|

Getting your Trinity Audio player ready... |

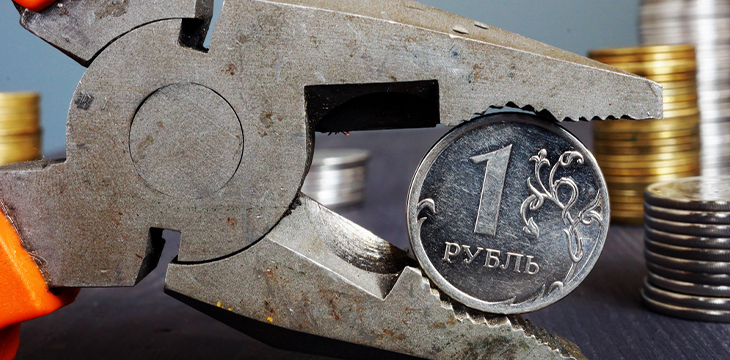

Russian lawmakers passed a bill that will allow businesses to use digital assets in international trade as part of the pariah nation’s ongoing efforts to evade global sanctions after its illegal invasion of Ukraine.

The law is expected to take effect in September, and the first digital asset transactions could take place before the end of the year, according to a Reuters report.

Russia’s economy has been under significant strain since its February 2022 invasion of Ukraine, and the resulting war that rages on. The international community quickly condemned Russia’s actions and began imposing sanctions almost immediately, with gusto.

One of the most severe measures was barring major Russian banks—including Bank Otkritie, Novikombank, Promsvyazbank, Rossiya Bank, Sovcombank, VEB and VTB—from the international financial messaging system Society for Worldwide Interbank Financial Telecommunication (SWIFT).

The unprecedented penalty of being removed from SWIFT delayed payments to Russia for its oil and gas exports, hampered Russian banks and forced the country to explore alternative money transfer options.

For this reason, it didn’t take long for Russia to turn to a digital asset space already rife with illicit finance, in large part due to its decentralized—to an extent—and pseudonymous nature, making it a popular money transfer option for terrorist financing, money launderers and, in Russia’s case, rogue nations.

Several firms have already been fined for helping Russian banks use digital assets. In June, Lithuania penalized digital asset firm Payeer €9.3 million ($10.1 million) for Russia-related sanction violations, specifically, allowing Russian customers to transfer money to EU-sanctioned Russian banks.

Anatoly Aksakov, head of the Duma’s financial market committee, told Bloomberg that under the new bill, digital assets would be held to the same set of regulations as foreign currencies—such as the U.S. Dollar (USD)—in Russia.

Russian lawmakers have been vocal about the need for creative solutions to its payment issues. Elvira Nabiullina, governor of the Russian central bank, predicted earlier in July that international payment systems not involving Western institutions would eventually emerge in response to sanctions.

“I think that some global platforms will gradually emerge, because countries look at our experience and understand the vulnerability of the financial infrastructure and the vulnerability in case they are included in only one existing system, such an understanding is gradually coming,” Nabiullina told the Financial Congress of the Bank of Russia.

This marks a reversal of the country’s previous stance, laid out in January 2022 when the Russian central bank proposed banning the use of digital assets for transactions, citing threats to financial stability, citizens’ well-being and monetary policy sovereignty; a proposal that became reality when Putin signed a law banning digital payments across the nation in July 2022.

Russian sanctions

Shortly after Russia invaded Ukraine, the U.S. barred the Soviet nation from making debt payments using foreign currency held in U.S. banks, effectively freezing the country’s U.S.-based assets and preventing it from using its foreign reserves to prop up the Russian ruble.

At the same time, the U.K. excluded key Russian banks from its financial system, frozen the assets of all Russian banks, and prevented Russian firms from borrowing money.

Several other jurisdictions followed suit, including the EU, Japan, and India, the world’s biggest arms importer, who announced in April of this year that it was unlikely to make any new weapons purchases from Russia.

But possibly the most severe punishment remains Russia’s removal from the SWIFT network, which connects financial institutions and corporations worldwide.

It seems a big ask to expect the bellicose country’s latest sanctions circumventing gambit, allowing the use of digital assets for international trade, to significantly reduce such severe measures.

Watch: ComplexCon Hong Kong explores the unseen potential of blockchain

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-21-2024

11-21-2024