|

Getting your Trinity Audio player ready... |

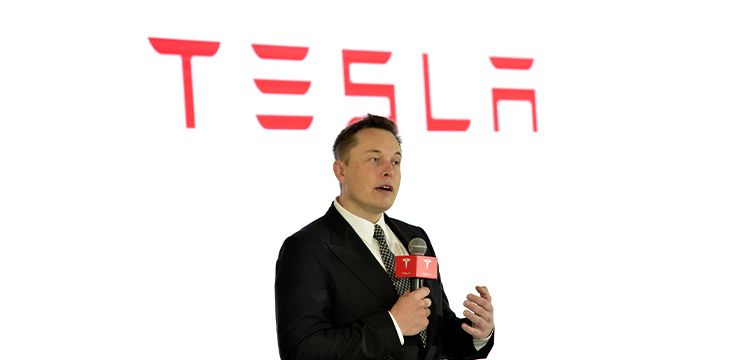

Elon Musk broke the hearts of BTC maxis on Wednesday, when he revealed that his Tesla firm had sold 75% of its BTC holdings, reportedly booking a nine-figure loss in the process.

Back in February 2021, Tesla announced that it had bought US$1.5 billion worth of BTC (each worth around $40,000 at the time of the announcement, although the company didn’t specify what average price it paid). In April, Musk revealed that Tesla had sold 10% of its BTC “essentially to prove liquidity of [BTC] as an alternative to holding cash on balance sheet.”

No, you do not. I have not sold any of my Bitcoin. Tesla sold 10% of its holdings essentially to prove liquidity of Bitcoin as an alternative to holding cash on balance sheet.

— Elon Musk (@elonmusk) April 26, 2021

On July 20, Tesla’s latest financial report card indicated that the company had “converted approximately 75% of our [BTC] purchases into fiat currency” by the end of the second quarter for approximately $936 million. Following this massive sell-off, Tesla still has roughly $218 million worth of digital assets on its balance sheet.

Last July, in response to a Twitter user claiming Tesla owned 42,069 BTC, Musk replied that Tesla’s holdings weren’t that high, “but it’s close.” If Tesla did hold around 42,000 BTC and sold three-quarters of this stack (31,500), it would have been at an average price of around $29,700 per token. BTC was worth $32,000 on January 1, 2021, the point at which Tesla reportedly began accumulating the tokens.

On Tesla’s Q2 analyst call, the company claimed it had sold its BTC “for a realized gain, offset by impairment charges on the remainder of our holdings, netting a $106 million cost to the P&L.” Other estimates of the fiscal hit Tesla endured by its ill-advised foray into digital magic beans suggest the company took a larger hit, possibly up to $175 million.

Sideshow Elon isn’t your ‘crypto’champion

Musk told analysts that Tesla was forced to liquidate the bulk of its BTC “to maximize our cash position, given the uncertainty of the COVID lockdowns in China.” Musk insisted that the sale “should not be taken as some verdict” on BTC, but his next comments didn’t exactly suggest raging confidence in the token’s long-term prospects.

Musk emphasized that Tesla was a sustainable energy-focused tech outfit, but “cryptocurrency is a sideshow to the sideshow” and “cryptocurrency is not something we think about a lot.” While Musk suggested that Tesla was “certainly open to increasing our [BTC] holdings in future,” he also stated that Tesla was “neither here nor there on cryptocurrency.”

BTC briefly climbed above $24,000 on July 20, but Tesla’s fire sale dragged the price down below $23,000, and the token struggled to stay above $22,000 in early July 21. While the hit to the token may have been measured, BTC maxis defaulted to their full-on rage mode at Musk’s betrayal, with lots of talk about Musk’s former “diamond hands” turning to “paper” and mocking Musk’s recent shirtless swimming pics.

Other diehards insisted that Tesla’s sell-off was a good thing for BTC, as it demonstrated the ease with which companies could unload their digital pet rocks on more credulous suckers. For these silver-lining soothsayers, there is literally no event that can’t be spun as irrefutable testimony to the enduring appeal of inert, function-free digital tulip bulbs.

In one final backhand to the BTC brigade, Musk confirmed on July 20 that Tesla “have not sold any of our Dogecoin.” Dogecoin to the moon, Alice!

Where does Musk stop and Tesla begin?

When Tesla first announced its BTC buy in February 2021, it also announced plans to accept BTC as payment for its vehicles. However, by May, Tesla “suspended” BTC-based sales (allegedly) due to Musk’s concerns over the token’s ugly energy consumption. In reality, the token’s volatility—along with its notoriously high transaction fees—make it utterly impractical as a currency.

At the time, Musk claimed that the company would resume BTC-based car sales once there was “confirmation of reasonable (~50%) clean energy usage by miners with positive future trend.” Musk would do well to research Bitcoin SV, the world’s most environmentally-friendly blockchain, due to its ability to cram an ever-increasing number of transactions into individual blocks with fees measured in fractions of a cent.

In the May suspension announcement, Musk also tweeted Tesla’s claim that the company “will not be selling any [BTC].” Musk also tweeted two emojis indicating ‘diamond hands,’ the inane slogan of BTC hodlers-at-all costs, so really, take whatever comments Musk makes about crypto with a grain (or sack) of salt.

Musk has repeatedly claimed that he hasn’t sold any of the BTC he personally holds—a portfolio that allegedly also contains some Doge and ETH—although no one knows how big his personal holdings are. In May 2020, he admitted owning a whopping 0.25 BTC, and the following March, he promised that he “won’t sell” his personal holdings.

Just a few months ago, Musk publicly declared that “I might pump, but I don’t dump” digital currencies but whether this anti-dumping stance applies to Tesla’s holdings is anyone’s guess. Musk is notorious for making public statements that benefit Tesla’s share price but later turn out to be erroneous, suggesting a pump/dump comfort level that should give serious pause to any retail investors looking to Musk for guidance.

These seemingly purposeful fictions have gotten Musk into hot water with the U.S. Securities and Exchange Commission (SEC), but Musk has yet to be issued a financial penalty to match the scale of the gains that he and his company reap from these antics, so it’s likely he’ll keep on doing it until he’s actually reined in.

This really isn’t shaping up as Musk’s week. The “BTC begone” news came the same week Musk learned that he’d lost his bid to defer his court reckoning with Twitter over his self-sabotaged acquisition bid. It’s never been clear how serious Musk was about acquiring the social media platform, but it fits with the growing narrative that, while undeniably a visionary, his attention span increasingly resembles a dog constantly on the watch for SQUIRRELS! Shareholders and crypto hodlers beware.

Watch: The BSV Global Blockchain Convention panel, Build on Blockchain: Common Challenges & Tools to Make it Easier

https://www.youtube.com/watch?v=RzSCrXf1Ywc&t=17675s

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024