|

Getting your Trinity Audio player ready... |

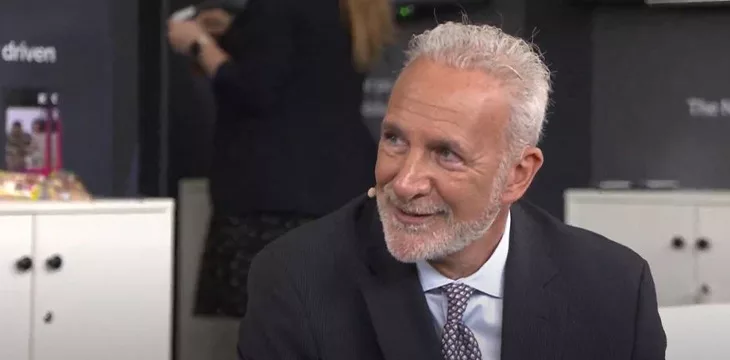

One of the most anticipated keynotes at the London Blockchain Conference was by Peter Schiff, who delved into how digital gold would work. He joined CoinGeek TV after his presentation to talk about tokenizing gold, the demise of fiat, and his unending feud with BTC Maxis.

Fiat may never quite go to zero as people still have some degree of confidence in it, he told CoinGeek TV host Kurt Wuckert Jr.

“But I don’t think fiat currencies have to go away to introduce a competitive alternative,” he says.

Schiff is a known critic of ‘crypto,’ specifically BTC, and is constantly clashing with BTC maxis on social media over the token’s lack of utility.

“They [maxis] are constantly trying to win me over. They like me, but they just don’t like the fact I haven’t drunk the Kool-Aid,” he mentioned.

Despite being a critic, Schiff revealed he had minted Ordinal NFTs on BTC for original paintings he’s auctioning, allowing purchasers to acquire a digital representation of their physical painting. This, he believes, is the future—using blockchain for tokenization. This is an application of blockchain he can get behind, especially in the gold industry.

Schiff is a blockchain proponent, and during his presentation at the conference, he delved into how tokenized gold can replace the U.S. dollar in global trade. While gold is superior to fiat, it’s not transactable, hindering its use as payment. Blockchain can change it all and bring a new era of digitized gold payments, the chief economist at Euro Pacific Asset Management says.

Schiff believes that fiat will face disruption in the near future as inflation rises and the purchasing value of fiat dwindles. However, this disruption will be driven by the people earning the money, not the spenders.

“If you’re providing goods and services in exchange for payment, you want to be paid in something of real value that you have confidence in. Ultimately, that’s what’s going to drive adoption and the movement into gold-backed crypto,” he states.

Watch: How a “Digital Gold” System Should Really Work

11-22-2024

11-22-2024