|

Getting your Trinity Audio player ready... |

Stablecoins have shown promise in facilitating payments, but the existing regulatory fragmentation globally poses the biggest threat to their adoption, a new report by the Bank for International Settlements (BIS) states.

The report, titled ‘Stablecoins: Regulatory Responses to their Promise of Stability,’ was

published this week by three senior officials at the BIS Financial Stability Institute.

The report noted that the promise of stability in the face of high volatility has made stablecoins popular and increasingly intertwined with mainstream finance. However, with the ‘crypto’ market still largely unregulated, they pose significant risks, necessitating regulatory intervention.

BIS acknowledged that stablecoins face varying regulations depending on the jurisdiction.

In some regions, only banks and a few non-bank institutions are allowed to issue stablecoins, such as in the United States and the United Kingdom. Yet in others like Hong Kong, regulators have issued stablecoin licenses to new types of financial entities that hold ‘crypto-specific licenses.’

These approaches have some similarities, including requiring issuers to maintain reserves in segregated accounts equal to or more than the value of circulating stablecoins. Regulators also pursue similar governance, prudential, AML, CFT, and risk management disclosures.

However, these approaches also have significant differences, which, according to the BIS, “lead to a lack of consistency and coordination in the oversight of stablecoins across jurisdictions.”

Even with common requirements like reserves, jurisdictions vary on specific aspects. Some, for instance, impose strict restrictions on the maturity of reserve assets. Singapore, for instance, has set a minimum credit rating for issuers of debt securities that stablecoin firms can hold as reserve assets.

Independent audits are universal. However, the frequency and scope of these attestations vary across jurisdictions.

Clear redemption policies are a global requirement, but just like with other policies, the specifics vary. In the European Union, Japan, and the U.K., the claim is against the issuer, while in other jurisdictions, it’s against the reserve assets.

Liquidity, minimum capital requirements, cybersecurity, governance and risk management, AML and CFT, disclosure, and marketing requirements are among the other differences across jurisdictions.

“As the adoption of stablecoins increases, preventing regulatory fragmentation and achieving a harmonious coexistence of different types of digital assets will become more important,” BIS concludes.

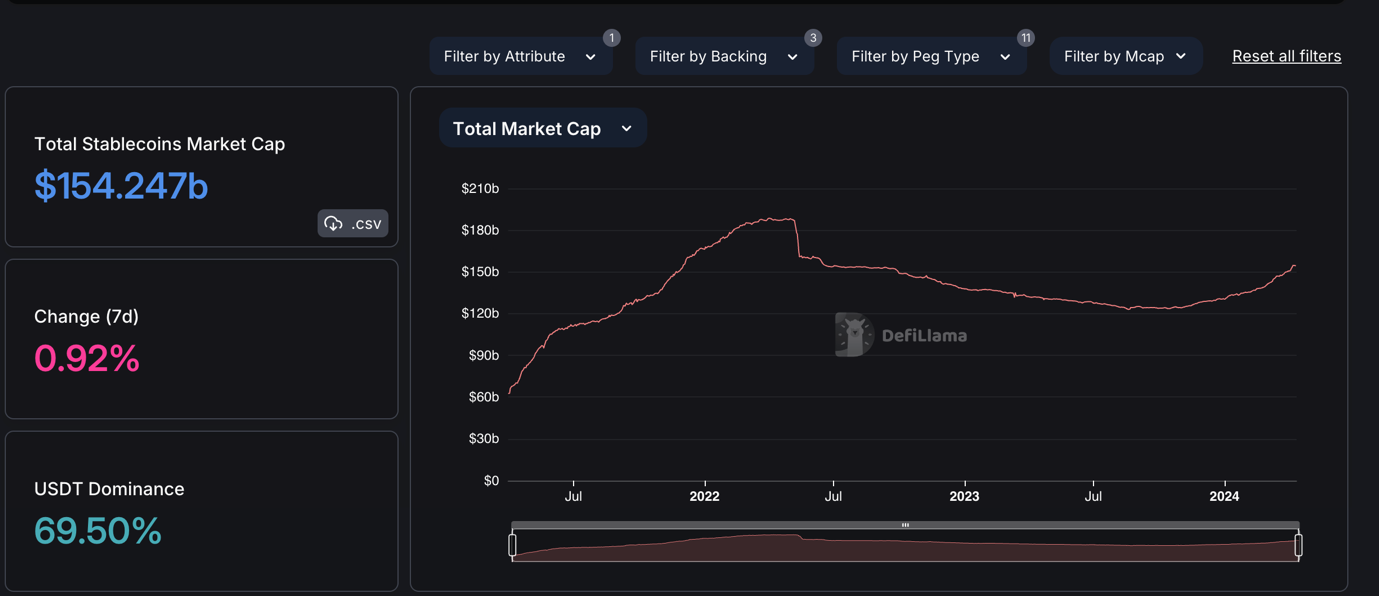

Stablecoins are worth $154.25 billion today and have been on a constant rise since last October. However, the market cap is still below the $188 billion record set in April 2022.

Watch: Tokenizing gold and stablecoins

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-22-2024

11-22-2024