|

Getting your Trinity Audio player ready... |

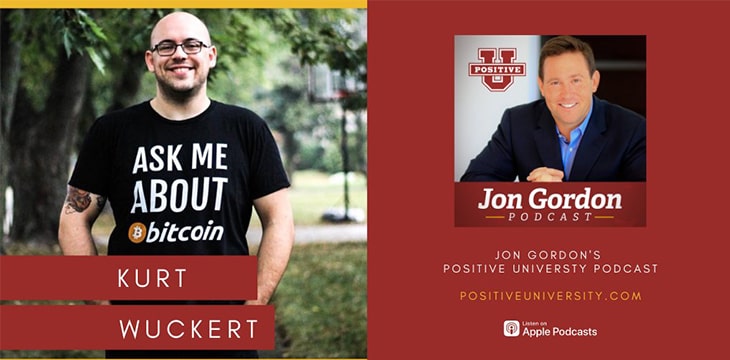

Real value over hype, competition over equity, and work versus luck—these are some of the main points covered in best-selling business author Jon Gordon’s latest “Positive University” episode. An outsider to the digital asset world, Gordon invited CoinGeek’s Bitcoin Historian Kurt Wuckert Jr. to the show to explain Bitcoin and what the past decade has been all about.

Jon Gordon is a writer and motivational speaker who has sold millions of copies of books such as “The Energy Bus,” “The Carpenter,” and “The Power of Positive Leadership.” He has appeared numerous times on major network television and consulted on leadership matters with Fortune 500 companies and professional sports teams.

You can listen to the full episode on Apple Podcasts here.

https://twitter.com/JonGordon11/status/1396582595597684736?s=20

Introduction to Bitcoin… and the price thing

Kurt explains his introduction to Bitcoin many years ago, when someone paid him in the currency for a printing job. This led the former cybersecurity worker to curiosity about how it works, why it has value, and then onto a deeper involvement that included a mining operation, app development, and investing/consulting as the co-founder and fundamental analyst of CryptoTradersPro.

“Ultimately, I’m just one of those guys who’s lived everything (about Bitcoin),” Kurt says. And the “bloody crypto crash” the market is currently enduring is simply part of the natural cycle, a “reset” that captures people’s attention and might encourage them to join in… at some stage.

The recent price surge in BTC and other digital assets has seen a parallel surge in interest from outside the blockchain sphere—as has happened during previous bull runs. By now, almost everyone has heard of “Bitcoin” but, for those who’ve read and written the blockchain news every day for the past decade, it can be surprising to discover that most people still understand very little about it.

Kurt attributes most of the recent enthusiasm (and subsequent crash) to public figure pronouncements like Elon Musk‘s and Michael Saylor‘s, suggesting many speculators are simply following his mood. He finds it “very curious” that wealthy people buy large amounts of BTC and suddenly become publicly bullish about its price.

Gordon is clearly thinking of BTC when he says “Bitcoin,” so listeners will likely be anticipating how Kurt manages to broach the topic of BTC’s technical limitations, development/investment issues, and of course, that BSV is actually the real Bitcoin. (Gordon does later reveal that he’s familiar with BSV, and asked to interview Kurt to find out what it was).

Kurt does this by introducing Gordon to Tether—the stablecoin that may or may not be (and most likely isn’t) backed by dollars and other digital assets, but which backs a lot of BTC’s market cap and trading activity. Tether the company has “sidestepped audits” and issued “sketchy financial statements” over the years, he explains, which is a significant problem for an asset that accounts for over 90% of all digital asset trades on exchanges.

While Tether creates an unease around the BTC market for those who know of its history, most remain oblivious. The BTC market has been artificially pumped to US$60,000 so in theory there’s no reason it couldn’t go on to $100,000 at some future stage.

He refers to BTC and digital asset price speculation as mainly “promises and hype backing up multiple layers of promises and hype”, musing on whether Saylor’s MicroStrategy (NASDAQ: MSTR) is some kind of crypto mutual fund these days, since its CEO seems far more interested in talking about Bitcoin.

Here comes the BSV part

However, he cautions that “BTC doesn’t actually do very much”, and that BTC’s popular “memes about decentralization, about having a Swiss bank in your pocket” ring hollow when people come to realize its significant limitations as a form of money.

BTC’s intentionally-crippled transaction throughput “very purposefully not useful for business applications” Kurt says, casually mentioning that he favors something called BSV. BSV’s chain-of-custody verification and data processing capacity make it far more appropriate for large-scale business use.

“That’s the kind of thing I’m bullish about long-term,” Kurt says, while noting that BTC remains the asset most in demand for price speculators. But without real-world utility based on a growing economy, there isn’t really any underlying value to digital assets.

Data is a commodity and Kurt says he prefers “distributed database/ledger” to the word “blockchain.” and in the end, “what could be more valuable than the aggregate economic data of the world?”

Gordon also asks about some of the “basics” of digital assets, the differences between proof-of-work and proof-of-stake, the benefits/disadvantages of each, and the issue of where the “coins” actually come from, which Kurt describes as “more of an interesting philosophical question.” His analogies for POW vs POS are quite interesting and useful, helping to explain how only competitive POW can really provide the incentives to secure data on a network.

He also answers questions about other well-known digital assets, saying Dogecoin is a great example of the “absurdism and immaturity” of some participants in the blockchain world. The two discuss how many of those “investing” in the space are fortunate speculators rather than builders—and how that is completely unsustainable as a money-making model.

It’s more about who can solve problems, who can scale, who can truly disrupt, who can take on global business and increase data integrity, Kurt says. He lists some of the potential uses for BSV, noting that while it has underperformed the market in 2021 as a tradeable asset, it’s looking for value over hype. Most of its potential hasn’t even been explored yet.

When deciding which blockchain platforms to delve deeper into, “look at the incentives, look at who’s involved,” he says. Does an asset create value, or simply absorb it?

It’s interesting to note that, in explaining the benefits of BSV, someone is really just explaining the benefits of Bitcoin as it originally existed. Even enthusiasts got caught up in the memes of “censorship resistance,” “non-central bank currencies” and “dollar collapse” before they really understood what Bitcoin was all about. Many are still lost in meme-world, but those who graduated are now exploring its deeper possibilities.

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024