|

Getting your Trinity Audio player ready... |

The empty block situation atop BSV in the Fall of 2022 has sparked a tangential yet related discussion if lower fees in response will increase demand. As a builder in the space who has developed several applications, I will give my take on this discussion.

I have been shilling Bitchat for around a month now since it resurfaced based off an _unwriter project from January 2019. Regardless of if the recently lowered transactions fee rates to 0.05 satoshis/byte on BSV impacted the re-implementation of this application, the reality is that the app resurfaced after fees lowered, not the other way around. A simple chat message costs 20 satoshis or less than 1/1000th of a penny at a BSV price of $46.

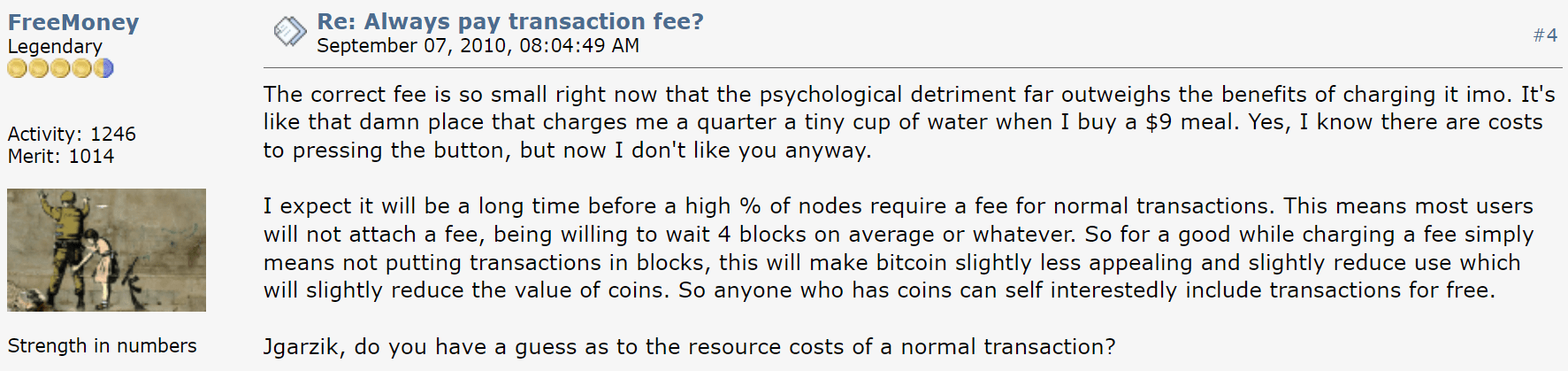

In the context of a famous Satoshi quote stating that nodes “should always allow at least some free transactions,” another user stated that the “psychological detriment far outweighs the benefits of charging” a fee, in 2010.

If a coffee shop offers a cup of coffee for free for a limited time if the coffee is good, there will be a line out of the door. Of course, the business does not view this as simply giving away goods and services for free but attracting potential customers. This is why Netflix for example offers free trials to attract new customers.

On the alleged low fee blockchain there exist practically zero opportunity for free transactions. Yet, businesses in the space clearly desire this based on the narrative that requiring users to first have Bitcoin to use an application is a hurdle to adoption. Free transactions can mitigate that issue, as applications can process those without burdening the customers first.

In my archival, private bookmarking application Windbell, I can attest that even a lower fee rate would improve my service, increase my revenue percentage, and allow me to onboard customers without requiring them to obtain Bitcoin first more efficiently.

This controversial situation around empty block mining indicates that we need to look backward to move forward. If Bitcoin SV’s value proposition is lower fees and micropayments, then surely even lower and some free fees and “nanopayments” will make it more valuable.

A counterargument to what I have presented thus far is that we need more services that take advantage of these nearly free transactions. Firstly, a core economic principle is that simply lowering prices may increase demand. Secondly, the counterargument is susceptible to the unseen principle of economics where we cannot assume the secondary consequences (negative or positive) of implementing any policy. What new businesses will be created with even lower fees? What data now makes sense to put on-chain at 1/10,000th of a penny? We do not know, nor can we assume.

We do know that businesses like Haste Arcade or HandCash would not have existed in the first place without micropayments. However, one of the core features of Bitcoin is micropayments so making it easier and more efficient to facilitate those surely will make the network more valuable in the long run.

How many objects were banged against the nail before the hammer was produced? How many attempts to strike fire occurred before the first spark? Craig Wright alludes to this here:

A topical debate on “spam” transactions has been had in the blockchain space for years. Any use of a product or service is good, as the merchant can learn from the experience. If the use becomes problematic, the merchant deals with that later as opposed to disincentivizing the demand in the first place. In conclusion, allow some free transactions, lower the fee rate even further and bring on the “spam.”

Watch: BSV Global Blockchain Convention presentation, LiteClient: Scaling blockchain with Simplified Payment Verification

11-22-2024

11-22-2024