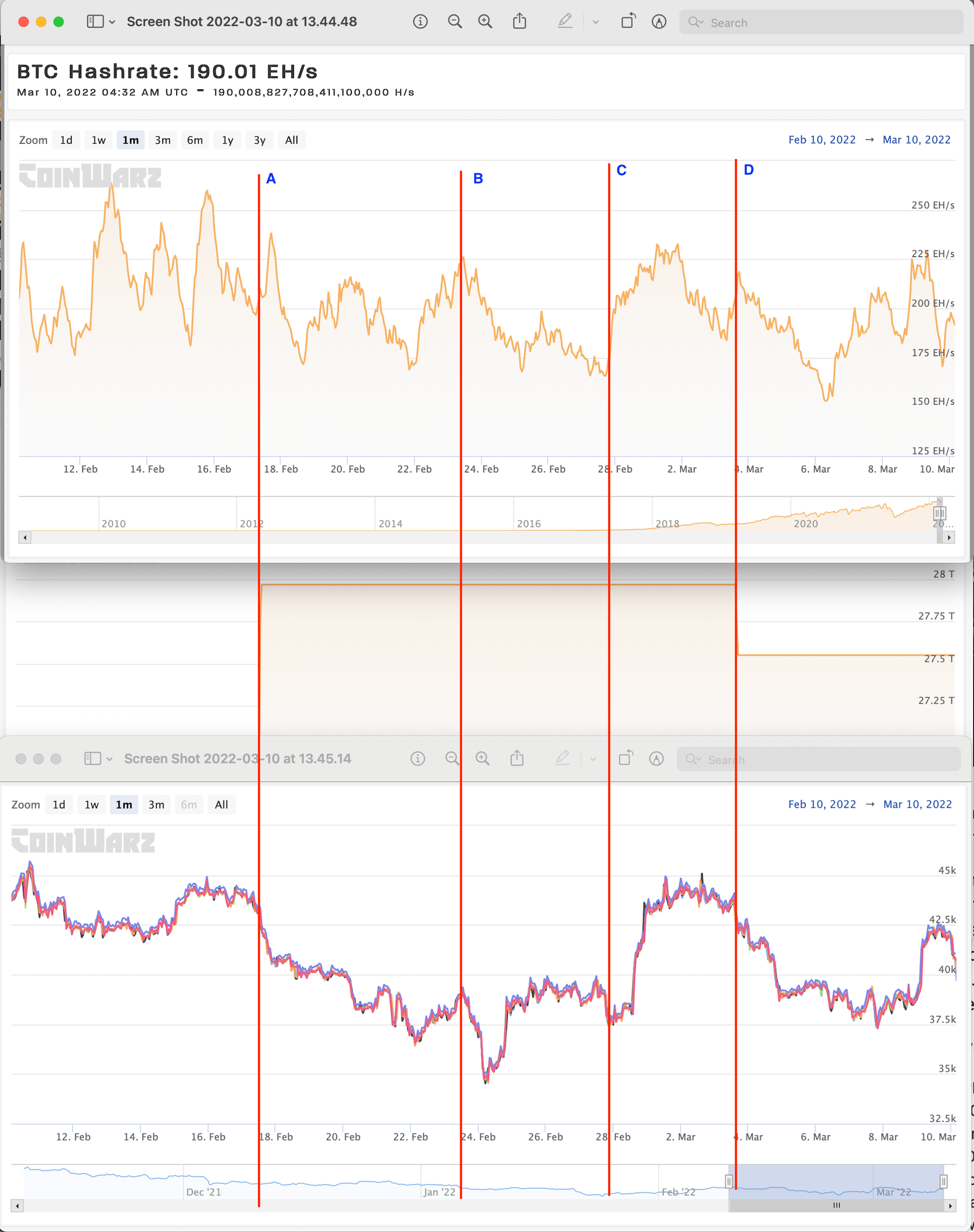

A recent article published by Bitcoin.com reflected on the drastic drop in BTC mining hash power from all-time highs in the weeks leading up to February 17.

It is worth pointing out that the years-long claim that hash power leading price is incorrect. The profitability calculation that every miner must go through is a complex one and one must take into account their own economic costs, access to liquidity, and also access to insider knowledge.

If we are to overlay a chart of hash power and price, (with the difficulty period in the middle), there are clearly times when the price leads the hash power, such as at point A, where a downtrend in prices lead to lower average hash rates in the same period between A and C. Furthermore, as seen in the D region, a lowering of the difficulty, which normally sees an increase in hash power actually saw a decrease in hash power for the first couple days of March 4-6. There seems to be little to any conclusions that one can draw simply by looking at the charts. But one thing is clear: both hash power and BTC price keep going up over time. But why?

While it is certainly the case that some miners may be micromanaging their hash power on a daily basis in order to maximize their returns, there are just too many competing factors that affect the profitability calculation to make any claims of price always leading hash power or vice-versa. For instance, one factor that is often overlooked is the 100-block rule, which ensures that no miners can spend their rewards almost a day later (100 blocks). This ensures that they don’t do anything that may affect the liquidity of their rewards earned the previous day, such as for instance, participating in a 51% attack on the network or other such hypothetical but completely impractical strategies.

Another aspect that strongly affects the price market but is not generally considered is that information disparity is likely the greatest driver of hash power strategy than the actual price. After all, would a hash power owner more likely react to prices that they see move on the exchange market or on insider knowledge that a big whale was moving to dump coins into the market or make a huge purchase? Like in equities markets, these sorts of insider information are much more likely to drive speculation, and where to deploy hash power is very much a speculation business (at least it is in the present day).

So what keeps speculation on BTC hash power (and price) keep on going up?

Price manipulation

With this knowledge, what would be the biggest insider signal of the markets going up or down?

Focusing on the upward signals first, because this one is easier, all one has to do is to know that USDT or Tether controls the BTC market, and every USDT minted inevitably is used to buy BTC in some exchange or another. Once this is understood, all a smart miner needs to do is watch the issuances of USDT on the blockchains as a leading indicator that the BTC price will be moving higher in the near term. The opposite is true. If there was a big whale preparing a large exit from Bitcoin markets, that would affect the investments in hash power. But it would have to be big. I mean, regulators making BTC illegal kind of big.

One thing is for certain that both BTC price and hash power (and thus energy expenditures) are tied up in a multilevel complex Ponzi scheme right now—where both will inevitably rise without fail so long as more and more participants are still willing to join the scheme. Liquidity is provided by a shadow central bank, Tether Inc., which has the ability to print money without any checks and balances because they operate in a grey area apparently outside of the jurisdiction of the United States. The money that they print can be distributed through their web of cooperating digital currency exchanges, also operating in the grey, most of which are not being too picky about where their customers come from and needing nothing more than an email to set up an account. This is modern banking, they say.

At least for now

All of this is currently possible because the price of BTC and its continual rise (powered by Tether) is sufficient to keep the hash power growing and enticing more and more participants to join the scheme. So long as the price keeps on doubling, then the hash power (and energy waste) will keep on rising. This will go on, at least until one of 3 things happen:

1) People stop joining in on the scheme after realizing the truth of the scheme.

2) An external authority puts a stop to Tether’s printing ability, thus un-tethering the BTC price from their printing press.

3) The diminishing block reward subsidy go to zero in the BTC protocol.

While the former 2 cases are more likely to happen soon, the 3rd is inevitable.

The Bitcoin protocol is set such that all bitcoin mining rewards will have been paid out sometime around 2140, and blocks will contain no reward subsidies and only fees (which on the BTC network currently make up less than 1% of block rewards). But long before then, 99.8% of ALL bitcoins (~21m) will have been given out by just 2040. That is less than 20 years. So, in all likelihood, this completely wasteful behavior of miners adding more and more hash power and burning more and more useful gigawatts of power will cease within the next two decades because mining BTC won’t earn you any rewards after that. So what to do with all your capital expenses? Well, hope you have made back your costs long before then1.

Suppose you are a miner, and this concerns you. In that case, you should be looking into alternative Bitcoin projects which actually focus on transaction fees as the primary component of mining rewards, such as BSV, and planning the migration from the BTC profit model, which is moving towards less and less transactions while having higher and higher BTC/USD prices in order to compensate, to one where you only use hash power to mine blocks if it is profitable to do so due to sufficient transactional volume, otherwise, just shut off your machines. It’s hard to get much more efficient than that.

/Jerry Chan

***

NOTE:

[1] Most miners plan to break even after two years deploying newly acquired hash power. This will radically change if they see the long-term price trend of bitcoin change within the next two years.

Watch: CoinGeek New York panel, How to Achieve Green Bitcoin: Energy Consumption & Environmental Sustainability

11-22-2024

11-22-2024