|

Getting your Trinity Audio player ready... |

Central bank digital currencies (CBDCs) are coming thick and fast, but in the largest economy in Europe, most citizens don’t know what the digital euro is.

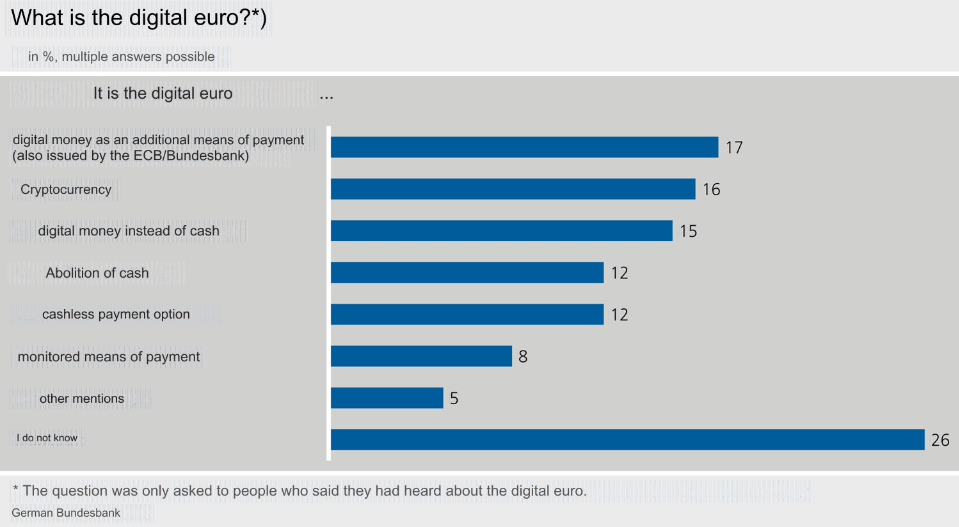

A recent survey of 2,012 people conducted by the Deutsche Bundesbank showed that three in five had never heard, read, or seen anything about the digital euro. Only 17% were able to correctly identify that it was a Eurosystem of digital currency that would be available alongside other forms of money. Of those who had heard of it, roughly 30% mistakenly believed it was meant to replace cash or that cash would be abolished if it was introduced.

Roughly half of respondents said they would “definitely” or “probably” use it, and just under half said they would “definitely” or “probably” not. Around 1% said they didn’t know.

Privacy is once again the biggest concern

In what is becoming a predictable trend, the Bundesbank survey found that privacy was the biggest concern regarding the digital euro. 75% of respondents rated it ‘important’ or ‘very important.’

Other prominent concerns were that the euro CBDC should run on European infrastructure (72%) and that you can pay with it offline without an internet connection (59%).

The European Central Bank (ECB) claims the digital euro can be used offline and that “transaction details would only be known to the payer and the payee.” As of now, the European CBDC is still in the design and testing phase, and while many expect it in 2025, the Bundesbank president is skeptical about this timeline.

In addition to the concerns of citizens, banks and economists have expressed concern about the potential for financial disintermediation should CBDCs become ubiquitous.

While some say commercial banks are merely fearmongering to protect their interests, some economists are concerned about unpredictable economic consequences if bank deposits are reduced. In Germany, another Bundesbank report estimates that 10% of all money could end up in the digital euro.

CBDCs are coming: A public blockchain can blunt the sharp edges

As this German survey and countless others show, privacy is one of the top concerns of citizens wary of CBDCs. With that comes a fear of government control and the state’s ability to track and trace citizens’ financial activities and even freeze/stop payments it does not approve of.

Yet, despite these concerns, CBDCs are coming. It seems that every week, CoinGeek reports on another country’s pilot program, test, or cooperation with other countries to make CBDCs work. Countries from China to Israel to the Bahamas and beyond are either rolling out or designing digital national currencies.

One thing they all have in common is that they run on private ledgers created by central banks and international institutions like the Bank for International Settlements (BIS). This only exacerbates fears about government control and financial spying.

The solution is to run CBDCs on a scalable public blockchain that no single party controls. Doing so would ensure financial transparency works both ways and remove transaction censorship and interference from the hands of any single entity. While court orders could be issued to freeze the funds of terrorists and criminal gangs, small, casual transactions and micropayments would be beyond their reach, and the sheer volume of transactions would make tracking and tracing everyone’s activity practically impossible.

If CBDCs are to become a reality, and it seems they will, they should run on a scalable public blockchain with no central authority controlling the nodes. The BSV Blockchain has the tools to allow programmable money at scale.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: Finding ways to use CBDC outside of digital currencies

11-22-2024

11-22-2024