|

Getting your Trinity Audio player ready... |

Discussions, networking, and new learnings continue on the second day of the Philippine Blockchain Week (PBW) at the Grand Marriott Ballroom in Pasay City, as experts, industry leaders, and enthusiasts convene to tackle the rise of artificial intelligence (AI), the evolution of the global finance sector, and what difference blockchain could make when integrated with existing technologies.

Countless innovations have been developed over time since the birth of the internet, but blockchain is one technology that may be considered the dark horse of them all, bringing in a wide range of potential use cases that experts said would massively change how we connect, transact, record, and tackle issues that have long plagued global industries.

Blockchain is said to be a critical tool that would support further innovation, particularly in developing countries like the Philippines. However, the tech’s reputation has been slightly tainted by the collapse of major exchanges and the speculation surrounding cryptocurrencies, the most common use case in blockchain. This led to regulators scrambling to craft legislation to prevent further damage to the global financial market, while some see the move as a way to gain control of the booming digital asset space.

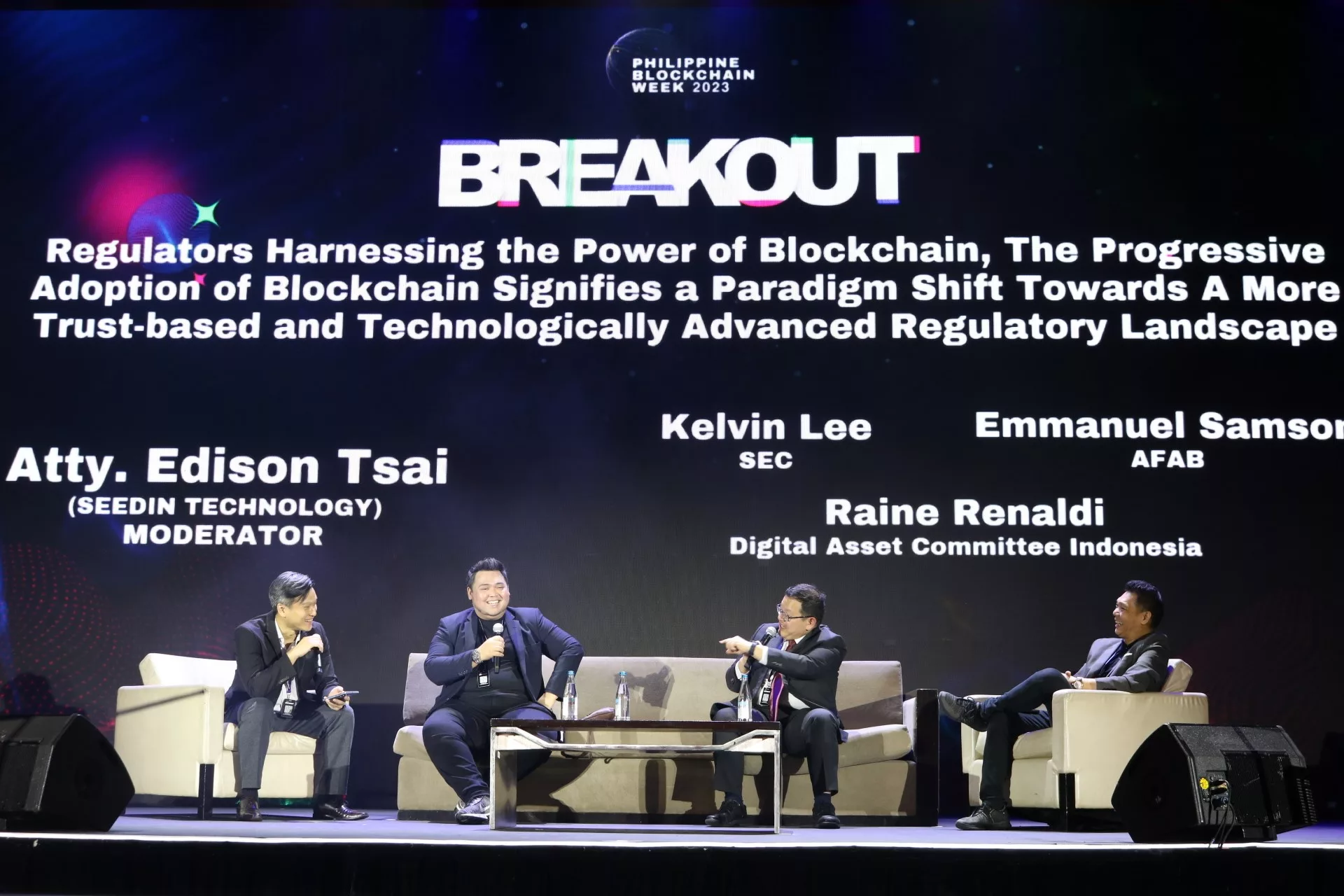

Philippine Securities and Exchange Commission (SEC) Commissioner Kelvin Lester Lee struck down this notion, stressing that regulating digital currencies is part of the agency’s effort to safeguard investors from high-risk assets. He, however, clarified that he could only speak for the SEC and not other regulators that are handling the fintech industry, including the Bangko Sentral ng Pilipinas (BSP), adding that the Commission is not looking to regulate digital assets as a whole but only those operating and are being treated as securities.

Lee, who was speaking at a panel moderated by SeedIn Technology President Edison Tsai, was also quick to note that the SEC is not in any way eyeing to control blockchain technology and rallied experts in the space and members of the public to talk with the Commission on matters involving regulating the sector.

“I intend to give everyone a chance to consult and comment on it, considering how the direction we’re going might be challenging…and perhaps, point out some issues in case we’re not doing the right thing,” he said. “I want to make sure we’re all aligned. We are all working together towards getting the Philippine economy on track.”

Impero Group Co-Founder and CEO Emmanuel Samson sided with Lee, stressing that blockchain is inevitable and regulation should be focused more on digital assets.

“Blockchain is gonna happen with or without regulation,” he noted.

While blockchain does not need to be regulated, with various entities utilizing the technology, the major challenge government watchdogs face is the tech’s changing phases.

“If we have a framework or sandbox, it has to be open,” Samson said, seeing it as one of the ways to ensure order in the blockchain space; the others are working with the community and raising people’s awareness of the emerging technology.

Meanwhile, Chief of Economy and Digital Asset Committee at the Indonesian Chamber of Commerce and Industry (KADIN) Raine Renaldi said it is vital for regulators to monitor first what is happening within one’s jurisdiction and neighboring countries before jumping to regulate or craft legislation targeting the sector. He mentioned the collapse of the Terra project in South Korea, which Indonesia has carefully assessed before any regulations were enforced.

Growing adoption of digital banking

Blockchain is proof of the evolving technological landscape, and with this development comes the revolution in the fintech industry.

From traditional banks, the fintech sector has, in recent years, seen the advent of e-wallets and is now witnessing the growing adoption of digital banking, a step toward achieving a cashless society and financial inclusion.

A panel moderated by Atty. Mark Gorriceta tackled the growing popularity of digital banking and why blockchain is critical in keeping the budding industry afloat.

Kicking off the nearly one-hour discourse on the matter, Gorriceta asked the panel consisting of Maya President Angelo Madrid, Coins.ph CEO Wei Zhou, CEO and President of Direct Agent 5 (DA5) Raymond Babst, and UNO Digital Bank Founder and CEO Manish Bhai, whether there is still a divide between traditional banks and innovative entities, as competition in the market has grown since the latter sprung to life.

While Madrid did not directly answer the question, he noted that traditional banks are making efforts to be digitalized and that doing so is not an issue, but he highlighted that not everything is about digitalization. Explaining further, the veteran banker said digital banks like Maya make it easier to access products and services that many Filipinos, especially the underserved, have a hard time doing in traditional banks.

Bhai was more straightforward, saying that the divide will stay despite traditional banks’ attempts to turn digital.

With the talk delving into the Philippines’ digital transformation, Gorriceta asked for the opinion of the panelists about the possible integration of blockchain and banking.

Babst said that convergence is inevitable and that the question is not about if but when this merger will occur.

Zhou agreed, noting that “change is coming” for banking institutions—be it traditional or digital—and blockchain integration is part of this as users’ behavior and demands change.

Similar to the previous panel, digital banking experts also pointed out that the integration will not happen overnight, considering the regulatory hurdles and the impacts of the recent collapses of major banks in the digital asset space.

While this may be the case, Zhou stressed that blockchain would be instrumental in bringing back the public’s trust, citing the tech’s ability to offer transparency, privacy, and greater auditability.

“We need new, better leaders in the [digital asset] space,” added Zhou, noting that this is also vital in building consumers’ trust.

Babst, on the other hand, pointed to regulation as the key to rebuilding the broken trust, adding that while blockchain has the power to spur innovation and create new products, it is the consumers who would decide what trend, product, or service will stay in the market.

Gorriceta also mentioned central bank digital currencies (CBDCs) and their possible impacts on the banking sector.

It can be noted that the BSP recently announced that it would use distributed ledger technology (DLT) Hyperledger Fabric in creating its CBDC under Project Agila.

Madrid admitted that CBDC will create more difficulty for banks but stressed that it is a positive move to help the Philippines embrace blockchain tech.

For his part, Bhai believes CBDCs are a great tool for the Philippines to grow its economy, citing the use cases of the digital fiat, while Babst sees Project Agila and utilizing blockchain as a “win for us all” as it signals the country’s openness to innovation.

While the three panelists were optimistic about the development of the country’s own CBDC, Zhou was slightly over the edge, saying that it would be better if the Philippines explored a wholesale CBDC instead, adding that private stablecoins would also benefit the country and that officials should look into it.

Blockchain for all

It’s packed here at the Diplomatic Hall because of the Blockchain 101 for Students of @philblockchain Week 2023.

Join the conversation and learn from industry thought leaders. #PBW2023 pic.twitter.com/A5tOoORRgS

— CoinGeek Philippines (@RealCoinGeek_PH) September 20, 2023

The second day of the most awaited Blockchain 101 by the Department of Information and Communications Technology (DICT) saw the Diplomatic Hall of the Marriot Grand Ballroom filled with enthusiastic students who want to learn more about the emerging blockchain technology and its fundamentals. Among the universities who joined the jampacked 101 lessons are MAPUA, Polytechnic University of the Philippines, AMA Computer Learning Center, Our Lady of Fatima University, and De La Salle University.

With the help of local experts in the field and the support of the DICT, students from various universities in the National Capital Region (NCR) had a chance to delve into the importance of blockchain, its use cases, and myths. Apart from the whole day of exclusive access to the world of blockchain, they got a chance to participate and have fun with the lineup of interactive games that aimed to teach them more about the other fields in the space.

Humans and Robots—who will take the lead?

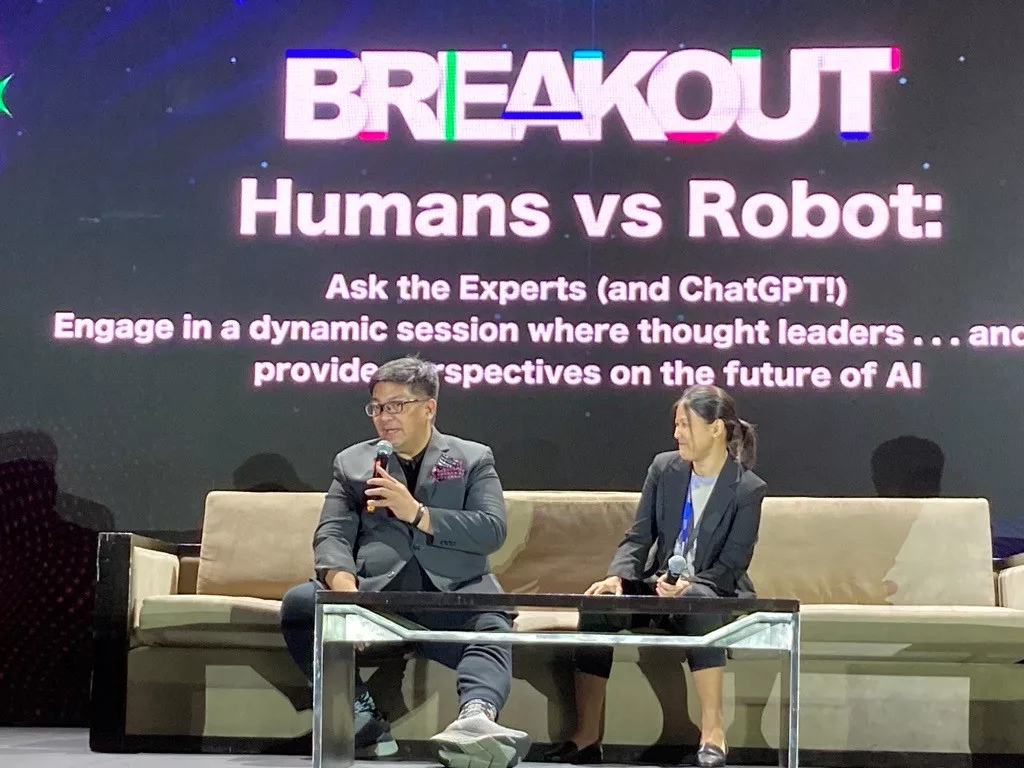

The Philippine Blockchain Week 2023 breaks out of the norm as they didn’t box the discussions on merely just blockchain talks. Occupying the plenary hall C of the grand ballroom was the Analytics & AI Association of the Philippines summit on artificial intelligence (AI).

One of the panel discussions picked the minds of the conference’s guests as they tackled the ethical use of AI. Moderating the session was Jenn Cadiz, head of Marketing and Media at Infanity.

Cadiz kickstarted the discussion by asking Dominic Ligot, Paul Soliman, Miguel De Guzman, and Lyantoinette Chua how AI would evolve. Ligot, a consultant on AI and Technology at the IT & Business Process Association of the Philippines, pointed out that AI is not designed to look out for errors, so for it to evolve in the future, users must continue to utilize it and build the system up.

Chiming in to speak about the importance of blockchain in AI, Soliman—founder and CEO of Hacktiv Colab Inc.—said that the two go hand-in-hand as blockchain technology enhances transparency in AI.

“I believe that blockchain would be the database of truth in the coming years,” Soliman said.

“Blockchain is needed in the coming years not to counter but to complement the current generative AI landscape,” he noted.

Wrapping up the discussion, the two gentlemen encourage the viewers not to be afraid of AI, as it won’t replace humans but would act as a tool to ease the workforce’s workload and provide a workaround for businesses.

Apart from AI taking over jobs, one of the greatest fears, along with the technology’s popularity, is AI taking over the human race, at least in intelligence. A Q&A panel again with Ligot and Reinabelle Reyes, associate professor at the National Institute of Physics in University of the Philippines Diliman, hints at the unbiased nature of AI and at another future iteration of the technology—Artificial general intelligence or AGI.

Taking over the stage, Reyes remarked AI wouldn’t be unbiased, relating that thought to the Science of AI, which she says involves human experiments and research. As for the future of AGI, the duo believes that it will happen, but a big chunk of it will still involve humans.

Today is Day 3 of the Philippine Blockchain Week 2023. Make sure to follow CoinGeek for the daily recaps. Also, follow CoinGeek Philippines on social media to see the live updates and highlights of the conference!

Watch: The Philippines is ready for blockchain tech, nChain Chairman Stefan Matthews says

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024