|

Getting your Trinity Audio player ready... |

Japanese company Zweispace, known for its work in the real estate technology (or “PropTech”) industry, has devised a Bitcoin-based smart contract structure to handle inheritances. It’s designed to reduce stress and legal hassles for families in a country where 30% of the population is over 60 years old, and 12.5% is over 75.

Japan’s elderly citizens are also its wealthiest, and according to Zweispace they hold around US$13 trillion in accumulated assets. They hold this value mainly in cash savings and real estate.

Zweispace’s new service, named “Pitashin,” functions as a kind of automated will. After a consultation with lawyers (required by law), a smart contract is generated to form an inheritance trust, which will automatically pay to beneficiaries upon confirmation of a trigger event—in this case, the death of the trustee.

Collaboration with legal experts

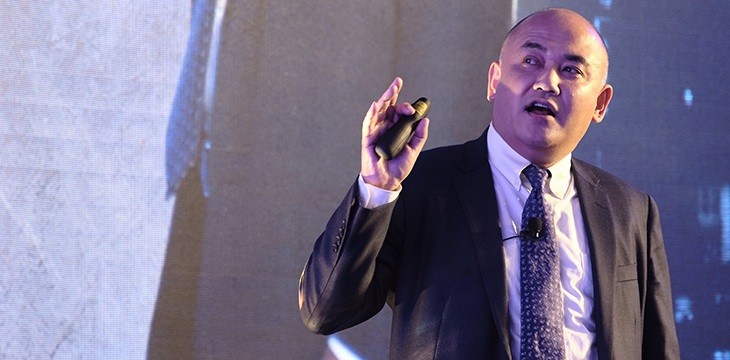

Founder and CEO Hayato Kameta said to develop the system, his company collaborated with Yasuhiro Ogino, a solicitor and legal expert in inheritance contracts and legal tech director at the Trust System Security Association.

The inheritance contracts will use a “legal token” tokenized on the BSV blockchain. Users would acquire these tokens through the legal advisory partner. Zweispace also produces Zweicoin, a stable blockchain asset backed by Japanese yen and real estate holdings.

Zweispace’s contract system is called ZWEICHAIN and is actually a combination of private and public blockchains (“zwei” means “two” in German). Formerly running on BCH, Kameta switched the public chain to BSV in 2019 on the advice of Ken Shishido, now the local BSV ambassador for the Bitcoin Association.

Scaling, fees and culture are BSV’s benefits

Kameta indicated he was also disappointed with the lack of development progress in BCH. While other blockchains still have certain benefits, he said, BSV was more attractive due to its “aggressive scaling,” low fees—and its community has a good culture.

His only expectation of BSV developers and miners is to maintain and manage the chain (something BTC and BCH couldn’t do) while those in other sectors of the technology industry would build solutions, and bring in enterprises and money. The cryptocurrency industry on the whole, he said, has not produced enough practical applications so growth is slow.

The BSV industry itself still needs more useful platforms and other tools to support its functions, like wallets and exchanges, Kameta said. Currently, no Japanese digital asset exchange supports BSV as they may legally only trade assets approved by the Financial Services Agency (FSA), Japan’s government regulator.

Zweispace is also working on other blockchain solutions that target the real estate industry. One example is its “Namazu” token, which records earthquake data from the company’s network of sensors and records it on-chain. Researchers can access the recorded data to help construction companies to prepare for and build better prediction models to assess the impact of earthquake damage. This is a major issue in Japan, where minor quakes are frequent and major events have caused trillions of dollars in damage.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024