|

Getting your Trinity Audio player ready... |

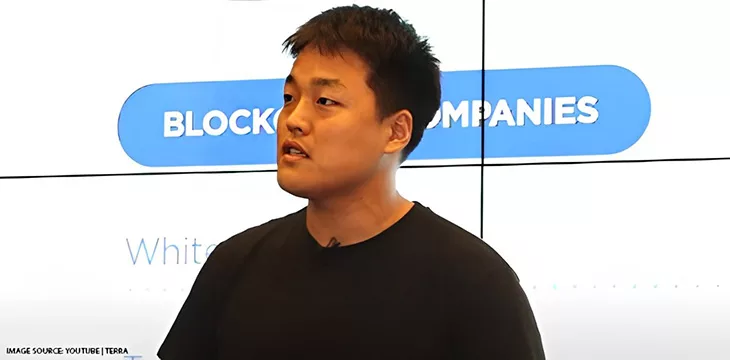

In an April 26 filing with the U.S. District Court for the Southern District of New York, Terraform’s legal team suggested that a court impose a maximum $1 million civil penalty after a jury found that the platform and Kwon were liable for defrauding investors.

Terraform argued that the SEC had “failed to prove that it is entitled to the expansive injunction and monetary sanctions it seeks,” also that the proposed fines would have to be obtained from the Luna Foundation Guard (LFG)—a “non-party” in the civil case—and therefore the court “should not grant any injunctive relief or disgorgement.”

LFG is a Singaporean non-profit set up by Do Kwon 2022, which acts as the official steward of Terra’s BTC. When Terra-Luna collapsed in May 2022, LFG spent $2.8 billion in digital assets trying to defend the peg of algorithmic stablecoin TerraUSD (UST), according to a third-party audit by N.Y.-based consultancy firm JS Held. However, LFG is not officially a defendant in the SEC’s case.

“To pursue disgorgement from LFG, the SEC was required to name LFG as a defendant or relief defendant, which it did not do […] This statute bars an order against TFL [Terraform Labs] to disgorge LFG funds because TFL did not receive them… Those funds belong to LFG, not TFL, and the token sales from which they arose were conducted by LFG,” the Terraform lawyers said.

“In conclusion, the Court should not grant any injunctive relief or disgorgement, and should impose at most a $1 million civil penalty against TFL.”

The Terra-Kwon legal team’s request came a week after the SEC said the pair should pay about $4.7 billion in disgorgement and prejudgment interest and $420 million and $100 million, respectively, in civil penalties.

Terra collapses and Kwon runs

Terraform Labs collapsed in May 2022 when its TerraUSD (UST) algorithmic stablecoin lost its peg to the U.S. dollar, leading to the printing of more of the company’s native token, LUNA, to prop up UST. This led to a crash in LUNA, and the whole Terra ecosystem came crashing down, with an estimated $60 billion being wiped out of the digital asset space.

Authorities in Kwon’s native South Korea issued an arrest warrant for him in September for violating capital market rules with Terraform Labs. He responded by seemingly going on the lam, fleeing to Montenegro—although he denies this interpretation of his actions.

This was followed by the SEC suing Terraform and Kwon in February 2023, accusing them of orchestrating a “fraudulent scheme” and violating securities laws by selling unregistered securities.

In March 2023, police in Montenegro arrested Kwon as he attempted to board a flight to Dubai, with South Korean police confirming his identity shortly after.

A few hours after Kwon’s arrest in Montenegro, U.S. federal prosecutors in New York filed charges against him over conspiracy to commit commodities fraud, securities fraud, wire fraud, conspiracy to defraud investors, and engaging in market manipulation.

A back-and-forth between South Korea, the U.S. and Montenegrin authorities ensued over who should get the chance to put Kwon on trial first.

In February, a court initially ruled that he was to be extradited to the U.S., but the Montenegro Court of Appeals later revoked this on March 5. It then appeared South Korea had won the race to prosecute the Terra co-founder, but at the eleventh hour, a legal challenge issued on March 21 by Montenegro’s top prosecutor postponed Kwon’s extradition again.

The Terraform Labs co-founder’s fate remains somewhat up in the air, with legal battles ongoing in Montenegro.

Watch: How Teranode enables unbounded scaling

Recommended for you

Lorem ipsum odor amet, consectetuer adipiscing elit. Elit torquent maximus natoque viverra cursus maximus felis. Auctor commodo aliquet himenaeos fermentum

Lorem ipsum odor amet, consectetuer adipiscing elit. Accumsan mi at at semper libero pretium justo. Dictum parturient conubia turpis interdum

11-21-2024

11-21-2024