|

Getting your Trinity Audio player ready... |

Introduction

Every four years, the Bitcoin network undergoes a halving event, a disinflationary mechanism that reduces the block reward subsidy given to miners by half. This process is designed to control the supply of Bitcoin, mimicking the extraction of precious resources, which become harder and more expensive to mine over time. It also encourages early entrants in the Bitcoin economy to incentivize the use of the ledger for commerce so that the network can be sustained by transaction fees.

As we approach another such milestone, the strategies of different Bitcoin variations—BTC, BCH, and BSV —come into sharp focus. Each has taken a distinct approach to navigating the challenges posed by reduced mining incentives.

BTC remains the leader in market cap and influence, holding a regressive approach to block size limits and hoping to engineer a centrally planned, expensive fee market. In contrast, BCH and BSV have experimented with block sizes, network structure, and transaction processing speeds as part of their strategies to increase transaction throughput and, subsequently, miner revenue through emergent transaction fees guided only by fundamental demand for space on their respective ledgers. This article delves into how each of these variants plan to sustain their network and miner community as the reward for block mining decreases, setting the stage for a detailed examination of their survival strategies in the face of inevitable halvings.

The fallout for BCH

With its approach to maintaining what is essentially a variation of the BTC Core protocol with slightly larger block sizes to encourage the use of the network as a peer-to-peer electronic cash system, BCH faces significant challenges post-halving. The reduction of block rewards from 6.25 BCH to 3.125 BCH just last week has led to a noticeable migration of miners to more profitable chains. As a result, BCH blocks slowed to a near halt in the days after the halving.

This data point raises concerns about the long-term security and stability of the BCH network over time. Sure, the adjustable difficulty algorithm caught up, but over time, market responses and future implications suggest a volatile path ahead, with the potential for increased value but also increased risk of attacks due to the reduced hash rate and BCH’s insistence that hash power governs the network but also that the network is a severe minority relative to global SHA-256. Not healthy.

Given that essentially zero research has gone into how BCH can conceivably scale beyond what a monolithic node implementation can handle (which is maybe 4-6GB block sizes), the network is in a precarious situation where it requires greater demand for survival, but can’t take on the level of demand necessary to survive without a deep and fundamental reengineering of the network. This is a very rough spot to be in.

What BCH has going for it is a considerable market cap, a passionate (albeit small) user base, and a few key influencers who could work to cascade people in the direction of BCH under pressure.

The Book Hijacking Bitcoin was recently released and also works as a sort of marketing asset for big block Bitcoin in general and BCH in specific. It remains to be seen what longer-term impact this will have.

Just got my copy delivered! @HijackingBTC by @rogerkver and @steveinpursuit. pic.twitter.com/IXyvbELXsz

— Kurt Wuckert Jr | GorillaPool.com (@kurtwuckertjr) April 5, 2024

BTC’s diminishing bull cycles

BTC’s position as the leading asset in the blockchain space has not shielded it from the effects of its own success. As evidenced by historical price data and market analysis, the diminishing returns of its bull cycles suggest a trend toward slower growth or possible stagnation. As halving events reduce the supply shock’s ability to catalyze significant price surges, the long-term outlook may require a recalibration of investor expectations. This could potentially lead to a more mature but less explosive market environment.

This is specifically why the BTC Core devs engineered the fee market to allow transaction fees to proliferate anytime there is demand for network bandwidth. This gives an incentive for miners to process high-fee transactions.

The problem with this methodology is the assumption that the price of fees won’t push users onto other blockchains or even centralized payment companies like PayPal or Western Union.

Also, the presumption that this strategy can work is also predicated on the presumption that the price of BTC will go up forever, and the data shows that it is a spurious prediction.

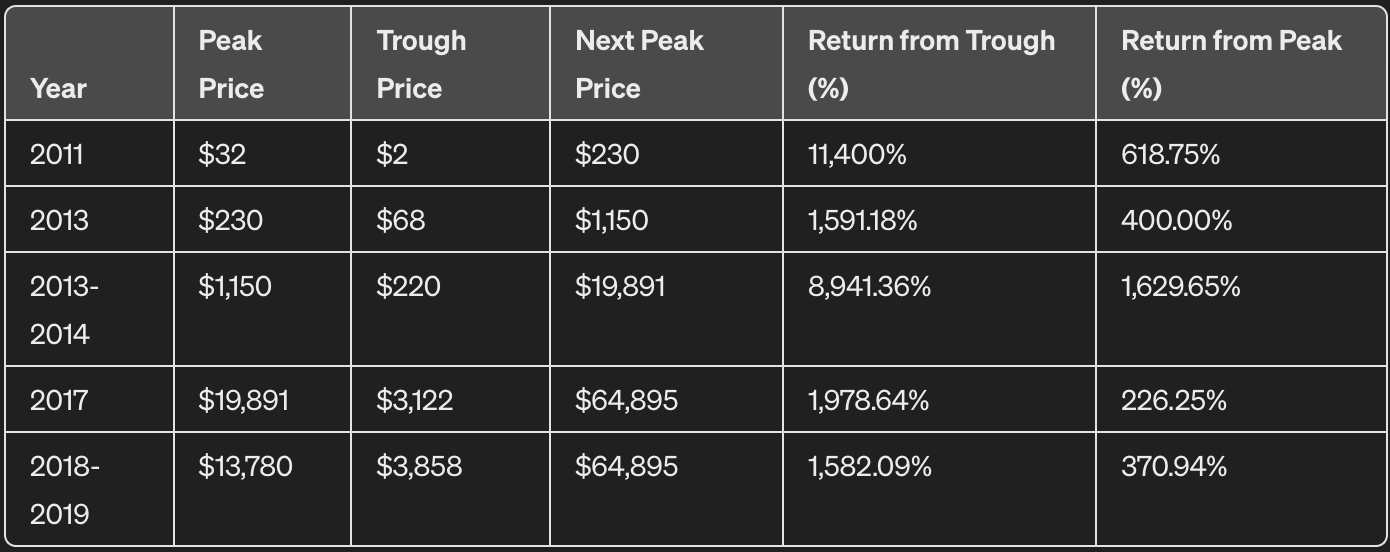

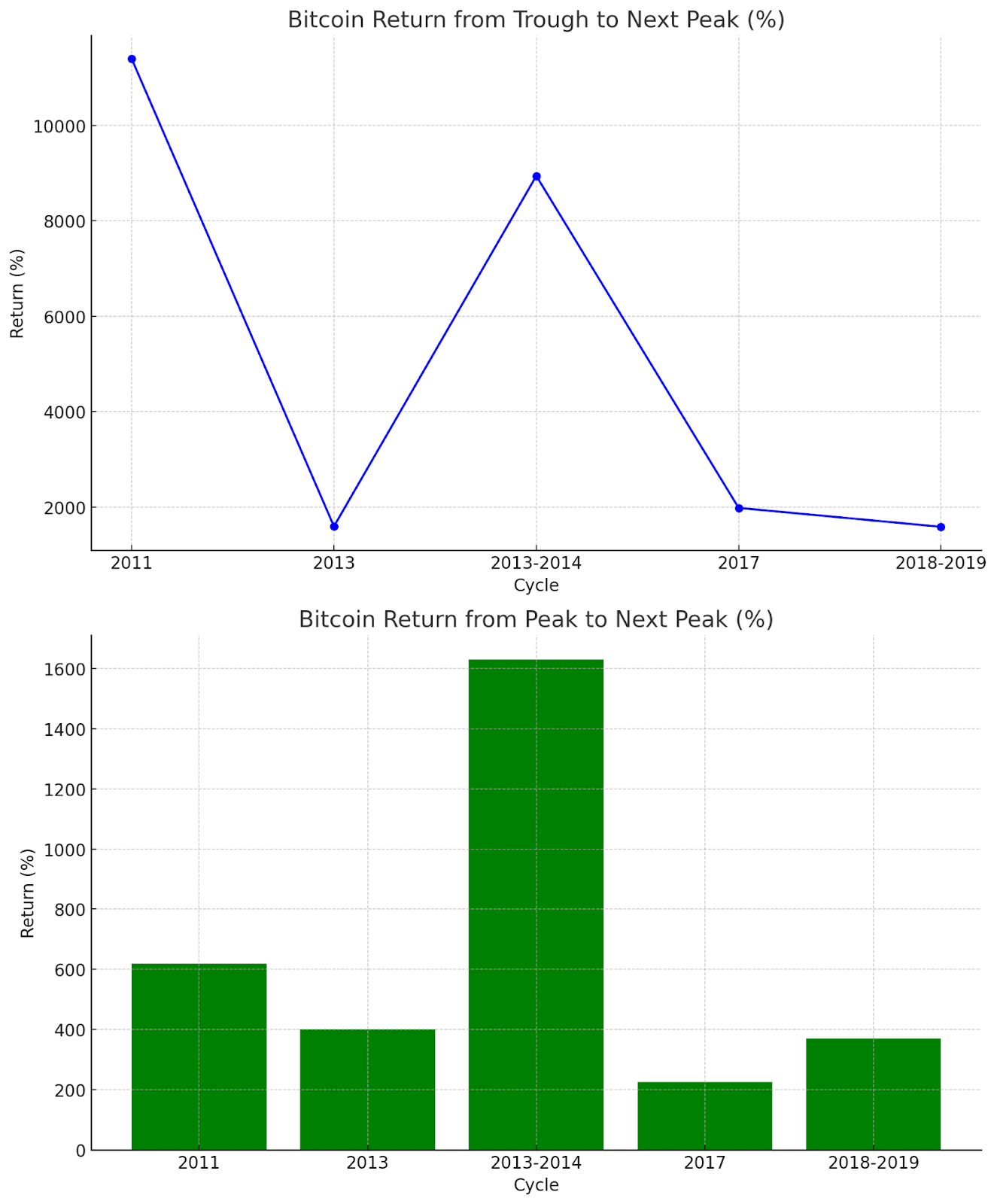

But let’s look at the math of peaks, troughs, and percentages of growth across every market cycle since Bitcoin’s inception.

Observations:

- Diminishing Returns: Each cycle’s return, from the trough and previous peak, generally diminishes over time. The staggering 11,400% return from 2011 through to the 2013 peak drops to more moderate figures in later cycles.

- Peak-to-Peak Growth: The return from one peak to the next also shows a trend of diminishing magnitude, highlighting the decreasing explosive growth that characterized Bitcoin’s early years.

These trends visually illustrate that while historical bull cycles have been impressive, the magnitude of returns is decreasing, suggesting that future cycles might not provide similarly spectacular gains. This should be obvious given that total global capital is finite, and therefore, liquidity would need to empty out of other assets to spill into BTC. Small blocker maximalists believe this is inevitable, but I posit that it is a very unreasonable prediction.

BSV’s proactive scaling strategy

BSV proposes a different path with its long-term proactive scaling strategy, which involves much more than increasing the block size to accommodate more transactions.

The BSV approach aims to replace block rewards with transaction fees as the primary incentive for miners without creating pressure on consumers with high transaction fees. Despite a dramatic decrease in hash rate post-halving, proponents argue that the increased transaction volume and lower fees could sustain miner incentives and network security in an upward trajectory with a nearly incalculable ceiling. This model could potentially offer a more sustainable form of revenue as block rewards dwindle, but it also requires a much higher level of transaction adoption to be viable.

These same issues challenge BCH, but BSV has been investing heavily in technology like Teranode, LiteClient, and overlay network tools, which are designed to break out Bitcoin’s basic functions into modular pieces to allow unprecedented levels of scale, SPV and client services built in a truly layered stack like the internet. BSV-focused entrepreneurs have also been preparing their businesses and clientele for such a future by engaging in mainnet stress tests, on-chain tournaments that generate lots of transactions, and many attempts at breaking world records for on-chain activity by testing client software on the network.

In a future where BSV is the global plumbing for commerce, the price of the base BSV asset can remain considerably less than that of BTC while pushing huge amounts of volume to pay nodes to process transactions. Furthermore, BSV nodes such as GorillaPool

and Taal have invented tools that allow users to leverage the data that already exists on chain so that the whole business model isn’t based on a constant flow of new transactions. Still, the value of stored data can be sold and resold into the economy via API or some other means of conveyance.

To be clear, I think BSV is undervalued, but the value proposition isn’t just “number go up.” It is also about growing the total pie so that everyone can build recursive, powerful businesses using the technology.

The future of Bitcoin’s security

As the landscape of SHA256 Bitcoin variants evolves, the reliance on transaction fees is set to become a cornerstone of network economics. BSV’s strategy to maintain robust network security through large blocks and low transaction fees is ambitious. It presents an alternative to the traditional block reward system, which may become increasingly untenable as rewards continue to decrease and price appreciation is blunted by simple economics. The effectiveness of this approach in preserving network integrity without the significant miner incentives provided by block rewards remains to be seen and will likely be a critical factor in its success or failure.

I’m betting on a future where Bitcoin is fully realized, and owning a piece of its infrastructure is extremely valuable.

Conclusion

The various strategies to navigate the reduction in block rewards highlight a broader challenge in the blockchain world. While BTC continues to hold its ground, BCH and especially BSV explore more radical changes to sustain their networks. BSV’s ambitious scaling plan places it in a unique position to potentially redefine the economic model of the world. As the industry moves forward, the importance of innovative and adaptable solutions will be crucial in securing the future of these digital assets.

Satoshi Nakamoto’s answer to Bitcoin scaling: Simplified Payment Verification

11-21-2024

11-21-2024